Unisciti alla nostra fan page

- Visualizzazioni:

- 1822

- Valutazioni:

- Pubblicato:

- 2018.10.25 14:53

- Aggiornato:

- 2023.03.29 13:48

-

Hai bisogno di un robot o indicatore basato su questo codice? Ordinalo su Freelance Vai a Freelance

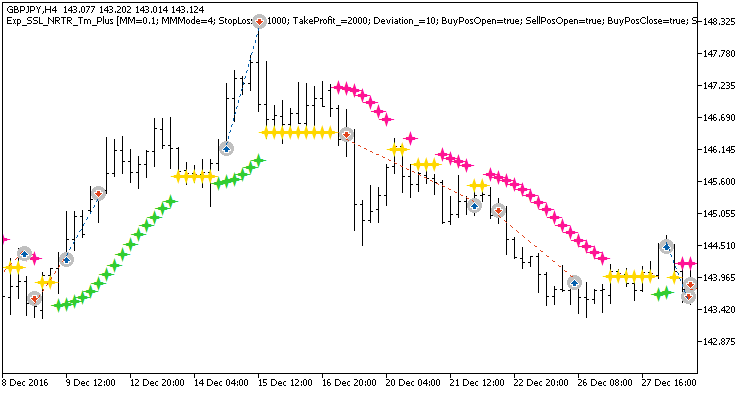

The trading system based on SSL_NRTR indicator signals with the possibility to set a fixed position holding time. The signal is formed when a bar is closing if the indicator changes its color from a non-trend to a trend one or from a trend one to an opposite trend one. Once position holding time exceeds a preset fixed limit, the position will be closed immediately:

input bool TimeTrade=true; //Enabling position exit by time input uint nTime=3840; //Open position holding time in minutes

For the generated EA to operate correctly, the compiled SSL_NRTR.ex5 indicator file should be in the <terminal_data_directory>\MQL5\Indicators folder.

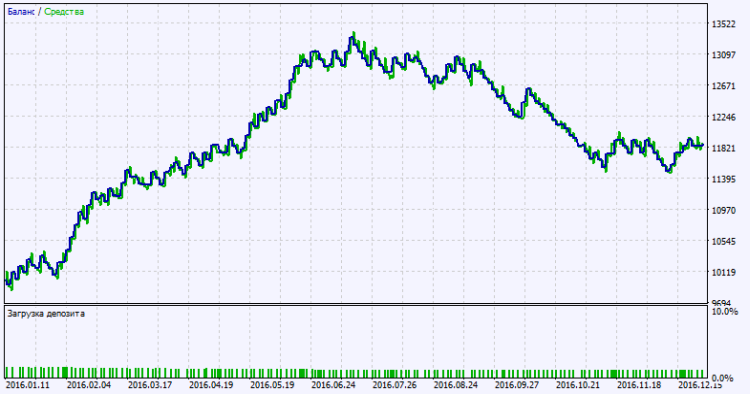

Default Expert Advisor's input parameters have been used during tests shown below.

Fig. 1. Examples of trades on the chart

Testing results for GBPJPY H4 over the year 2017:

Fig. 2. Test results chart

Tradotto dal russo da MetaQuotes Ltd.

Codice originale https://www.mql5.com/ru/code/22118

SSL_NRTR_HTF

SSL_NRTR_HTF

SSL_NRTR indicator with the timeframe selection option available in input parameters

Tunnel Method

Tunnel Method

Trading based on three iMAs (Moving Average, MA)

Exp_XHullTrend_Digit

Exp_XHullTrend_Digit

Exp_XHullTrend_Digit is based on signals generated by XHullTrend_Digit indicator

Exp_MA_Rounding_Candle_MMRec

Exp_MA_Rounding_Candle_MMRec

The trading system based on the MA_Rounding_Candle indicator signals with an ability to change the volume of a forthcoming trade depending on the results of the previous trades for this trading system