당사 팬 페이지에 가입하십시오

- 조회수:

- 7034

- 평가:

- 게시됨:

- 2013.01.23 15:54

- 업데이트됨:

- 2023.03.29 13:42

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

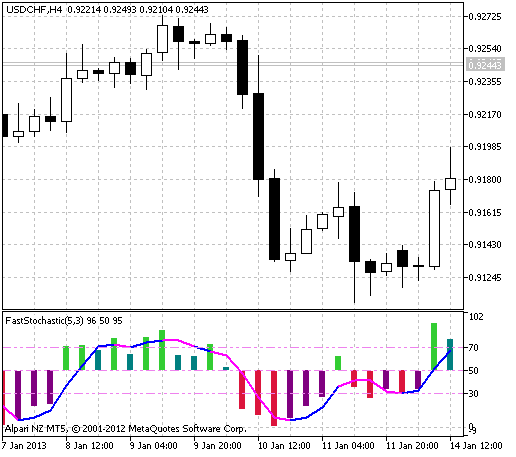

The Fast Stochastic indicator is one of modifications of a popular stochastic oscillator of С. Lane's stochastic that means "fast stochastic". The main objective of the oscillator is definition of overbought / oversold zones of the market after which the price reversal comes.

The Fast Stochastic oscillator formula calculates the ratio of the current close price to the maximum or the minimum for a certain period, thus, the dynamics of the indicator can indicate the speed of the price action.

As a traditional Stochastic, the Fast Stochastic is realized in the chart in the form of %K and %D lines which are calculated using the following formula:

%K[i] = 100*(Price[i] — MaxHigh[N]) / (MaxHigh[N] — MinLow[N]);

%D[i] = MA(%K[i], P);

This is a little modified version of the standard indicator, thus, its signals are represented by crossing of %K and %D lines and also the output from the critical ranges.

The indicator uses SmoothAlgorithms.mqh library classes (must be copied to the terminal_data_folder\MQL5\Include). The use of the classes was thoroughly described in the article "Averaging price series for intermediate calculations without using additional buffers".

Fig.1 The FastStochastic indicator

MetaQuotes Ltd에서 러시아어로 번역함.

원본 코드: https://www.mql5.com/ru/code/1457

ADX Cross Hull Style

ADX Cross Hull Style

A semaphore, arrow indicator drawn on the basis of the ADX technical indicator

Exp_TMA

Exp_TMA

The breakthrough trading system based on the signals of the TMA indicator

ChannelAnt

ChannelAnt

The channel indicator that draws support and resistance lines.

Exp_MBKAsctrend3

Exp_MBKAsctrend3

The Expert Advisor drawn on the principle of the semaphore, signal MBKAsctrend3 indicator.