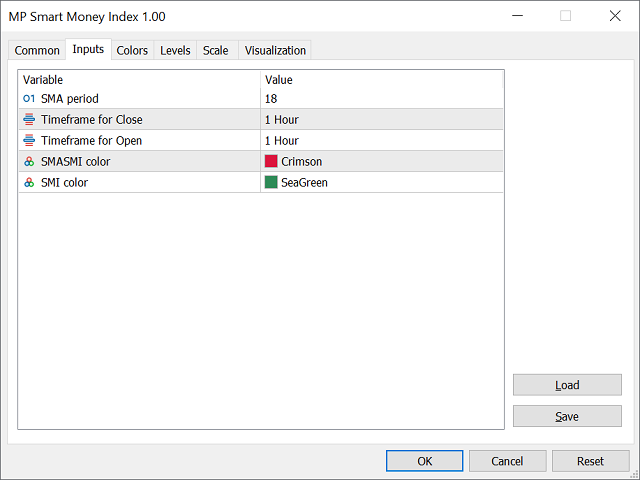

MP SMI for MT5

- Индикаторы

- Pierre Ksachikian

- Версия: 1.0

The purpose of using Smart money index (SMI) or smart money flow index is to find out investors sentiment. The index was constructed by Don Hays and measures the market action.

The indicator is based on intra-day price patterns. The beginning of the trading day is supposed to represent the trading by retail traders. The majority of retail traders overreact at the beginning of the trading day because of the overnight news and economic data. There is also a lot of buying on market orders and short covering at the opening. In the last hours of trading, institutional, smart and experienced investors start trading (the “smart” money trades) having the opportunity to evaluate market performance.

So, the basic strategy is to bet against the morning price trend and bet with the evening price trend.

Usage rules:

The SMI sends no clear signal whether the market is bullish or bearish. There are also no fixed absolute or relative readings signaling about the trend. Traders need to look at the SMI dynamics relative to that of the market. When the SMI is rising sharply when the market falls, it is indicative that smart money is buying, and the market is to revert to an uptrend soon. In contrast, when SMI falls rapidly while the market is bullish, it means that smart money is selling and that market is to revert to a downtrend soon.

___________________________________________________________________________________

Disclaimer:

Do NOT trade or invest based upon the analysis presented on this channel. Always do your own research and due diligence before investing or trading. I’ll never tell you what to do with your capital, trades or investments. I’ll also never recommend for you to buy, sell, long or short any asset, commodity, security, derivative or cryptocurrency related instrument as it's extremely HIGH RISK! You should always consult with a professional/licensed financial adviser before trading or investing in any type of assets.