Версия 3.62

2024.10.29

“Quick Direction Correction” (only for GBPUSD) feature has been added.

It can more quickly identify market directions and close orders in the wrong direction. However, it may sometimes exit too early, resulting in not achieving optimal profits. It is suitable for recent market conditions and is enabled by default but can be turned off manually. This feature only applies to GBPUSD. Currently, EURUSD is performing well.

Версия 3.61

2024.08.21

1.The strategy research to address the latest market conditions has been completed. We will conduct an extra update, hoping that the EA can quickly adapt to market changes.

The new strategy has been integrated into the Intelligent Market Filtering System. It is recommended to keep it enabled by default.

2. The default value for the order mode "The mode used to place the number of lots" has been changed to "Initial Capital Risk Mode". This mode allows for a more intuitive observation of market changes and capital recovery. The previous "Risk Mode" is a compound interest mode, more suitable for capital growth in favorable market conditions. You can choose according to your preference.

Версия 3.60

2024.08.13

1. Added "Daily Maximum Drawdown Limit (%)" function, mainly for use by prop firms, not recommended for use as a stop loss.

2. Adjusted parameters for EURUSD and AUDUSD based on real account performance.

3. Updated training data.

Версия 3.59

2024.06.09

1. Added start trading time function, accurate to the second.

2. Added support for currency pair conversion with suffixes.

3. No longer need to switch time frames to obtain market information.

4. Added profit percentage closing function. (for prop firm)

5. Added unique entry point function. (for prop firm)

6. Fixed the issue where changing settings required a reload to take effect.

7. Retrained the EURUSD currency pair with new parameters.

8. Set risk mode as the default mode.

9. Updated the latest training data.

The unique entry point function will add or subtract random price points from 0 to the specified value, reducing order similarity without affecting performance within 5 points. The EA has added necessary functions for the prop firm challenge and is now prop firm ready.

Версия 3.58

2024.03.12

3.57 reuploaded

Версия 3.57

2024.03.12

1. The default setting "RiskMod" has been changed to "InitialCapitalRiskMode," removing the compounding effect to facilitate easier observation of EA performance changes, thus enhancing trading confidence. Keeping the order size constant despite a reduction in capital also favors profit recovery. Users may change this as needed.

2. Based on live trading performance, the "Intelligent Dynamic Parameters" has been set to off by default, and the parameters have been optimized when turned off. Turning it on will restore performance to the level of version 3.56.

3. An optimized "AutoGetData" function has been added to address the issue of some clients' trading platforms not placing orders for extended periods.

4. The "FIFO Rule" has been set to true by default.

5. The "Reduce close conditions after long times" has been set to true by default.

6. Some minor issues have been corrected.

The update has not reduced performance; the decrease in profits is due to the new default "InitialCapitalRiskMode" not employing compounding growth. Switching to "RiskMod" will restore compounding growth, significantly increasing profits. Both modes have their pros and cons, and users can modify them as needed.

Версия 3.56

2024.02.09

Significant upgrade includes:

1. Addition of a profit target, after which the EA will stop placing orders. The value is the percentage growth since the EA started running, and it will be recalculated from zero upon a reload or setting change.

2. Introduction of a FIFO option, as most US brokers follow this rule. When the FIFO option is enabled, hedging functions will be unavailable.

3. Algorithm has been readjusted, and the issue of not opening trades due to insufficient information has been resolved.

4. Training data have been updated.

It is normal for the algorithm adjustments in this upgrade to result in different order positions in backtesting compared to previous trades.

Версия 3.52

2023.10.22

Important upgrade

1. Added market situation judgment function (market situation). The default is adaptive mode. The adaptive mode can already identify some strong trend markets. If there is a clear trend market driven by major news, you can manually switch to trend mode or oscillation mode to implement artificial circuit monitoring. When this function is turned off, the effect is the same as oscillation mode. Trend mode reduces trading opportunities. Although profits are lower, accuracy can be improved and drawdowns can be reduced.

2. 1 account currency in USD: The number of US dollars that 1 unit of account currency can be exchanged for. EA calculates the order size based on this value. The default value for US dollar accounts is 1. It enables different currency accounts to place orders at standard risk values. Fixed the issue of excessively large orders for Japanese Yen accounts.

3. Added timeout close position standard function to reduce holding time. Parameters have been optimized based on big data for each currency pair.

4. Updated with latest training data.

Note that changing EA settings or upgrading EA will reset accumulated drawdown to zero for recalculation.

Версия 3.50

2023.09.14

Major Upgrade 3.5 version

1. Added a new filtering algorithm to decrease the drawdown rate

2. Adjusted the sensitivity of hedge protection

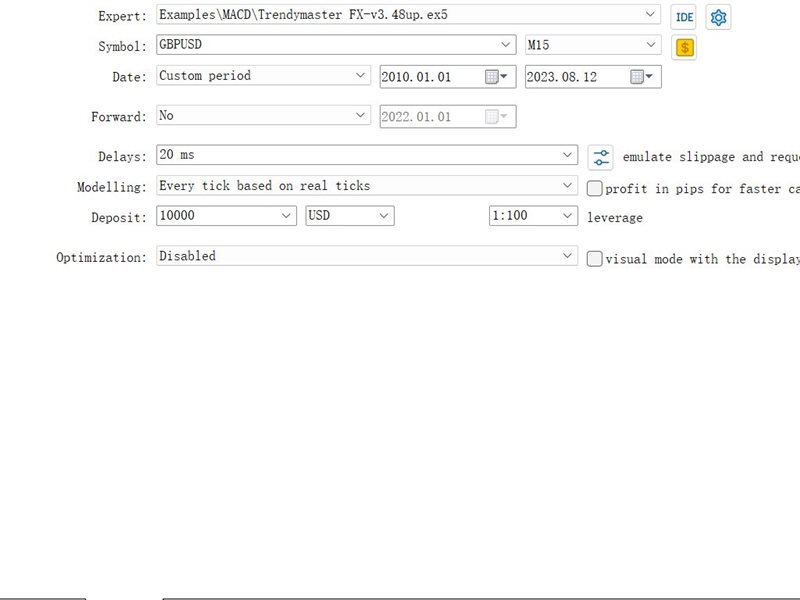

3. Expanded the training data, with the new model utilizing 20 years of training data

Given the substantial changes brought by the new model, it's normal for the order position to differ from before.

Among all currency pairs, USDJPY fluctuates the most, with increased trading frequency and more frequent hedging.

One of the best EAs indeed! Very easy to setup and accurate automatic trading. I am quite impressed and delighted to have this powerful EA in my arsenal. Great work Mr. Chen, my hats off!