Unisciti alla nostra fan page

- Visualizzazioni:

- 6415

- Valutazioni:

- Pubblicato:

- 2018.08.15 17:20

-

Hai bisogno di un robot o indicatore basato su questo codice? Ordinalo su Freelance Vai a Freelance

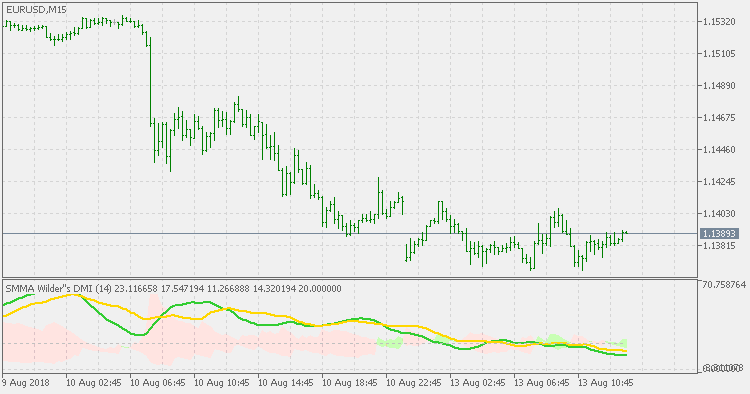

Within the suite of indicators that make up Wilder’s directional movement index (DMI) are the plus directional movement indicator (+DI) and the minus directional movement indicator (-DI). They provide the foundation for the more widely recognized average directional index (ADX). Whereas the ADX offers information about the strength of price movement but not its direction, the +DI and -DI furnish information about the positive or negative direction of price movement over a period of time.

Wilder provides complete information about the function and construction of all the components that make up the directional movement index in his 1978 book, New Concepts In Technical Trading Systems. In general, the plus and minus components of the DMI focus on that portion of the current bar’s trading range that is outside the range of the previous price bar. If it is higher, it is considered to be positive (+) and if it is lower, it is labeled negative (-). These values are divided by the true range and averaged over time, usually 14 periods. A move by the +DI above the -DI indicates that positive or upward price direction has overtaken negative or downward price direction. Conversely, when +DI falls below -DI, declining price either from selling pressure or lack of upward price momentum is taking control. Potential changes in direction or trend occur when the lines intersect.

Wilders is using what is sometimes called Wildes EMA in DMI calculation (Wilders EMA is, as far as values are concerned, same as SMMA). This version extends the calculation and allows you to chose different type of average for that calculation (the usual set : SMA, EMA, SMMA or LWMA)

Logarithmic Garman Klass volatility

Logarithmic Garman Klass volatility

Logarithmic Garman Klass volatility

Yang Zhang extension of Garman Klass Volatility

Yang Zhang extension of Garman Klass Volatility

Yang Zhang extension of Garman Klass Volatility

Smooth ATR trend envelopes of averages

Smooth ATR trend envelopes of averages

Smooth ATR trend envelopes of averages

Volty channel stop - smooth ATR

Volty channel stop - smooth ATR

Volty channel stop - smooth ATR