Voir comment télécharger gratuitement des robots de trading

Retrouvez-nous sur Facebook !

Rejoignez notre page de fans

Rejoignez notre page de fans

Vous avez aimé le script ? Essayez-le dans le terminal MetaTrader 5

- Vues:

- 5454

- Note:

- Publié:

- 2019.01.29 12:06

-

Besoin d'un robot ou d'un indicateur basé sur ce code ? Commandez-le sur Freelance Aller sur Freelance

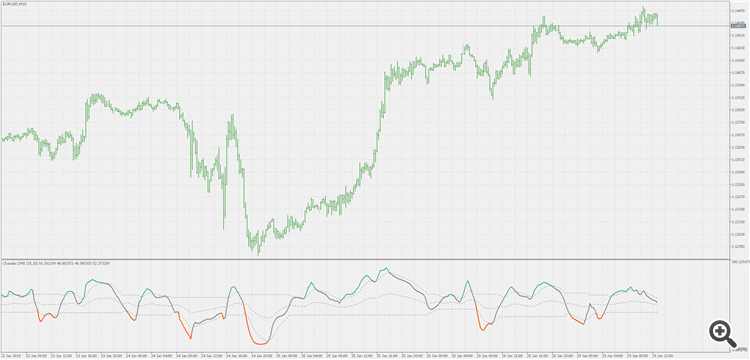

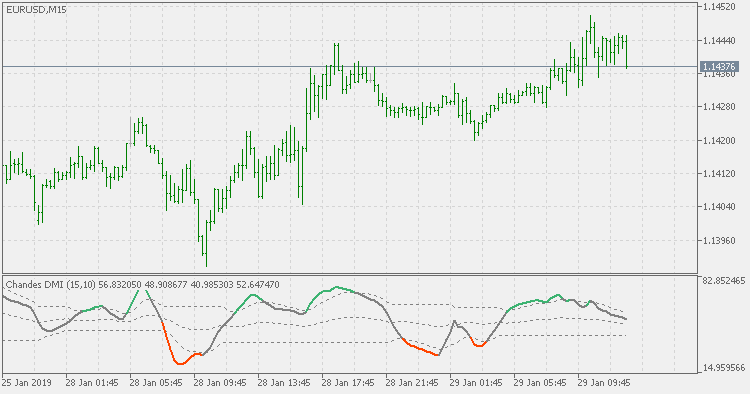

Theory :

Original definition of the Tushar Chande's and Stanley Kroll's DMI is the following :The dynamic momentum index is used in technical analysis to determine if a security is overbought or oversold. This indicator, developed by Tushar Chande and Stanley Kroll, is very similar to the relative strength index (RSI). The main difference between the two is that the RSI uses a fixed number of time periods (usually 14), while the dynamic momentum index uses different time periods as volatility changes, typically between five and 30.

This version is deviating from it in a number of ways :

- it is using RSX instead of RSI for calculation (thus producing a much smoother result)

- it is using standard deviation adapting to calculate that RSX

- it is adding discontinued signal lines instead of using fixed levels for OB/OS signal

Usage :

You can use color changes as signals. Color change can be one of the following :

- color change on slope change

- color change on outer dsl signal lines cross

- color change on middle dsl signal lines cross. the middle signal line is calculated as the average of upper and lower, which makes it a good new "zero" line (or 50 line in case of DMI)

Chande's DMI - std adaptive with floating levels

Chande's DMI - std adaptive with floating levels

Chande's DMI - std adaptive with floating levels

Volatility ratio

Volatility ratio

Volatility ratio - standard deviations based