LiteFinance / Профиль

Онлайн ECN брокер LiteFinance (ex. LiteForex) с 2005 года предоставляет клиентам возможность выхода к глубочайшей ликвидности на валютном, товарном и фондовом рынках. Для торговли через LiteFinance (ex. LiteForex) доступны все основные валютные пары и кросс-курсы, нефть, драгоценные металлы, биржевые индексы, акции корпораций и самый большой набор криптовалютных пар среди брокеров.

Друзья

381

Заявки

Исходящие

LiteFinance

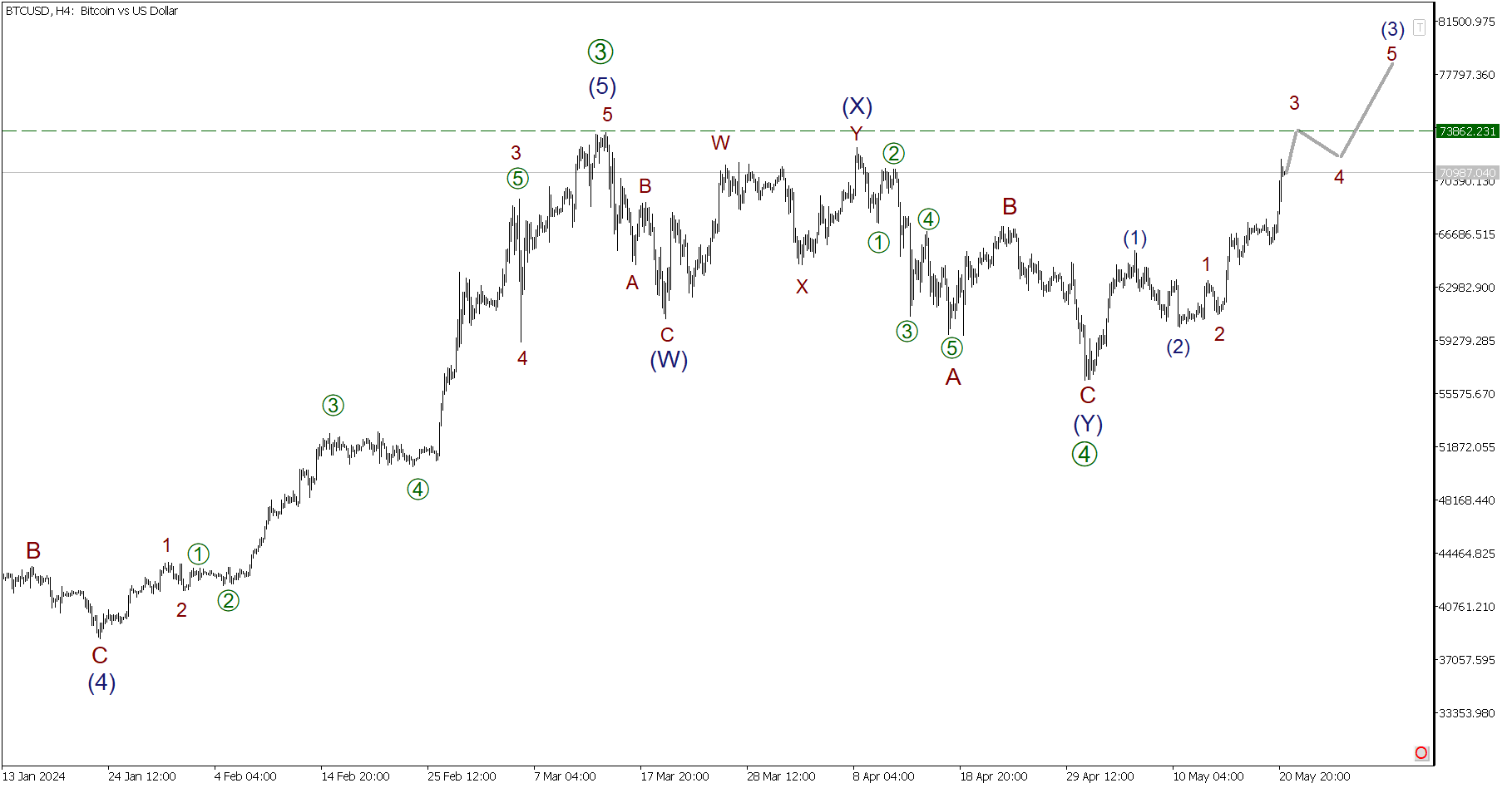

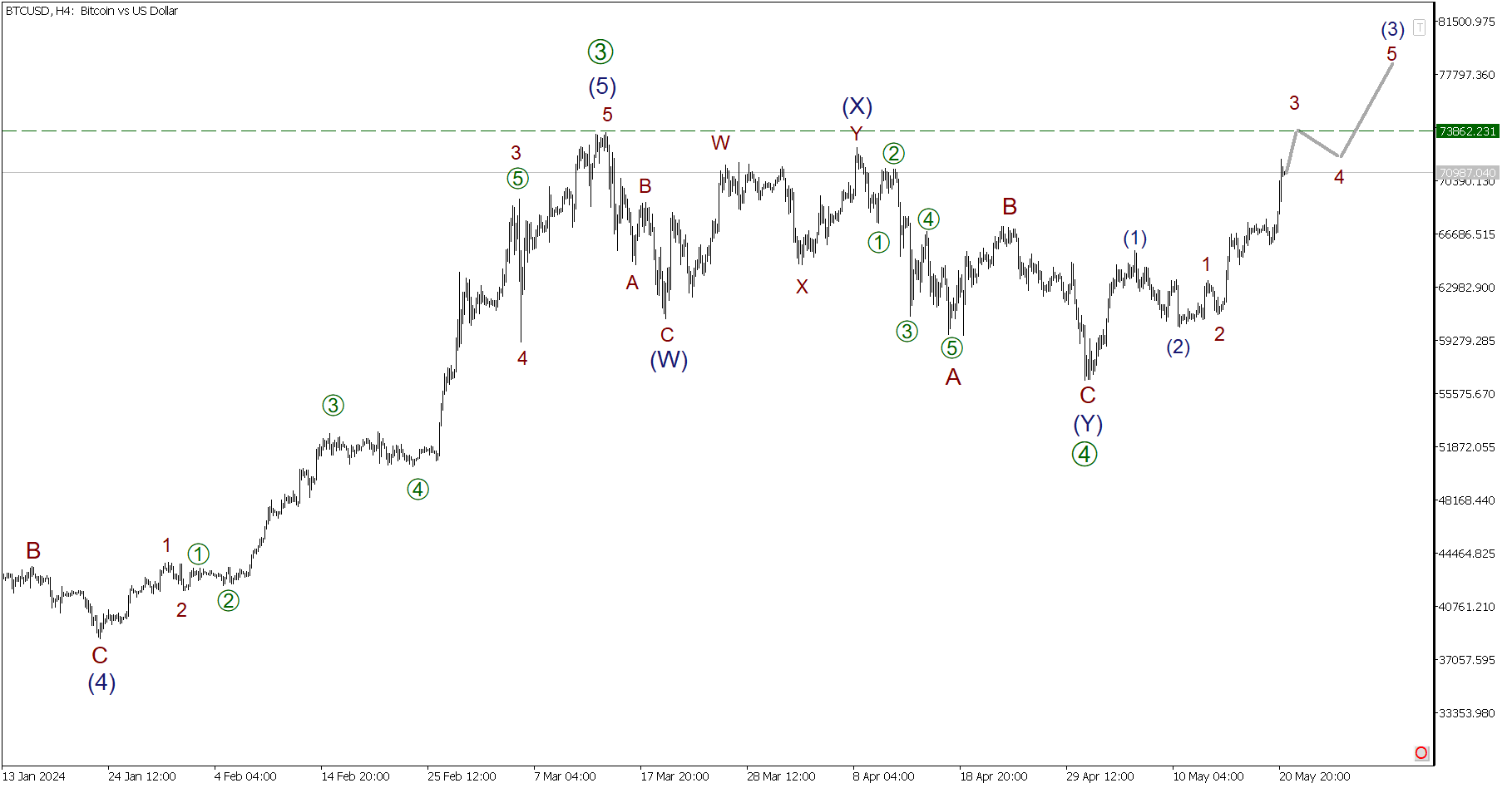

Short-term analysis for BTCUSD, XRPUSD, and ETHUSD for 22.05.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum. I offer entry signals to trade each cryptocurrency.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-22052024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum. I offer entry signals to trade each cryptocurrency.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-22052024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term analysis for BTCUSD, XRPUSD, and ETHUSD for 21.05.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum. I offer entry signals to trade each cryptocurrency.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-21052024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum. I offer entry signals to trade each cryptocurrency.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-21052024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term analysis for BTCUSD, XRPUSD, and ETHUSD for 20.05.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum. I offer entry signals to trade each cryptocurrency.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-20052024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum. I offer entry signals to trade each cryptocurrency.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-20052024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term analysis for BTCUSD, XRPUSD, and ETHUSD for 17.05.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum. I offer entry signals to trade each cryptocurrency.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-17052024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum. I offer entry signals to trade each cryptocurrency.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-17052024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term analysis for BTCUSD, XRPUSD, and ETHUSD for 16.05.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum. I offer entry signals to trade each cryptocurrency.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-16052024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum. I offer entry signals to trade each cryptocurrency.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-16052024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term analysis for BTCUSD, XRPUSD, and ETHUSD for 14.05.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum. I offer entry signals to trade each cryptocurrency.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-14052024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum. I offer entry signals to trade each cryptocurrency.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-14052024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term analysis for BTCUSD, XRPUSD, and ETHUSD for 07.05.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum. I offer entry signals to trade each cryptocurrency.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-07052024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum. I offer entry signals to trade each cryptocurrency.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-07052024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Euro is positive. Forecast as of 18.05.2021

Fundamental euro forecast for six months

Silence is consent. When in February the ECB actively resented the growth of European bond yields, threatening to increase the volume of asset purchases under the QE (which ultimately happened), the bond yields of the EU countries grew not as fast as now. In May, German bond yields should return to a level above zero for the first time since 2019, and Natwest expects the interest rate to hit 0.25% by the end of 2021. What's the matter? Why is the European Central Bank silent? After all, the ECB understands that the euro is strengthening amid the euro-area bond yields rally.

In fact, a rally in bond yields can happen for right and wrong reasons. Due to slow vaccinations, a worsening epidemiological situation, and related lockdowns in the first quarter, the euro-area economy faced a double-dip recession. Now, thanks to the vaccination campaign acceleration (the EU plans that 70% of the adult population should receive at least one dose of the vaccine by the end of the summer) and the belief in the opening and the rebound of the economy, the situation looks very different.

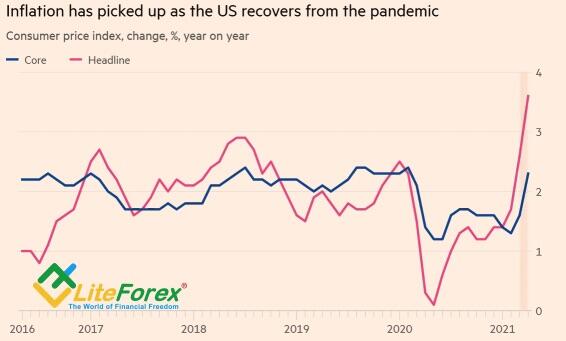

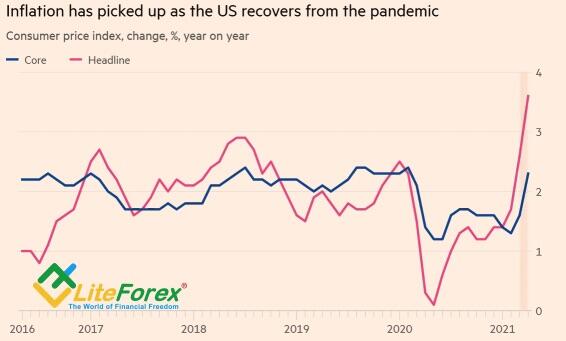

For the ECB, inflationary expectations and real yields are important. In February, the first remained practically unchanged, while 10-year Germany’s real yield grew faster than the nominal. Today, German inflation expectations have jumped to 1.6%, the highest since 2018, while real yield is down. Three months ago, euro-area bond yields were rising for the wrong reasons. They were pushed up by the news from the USA. In May, positive economic data in the euro area became the main growth driver.

Yes, the inflation growth in the USA is much faster than in the euro area. Considering the difference between the inflation rates in the US and Europe, some analysts suggest shocking forecasts for the EURUSD drop below parity. However, let us be reasonable. The pandemic “was an unprecedented shock, it led to an unprecedented collapse, and we may have an unprecedented recovery," Fed Vice Chair Richard Clarida said. It is hard to argue, especially looking at the controversial reports on US inflation and employment.

Just as Treasury yields supported the US dollar in January-March, European bond yields have strengthened the euro in April-May. But this is not the only advantage of the euro.

The White House has begun to speculate about a reduction in tariffs set by Donald Trump. The average US import tariffs in trade with China are currently 19.3%, with the rest of the world - 3%. The tariffs are clearly accelerating inflation, which reduces the likelihood that Congress will approve the new fiscal stimulus package proposed by Joe Biden. In April, import prices in the US jumped to 10.6%, the highest since October 2011.

EURUSD trading plan for six months

Lowering tariffs is good for export-led countries. Earlier, trade wars created obstacles not only for China but for the EURUSD bulls as well. I suppose some negative is still priced into the pair’s quotes. That is why the reduction in tariffs could support the euro rise to the previously indicated targets at $1.24 and $1.255.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-is-positive-forecast-as-of-18052021/?uid=285861726&cid=79634

Dynamics of EURUSD and core inflation difference

Fundamental euro forecast for six months

Silence is consent. When in February the ECB actively resented the growth of European bond yields, threatening to increase the volume of asset purchases under the QE (which ultimately happened), the bond yields of the EU countries grew not as fast as now. In May, German bond yields should return to a level above zero for the first time since 2019, and Natwest expects the interest rate to hit 0.25% by the end of 2021. What's the matter? Why is the European Central Bank silent? After all, the ECB understands that the euro is strengthening amid the euro-area bond yields rally.

In fact, a rally in bond yields can happen for right and wrong reasons. Due to slow vaccinations, a worsening epidemiological situation, and related lockdowns in the first quarter, the euro-area economy faced a double-dip recession. Now, thanks to the vaccination campaign acceleration (the EU plans that 70% of the adult population should receive at least one dose of the vaccine by the end of the summer) and the belief in the opening and the rebound of the economy, the situation looks very different.

For the ECB, inflationary expectations and real yields are important. In February, the first remained practically unchanged, while 10-year Germany’s real yield grew faster than the nominal. Today, German inflation expectations have jumped to 1.6%, the highest since 2018, while real yield is down. Three months ago, euro-area bond yields were rising for the wrong reasons. They were pushed up by the news from the USA. In May, positive economic data in the euro area became the main growth driver.

Yes, the inflation growth in the USA is much faster than in the euro area. Considering the difference between the inflation rates in the US and Europe, some analysts suggest shocking forecasts for the EURUSD drop below parity. However, let us be reasonable. The pandemic “was an unprecedented shock, it led to an unprecedented collapse, and we may have an unprecedented recovery," Fed Vice Chair Richard Clarida said. It is hard to argue, especially looking at the controversial reports on US inflation and employment.

Just as Treasury yields supported the US dollar in January-March, European bond yields have strengthened the euro in April-May. But this is not the only advantage of the euro.

The White House has begun to speculate about a reduction in tariffs set by Donald Trump. The average US import tariffs in trade with China are currently 19.3%, with the rest of the world - 3%. The tariffs are clearly accelerating inflation, which reduces the likelihood that Congress will approve the new fiscal stimulus package proposed by Joe Biden. In April, import prices in the US jumped to 10.6%, the highest since October 2011.

EURUSD trading plan for six months

Lowering tariffs is good for export-led countries. Earlier, trade wars created obstacles not only for China but for the EURUSD bulls as well. I suppose some negative is still priced into the pair’s quotes. That is why the reduction in tariffs could support the euro rise to the previously indicated targets at $1.24 and $1.255.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-is-positive-forecast-as-of-18052021/?uid=285861726&cid=79634

Dynamics of EURUSD and core inflation difference

LiteFinance

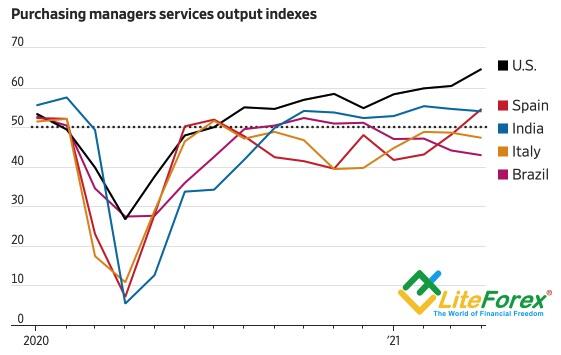

Dollar: from boom to scandal. Forecast as of 17.05.2021

Weekly US dollar fundamental forecast

The US economic recovery looks like a scandal rather than a boom. Controversial economic data create problems for the White House because its previous fiscal stimulus turned into an acceleration of inflation and pressed down the employment growth. Republicans compare the current situation to the era of stagflation under President Jimmy Carter, and Democrats are forced to admit that this will be a chaotic recovery. So, the US economic rebound may not be as fast as the Fed and IMF expect. The USA could lose its exclusivity, setting back the EURUSD bears.

It is one thing when financial markets test Fed’s strength, but it is different when the White House loses touch with the electorate. According to the University of Michigan, the US consumer sentiment index dropped to its three-month low of 82.3, lower than the most pessimistic forecasts of Bloomberg experts. Consumer inflation expectations for the next year increased to 4.6%, while 43% of the survey’s respondents said prices could rise by at least 5%. The last time such inflation was in 1991. Consumers are concerned that the era of low prices has finished. That is why Congress may not adopt new fiscal stimulus packages of $4 trillion proposed by Joe Biden. If the stimulus plans are rejected, the US economy won’t be rising as fast as the EURUSD bears wish.

The euro bulls bet on the increase in the euro-area inflation and PMI. Consumer prices in the euro area could jump up to 2% over the next few months, encouraging the Governing Council’s hawks to go ahead. The minutes of the ECB April meeting highlighted encouraging signs of the global demand recovery, fiscal stimulus in the US, and an acceleration in the vaccine rollouts across the EU. Therefore, the ECB believes the euro-area economy could recover sooner than earlier expected.

The evidence of a faster growth could be the euro-area PMI report. Other highlights of the week ending May 21 are the report on the European inflation and the FOMC meeting’s minutes. According to Bloomberg experts, the euro-area services PMI will continue rising, proving that the euro-area economy can manage the double-dip recession. Although skeptics claim that the difference between the US and euro-area PMI could be the widest over many years, who will guarantee following a series of chaotic data in the USA?

Weekly EURUSD trading plan

Of course, the supply will catch up with the demand. However, until it happens, the discrepancy between the recovery of industries will continue to manifest itself most unexpectedly. The theory of the US economic boom may not work out, which, amid positive economic data in the euro-area, will encourage the EURUSD bulls to go ahead. If the euro price consolidates above $1.211, it could continue rallying up to $1.22 and $1.226. If it doesn’t consolidate, there should be short-term consolidation in the range of $1.198-$1.218.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-from-boom-to-scandal-forecast-as-of-17052021/?uid=285861726&cid=79634

Dynamics of Treasury yield and inflation expectations

Weekly US dollar fundamental forecast

The US economic recovery looks like a scandal rather than a boom. Controversial economic data create problems for the White House because its previous fiscal stimulus turned into an acceleration of inflation and pressed down the employment growth. Republicans compare the current situation to the era of stagflation under President Jimmy Carter, and Democrats are forced to admit that this will be a chaotic recovery. So, the US economic rebound may not be as fast as the Fed and IMF expect. The USA could lose its exclusivity, setting back the EURUSD bears.

It is one thing when financial markets test Fed’s strength, but it is different when the White House loses touch with the electorate. According to the University of Michigan, the US consumer sentiment index dropped to its three-month low of 82.3, lower than the most pessimistic forecasts of Bloomberg experts. Consumer inflation expectations for the next year increased to 4.6%, while 43% of the survey’s respondents said prices could rise by at least 5%. The last time such inflation was in 1991. Consumers are concerned that the era of low prices has finished. That is why Congress may not adopt new fiscal stimulus packages of $4 trillion proposed by Joe Biden. If the stimulus plans are rejected, the US economy won’t be rising as fast as the EURUSD bears wish.

The euro bulls bet on the increase in the euro-area inflation and PMI. Consumer prices in the euro area could jump up to 2% over the next few months, encouraging the Governing Council’s hawks to go ahead. The minutes of the ECB April meeting highlighted encouraging signs of the global demand recovery, fiscal stimulus in the US, and an acceleration in the vaccine rollouts across the EU. Therefore, the ECB believes the euro-area economy could recover sooner than earlier expected.

The evidence of a faster growth could be the euro-area PMI report. Other highlights of the week ending May 21 are the report on the European inflation and the FOMC meeting’s minutes. According to Bloomberg experts, the euro-area services PMI will continue rising, proving that the euro-area economy can manage the double-dip recession. Although skeptics claim that the difference between the US and euro-area PMI could be the widest over many years, who will guarantee following a series of chaotic data in the USA?

Weekly EURUSD trading plan

Of course, the supply will catch up with the demand. However, until it happens, the discrepancy between the recovery of industries will continue to manifest itself most unexpectedly. The theory of the US economic boom may not work out, which, amid positive economic data in the euro-area, will encourage the EURUSD bulls to go ahead. If the euro price consolidates above $1.211, it could continue rallying up to $1.22 and $1.226. If it doesn’t consolidate, there should be short-term consolidation in the range of $1.198-$1.218.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-from-boom-to-scandal-forecast-as-of-17052021/?uid=285861726&cid=79634

Dynamics of Treasury yield and inflation expectations

LiteFinance

Dollar leads the bulls to a slaughter

Without the growth in Treasury yield, the greenback won’t strengthen

Forecasting is an ungrateful thing; it could be dangerous at the time of the pandemic. Economic patterns do not accurately forecast pivot points, but they determine the trends well. The COVID-19 pandemic and its economic fallout imply a number of pivot points. That is why the discrepancies between the forecasts and actual data on US unemployment and inflation for April have been so great. Bloomberg experts have been wrong, and the markets have been jumping up and down. I am jumping with a parachute today and tell you about the experience tomorrow. The status was updated 84 days ago.

Unfortunately, experience teaches only to make new mistakes. A surge in Treasury yields and the consumer prices increase to 4.2% made investors buy dollars. Markets remembered about March events when the greenback strengthened amid the talks that the Treasury bull market had turned down (the price is moving opposite the yields). The bets on the trend reversal have ended up in losses over the decades. Will this time the Treasury bulls go the slaughter?

Friendship with the brains serves the good. Following the Treasury yield stabilization in April – early May, many analysts suggested that the yields do not grow because the Fed is unwilling to normalize the monetary policy. The real reason is that there are a lot of buyers in the US bond market. The US Treasury yield is still much higher than that of the government bonds in Japan or Germany. The Federal Reserve doesn’t want to raise the interest rates, contributing to a faster shift from euros to dollars. After all, Jerome Powell and his fellow central bankers have poured so much money into the financial system that investors do not know what to do with it. The Treasury bulls seem unlikely to go to the slaughter, and traders should closely watch the bond markets in other countries. Otherwise, they can lose their heads. Or money. Anyway, you can’t lose more than you have.

How repulsive insincere people are! They pretend to believe when you tell a lie! The Fed used to pledge not to correct the federal funds rate and changed it, so it could be lying this time. The Fed is willing to be patient, but any patience has its limits. Reuters experts say the core PCE at 2.8% should be the limit. All investors try to catch any word from the Fed’s officials, but the US central bank is not a magic goldfish fulfilling the wishes. I do not think the tests for the Fed’s strength will result in meeting the market expectations.

If you won, somebody must have lost. That is the Forex law. Today you enjoy your profit, and tomorrow, you are sad because of a loss. News is not what you should rely on when making your trading decision. Good news and expectations may not do any good.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/chatty-forex/dollar-leads-the-bulls-to-a-slaughter/?uid=285861726&cid=79634

Without the growth in Treasury yield, the greenback won’t strengthen

Forecasting is an ungrateful thing; it could be dangerous at the time of the pandemic. Economic patterns do not accurately forecast pivot points, but they determine the trends well. The COVID-19 pandemic and its economic fallout imply a number of pivot points. That is why the discrepancies between the forecasts and actual data on US unemployment and inflation for April have been so great. Bloomberg experts have been wrong, and the markets have been jumping up and down. I am jumping with a parachute today and tell you about the experience tomorrow. The status was updated 84 days ago.

Unfortunately, experience teaches only to make new mistakes. A surge in Treasury yields and the consumer prices increase to 4.2% made investors buy dollars. Markets remembered about March events when the greenback strengthened amid the talks that the Treasury bull market had turned down (the price is moving opposite the yields). The bets on the trend reversal have ended up in losses over the decades. Will this time the Treasury bulls go the slaughter?

Friendship with the brains serves the good. Following the Treasury yield stabilization in April – early May, many analysts suggested that the yields do not grow because the Fed is unwilling to normalize the monetary policy. The real reason is that there are a lot of buyers in the US bond market. The US Treasury yield is still much higher than that of the government bonds in Japan or Germany. The Federal Reserve doesn’t want to raise the interest rates, contributing to a faster shift from euros to dollars. After all, Jerome Powell and his fellow central bankers have poured so much money into the financial system that investors do not know what to do with it. The Treasury bulls seem unlikely to go to the slaughter, and traders should closely watch the bond markets in other countries. Otherwise, they can lose their heads. Or money. Anyway, you can’t lose more than you have.

How repulsive insincere people are! They pretend to believe when you tell a lie! The Fed used to pledge not to correct the federal funds rate and changed it, so it could be lying this time. The Fed is willing to be patient, but any patience has its limits. Reuters experts say the core PCE at 2.8% should be the limit. All investors try to catch any word from the Fed’s officials, but the US central bank is not a magic goldfish fulfilling the wishes. I do not think the tests for the Fed’s strength will result in meeting the market expectations.

If you won, somebody must have lost. That is the Forex law. Today you enjoy your profit, and tomorrow, you are sad because of a loss. News is not what you should rely on when making your trading decision. Good news and expectations may not do any good.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/chatty-forex/dollar-leads-the-bulls-to-a-slaughter/?uid=285861726&cid=79634

LiteFinance

Dollar plays with time. Forecast as of 13.05.2021

Weekly US dollar fundamental forecast

There is nothing more permanent than temporary. The financial markets' reaction to the significant rise in consumer prices has proven that investors doubt the Fed's mantra of a short-term boost in inflation. The Treasury yield has had the best daily rise since February, and the correction of stock indices continued. After hitting the 26th and 24th all-time highs in 2021 by the S&P 500 and the Dow Jones in the week ended May 7, they featured their worst three-day drop in nearly seven months. So the greenback has naturally strengthened.

The consumer price growth by 4.2% in April was the fastest since September 2008; core inflation rose by 3%, the most significant growth since 1995. It surprised even Fed Vice President Richard Clarida. The report has been hot but not overheated. The Federal Reserve will not change its policy because of a single strong report. Clarida noted that CPI has increased and is likely to rise a little more before falling at the end of the year. However, in 2022-2023, the indicator will return to the target of 2% or slightly higher.

The Fed Vice President stressed that the central bank would continue to monitor inflationary expectations closely. If the situation does not develop in accordance with its baseline forecast, it will immediately intervene.

After the US inflation report, investors wonder how long inflation pressure will last. Atlanta Fed chair Raphael Bostic expects increased CPI volatility until September. On condition of anonymity, White House officials told Bloomberg that inflation volatility would last till the end of the year. Republicans criticizing Joe Biden for the negative impact of fiscal stimulus on employment argue that this is not a temporary phenomenon. This is the type of thing that will start to change inflationary expectations.

After such surprises from employment and consumer prices (the discrepancy in the forecasts of Bloomberg experts and the actual data on the first indicator turned out to be a record, on the second - the widest since 1996), I would not be surprised if not only Republicans but also some Democrats begin to doubt the advisability of additional aid packages of $4 trillion. If Congress does not approve the new stimulus package, the US stock indexes could continue falling, strengthening the dollar.

However, I believe the EURUSD drop after the US inflation report has been too deep. Supply disruptions will be eliminated, and people getting back to work will reduce the gap between the demand for goods and services and their supply. I do not think that the Fed will abandon its mantra about the temporary nature of the acceleration of consumer prices. Otherwise, the Fed’s authority will be undermined. Norges Bank, for example, doesn’t raise the interest rate, although inflation in the country has been above the target of 2% for more than a year.

Weekly EURUSD trading plan

The Fed is likely to remain passive, so it will be relevant to buy the EURUSD when the price returns to a level above 1.211.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-plays-with-time-forecast-as-of-13052021/?uid=285861726&cid=79634

Dynamics of US inflation

Weekly US dollar fundamental forecast

There is nothing more permanent than temporary. The financial markets' reaction to the significant rise in consumer prices has proven that investors doubt the Fed's mantra of a short-term boost in inflation. The Treasury yield has had the best daily rise since February, and the correction of stock indices continued. After hitting the 26th and 24th all-time highs in 2021 by the S&P 500 and the Dow Jones in the week ended May 7, they featured their worst three-day drop in nearly seven months. So the greenback has naturally strengthened.

The consumer price growth by 4.2% in April was the fastest since September 2008; core inflation rose by 3%, the most significant growth since 1995. It surprised even Fed Vice President Richard Clarida. The report has been hot but not overheated. The Federal Reserve will not change its policy because of a single strong report. Clarida noted that CPI has increased and is likely to rise a little more before falling at the end of the year. However, in 2022-2023, the indicator will return to the target of 2% or slightly higher.

The Fed Vice President stressed that the central bank would continue to monitor inflationary expectations closely. If the situation does not develop in accordance with its baseline forecast, it will immediately intervene.

After the US inflation report, investors wonder how long inflation pressure will last. Atlanta Fed chair Raphael Bostic expects increased CPI volatility until September. On condition of anonymity, White House officials told Bloomberg that inflation volatility would last till the end of the year. Republicans criticizing Joe Biden for the negative impact of fiscal stimulus on employment argue that this is not a temporary phenomenon. This is the type of thing that will start to change inflationary expectations.

After such surprises from employment and consumer prices (the discrepancy in the forecasts of Bloomberg experts and the actual data on the first indicator turned out to be a record, on the second - the widest since 1996), I would not be surprised if not only Republicans but also some Democrats begin to doubt the advisability of additional aid packages of $4 trillion. If Congress does not approve the new stimulus package, the US stock indexes could continue falling, strengthening the dollar.

However, I believe the EURUSD drop after the US inflation report has been too deep. Supply disruptions will be eliminated, and people getting back to work will reduce the gap between the demand for goods and services and their supply. I do not think that the Fed will abandon its mantra about the temporary nature of the acceleration of consumer prices. Otherwise, the Fed’s authority will be undermined. Norges Bank, for example, doesn’t raise the interest rate, although inflation in the country has been above the target of 2% for more than a year.

Weekly EURUSD trading plan

The Fed is likely to remain passive, so it will be relevant to buy the EURUSD when the price returns to a level above 1.211.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-plays-with-time-forecast-as-of-13052021/?uid=285861726&cid=79634

Dynamics of US inflation

LiteFinance

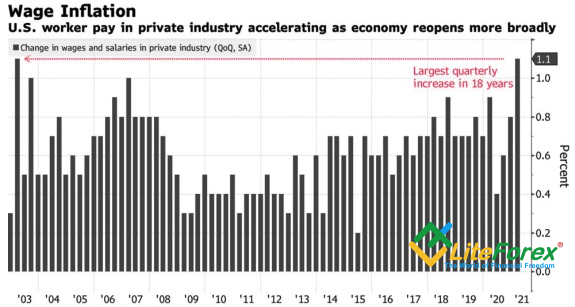

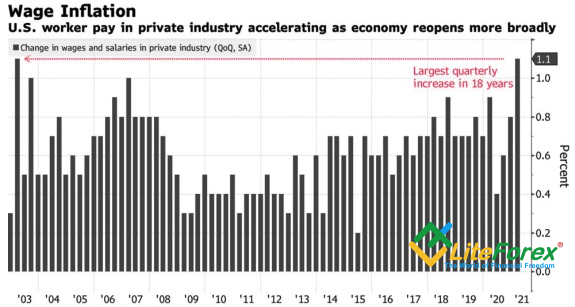

Dollar and the freedom of choice. Forecast as of 11.05.2021

Weekly US dollar fundamental forecast

Western countries show off their democracies, but governments could forget about them as soon as democratic principles become an obstacle. Boris Johnson denies the people of Scotland the right to self-determination, calling the idea of a referendum on independence absurd. Spain, Italy, and France impose restrictions on the purchase of bonds by hedge funds at auctions, trying to prevent the bond yields growth. Joe Biden argues that those unemployed Americans who have been offered vacancies must accept them; otherwise, they risk losing unemployment benefits. But what about freedom of choice?

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-and-the-freedom-of-choice-forecast-as-of-11052021/?uid=285861726&cid=79634

Dynamics of wages and salaries in US private sector

Weekly US dollar fundamental forecast

Western countries show off their democracies, but governments could forget about them as soon as democratic principles become an obstacle. Boris Johnson denies the people of Scotland the right to self-determination, calling the idea of a referendum on independence absurd. Spain, Italy, and France impose restrictions on the purchase of bonds by hedge funds at auctions, trying to prevent the bond yields growth. Joe Biden argues that those unemployed Americans who have been offered vacancies must accept them; otherwise, they risk losing unemployment benefits. But what about freedom of choice?

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-and-the-freedom-of-choice-forecast-as-of-11052021/?uid=285861726&cid=79634

Dynamics of wages and salaries in US private sector

LiteFinance

Dollar runs a marathon. Forecast as of 10.05.2021

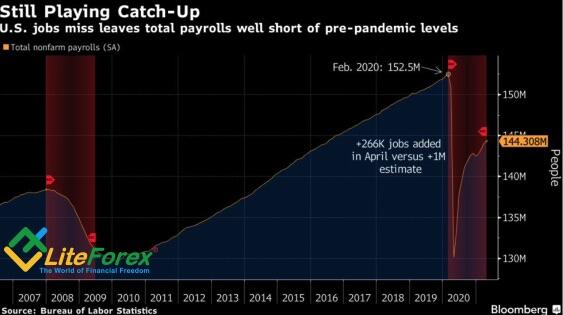

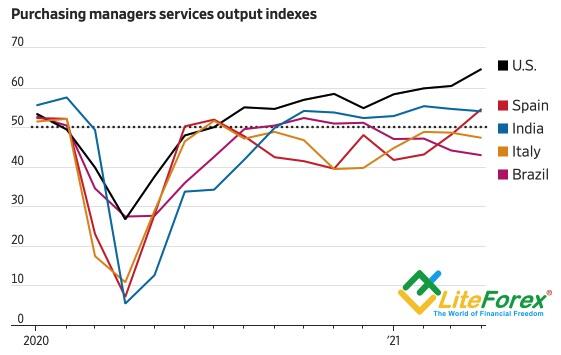

Weekly US dollar fundamental forecast

Recovery is not a sprint, it is a marathon. The US economy has a long way to go. Some analysts could suggest that Joe Biden's words in response to the disappointing US jobs report sound like an excuse. In my opinion, Biden explains why the Fed is in no hurry to discuss unwinding the monetary stimulus. The US economic recovery could seem booming at some point, but without the help of the central bank, it risks slowing down.

In April, US employment increased by 266,000 jobs, well below the expectations of Bloomberg experts. The previous report was revised down to +770,000. The report leaves the US roughly 8 million jobs below pre-pandemic levels. Unemployment ticked up to 6.1% from the previous figure of 6.1%. Some companies continue to doubt the economic prospects, others cannot find employees. Problems filling vacancies arise because the government pays people to keep them from returning to work, Republicans say. According to BofA Merrill Lynch estimates, those Americans who earn less than $ 32,000 a year, with existing support programs, have no reason to go to work at all.

According to Minneapolis Fed President Neel Kashkari, a weak US jobs report explains why the Fed has tied monetary policy to the pace of economic recovery. The market reaction proves that investors have finally believed that the central bank will continue to remain passive. Treasury yields fell and the USD had its worst daily drop in five months. It has almost returned to the levels of early 2021, and the idea of its significant weakening, which prevailed at the end of 2020, is again discussed in Forex.

Citi notes that the US exclusivity is exhausting, and the greenback is weakening amid the Fed’s passive attitude, moderate risk appetite, and global economic recovery. UniCredit expects the further decline of the USD as the global growth is recovering and the risk appetite is improving. In the week ended on May 2, hedge funds boosted their dollar shorts against a basket of major currencies to $10 billion, up from $4 billion in mid-April. The current USD shorts are far from $31 billion in 2020. It means the greenback has more room to fall.

However, the EURUSD bulls still have some problems. Following a drop after the US weak jobs report, the Treasury yields are recovering. Investors are now focused on the US inflation data, which, according to the forecasts, could be at 3.6% in April. If so, will the Fed remain as cool as it is now?

Weekly EURUSD trading plan

I believe, the Fed will hold its policy unchanged. This is not a sprint, this is a marathon. The EURUSD is close to the targets at 1.218 and 1.23, I indicated in late April. It is still relevant to add up to the longs on the corrections.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-runs-a-marathon-forecast-as-of-10052021/?uid=285861726&cid=79634

Dynamics of US employment

Weekly US dollar fundamental forecast

Recovery is not a sprint, it is a marathon. The US economy has a long way to go. Some analysts could suggest that Joe Biden's words in response to the disappointing US jobs report sound like an excuse. In my opinion, Biden explains why the Fed is in no hurry to discuss unwinding the monetary stimulus. The US economic recovery could seem booming at some point, but without the help of the central bank, it risks slowing down.

In April, US employment increased by 266,000 jobs, well below the expectations of Bloomberg experts. The previous report was revised down to +770,000. The report leaves the US roughly 8 million jobs below pre-pandemic levels. Unemployment ticked up to 6.1% from the previous figure of 6.1%. Some companies continue to doubt the economic prospects, others cannot find employees. Problems filling vacancies arise because the government pays people to keep them from returning to work, Republicans say. According to BofA Merrill Lynch estimates, those Americans who earn less than $ 32,000 a year, with existing support programs, have no reason to go to work at all.

According to Minneapolis Fed President Neel Kashkari, a weak US jobs report explains why the Fed has tied monetary policy to the pace of economic recovery. The market reaction proves that investors have finally believed that the central bank will continue to remain passive. Treasury yields fell and the USD had its worst daily drop in five months. It has almost returned to the levels of early 2021, and the idea of its significant weakening, which prevailed at the end of 2020, is again discussed in Forex.

Citi notes that the US exclusivity is exhausting, and the greenback is weakening amid the Fed’s passive attitude, moderate risk appetite, and global economic recovery. UniCredit expects the further decline of the USD as the global growth is recovering and the risk appetite is improving. In the week ended on May 2, hedge funds boosted their dollar shorts against a basket of major currencies to $10 billion, up from $4 billion in mid-April. The current USD shorts are far from $31 billion in 2020. It means the greenback has more room to fall.

However, the EURUSD bulls still have some problems. Following a drop after the US weak jobs report, the Treasury yields are recovering. Investors are now focused on the US inflation data, which, according to the forecasts, could be at 3.6% in April. If so, will the Fed remain as cool as it is now?

Weekly EURUSD trading plan

I believe, the Fed will hold its policy unchanged. This is not a sprint, this is a marathon. The EURUSD is close to the targets at 1.218 and 1.23, I indicated in late April. It is still relevant to add up to the longs on the corrections.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-runs-a-marathon-forecast-as-of-10052021/?uid=285861726&cid=79634

Dynamics of US employment

LiteFinance

Is dollar hysterical? Forecast as of 07.05.2021

Weekly US dollar fundamental forecast

Investors continue discussing the events of 2013 when tapering of the QE in the US resulted in turmoil in financial markets. Some traders hedge against the risks of a taper tantrum by selling Treasuries, some believe it will not happen in 2021 and buy stocks. The first ones are getting fewer, the number the second increases. Therefore, the stock indexes hit new all-time highs, and the EURUSD grows.

Investors have prepared for the US jobs report. The consensus forecast of Reuters experts suggests that nonfarm payrolls likely increased by 978,000 jobs in April after rising by 916,000 in March. If the forecast is met, the job losses will decrease from 20.7 million at the peak of the recession to 7.5 million. Markets are getting more and more convinced that the jobs report will be strong. However, the signs of the employment rebound are a double-edged sword. This process could improve risk appetite and allow the S&P 500 to rally further. On the other hand, growing risks of the inflation surge could push Treasury yields up and overvalued stocks down.

Judging by the March events, when the rally in the Treasury yields did not worry the FOMC officials, the growth of stock indices, on the contrary, may encourage the Fed to take action. According to Dallas Fed President Robert Kaplan, imbalances in financial markets can lead to the fact that the issues of winding down QE will need to be raised sooner rather than later. The Fed, of course, welcomes the improved financial conditions, allowing the economy to recover faster, but notes in its latest report that if risk appetite falls from elevated levels, a number of assets could be vulnerable to deep and sudden drops, which could stress the financial system.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/is-dollar-hysterical-forecast-as-of-07052021/?uid=285861726&cid=79634

Dynamics of US financial conditions

Weekly US dollar fundamental forecast

Investors continue discussing the events of 2013 when tapering of the QE in the US resulted in turmoil in financial markets. Some traders hedge against the risks of a taper tantrum by selling Treasuries, some believe it will not happen in 2021 and buy stocks. The first ones are getting fewer, the number the second increases. Therefore, the stock indexes hit new all-time highs, and the EURUSD grows.

Investors have prepared for the US jobs report. The consensus forecast of Reuters experts suggests that nonfarm payrolls likely increased by 978,000 jobs in April after rising by 916,000 in March. If the forecast is met, the job losses will decrease from 20.7 million at the peak of the recession to 7.5 million. Markets are getting more and more convinced that the jobs report will be strong. However, the signs of the employment rebound are a double-edged sword. This process could improve risk appetite and allow the S&P 500 to rally further. On the other hand, growing risks of the inflation surge could push Treasury yields up and overvalued stocks down.

Judging by the March events, when the rally in the Treasury yields did not worry the FOMC officials, the growth of stock indices, on the contrary, may encourage the Fed to take action. According to Dallas Fed President Robert Kaplan, imbalances in financial markets can lead to the fact that the issues of winding down QE will need to be raised sooner rather than later. The Fed, of course, welcomes the improved financial conditions, allowing the economy to recover faster, but notes in its latest report that if risk appetite falls from elevated levels, a number of assets could be vulnerable to deep and sudden drops, which could stress the financial system.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/is-dollar-hysterical-forecast-as-of-07052021/?uid=285861726&cid=79634

Dynamics of US financial conditions

LiteFinance

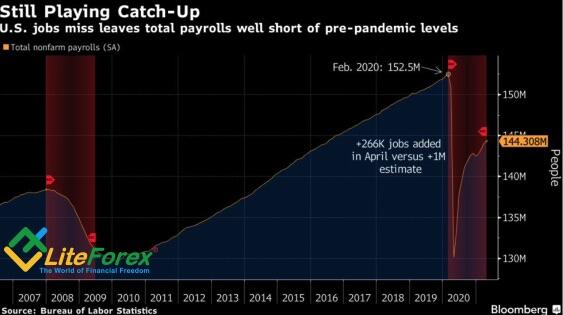

Dollar is set back by central bank. Forecast as of 06.05.2021

Divergence in the economic expansion is a reason to sell the EURUSD. However, the Fed’s hawks turn into doves, and the euro bears are set back. Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

For some traders, the US dollar exchange rate is a puzzle; for others, the dollar price is, on the contrary, a clue to whether the Fed is right saying that the consumer price surge is temporary. If the Fed is wrong, and US inflation should be high for a long time, the central bank will have to raise the interest rate, supporting the dollar rally. Otherwise, if the Fed is right, the dollar will not rise even amid the US economic strength. I am glad about such a trend. The Forex pricing again depends on the monetary policy, rather than trade wars or pandemics.

The Fed is the primary obstacle setting back the EURUSD bears. If the US central bank acted in the old way, one could safely trade the ideas based on the dollar smile theory. The dollar smile theory suggests the greenback should strengthen at the recession peak amid high demand for safe-havens, and then the dollar goes down amid aggressive monetary stimulus. Finally, at the third stage, the USD again should rise as the US economy leads ahead of other advanced economies.

To weaken the dollar, global GDP should be recovering evenly. However, the availability of vaccines and epidemiological conditions are different in different countries. So, the global economic recovery will hardly be even. According to Bloomberg research, rich countries will reach the vaccination level of 70-85% of the population required to return to normal life in August, the poor - only in 2024.

In March, the US position looked as exclusive as that of China, having effectively managed the pandemic during most of 2020. As a result, the greenback grew amid the US exclusivity just as the yuan did last year. In April, the dollar faced serious competition as the vaccination campaign progressed in the EU. Investors expect the growth gap between the EU and the US should narrow. However, the services PMI data prove the opposite. The US PMI is close to the highest levels since 1997, while the euro-area PMI doesn’t show consistent growth.

If the Fed in such conditions used the classical approach of the rate hikes, which Janet Yellen reminded about just the other day, I would not hesitate to recommend selling EURUSD. However, the Fed believes that strong economic growth is needed to offset the shock resulted from the pandemic, so monetary policy will remain ultra-easy for a long time. When the Fed hawks turn into doves, the dollar is pressed down.

Weekly EURUSD trading plan

I believe the market should continue testing the Fed’s strength. The US April jobs report will be a good test. Strong employment data will increase the risk of the Treasury yield growth and the EURUSD drop towards 1.196 and 1.193. Otherwise, if Treasury yields do not react, the euro will rise to a level above $1.2045.*

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-is-set-back-by-central-bank-forecast-as-of-06052021/?uid=285861726&cid=79634

Dynamics of services PMIs

Divergence in the economic expansion is a reason to sell the EURUSD. However, the Fed’s hawks turn into doves, and the euro bears are set back. Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

For some traders, the US dollar exchange rate is a puzzle; for others, the dollar price is, on the contrary, a clue to whether the Fed is right saying that the consumer price surge is temporary. If the Fed is wrong, and US inflation should be high for a long time, the central bank will have to raise the interest rate, supporting the dollar rally. Otherwise, if the Fed is right, the dollar will not rise even amid the US economic strength. I am glad about such a trend. The Forex pricing again depends on the monetary policy, rather than trade wars or pandemics.

The Fed is the primary obstacle setting back the EURUSD bears. If the US central bank acted in the old way, one could safely trade the ideas based on the dollar smile theory. The dollar smile theory suggests the greenback should strengthen at the recession peak amid high demand for safe-havens, and then the dollar goes down amid aggressive monetary stimulus. Finally, at the third stage, the USD again should rise as the US economy leads ahead of other advanced economies.

To weaken the dollar, global GDP should be recovering evenly. However, the availability of vaccines and epidemiological conditions are different in different countries. So, the global economic recovery will hardly be even. According to Bloomberg research, rich countries will reach the vaccination level of 70-85% of the population required to return to normal life in August, the poor - only in 2024.

In March, the US position looked as exclusive as that of China, having effectively managed the pandemic during most of 2020. As a result, the greenback grew amid the US exclusivity just as the yuan did last year. In April, the dollar faced serious competition as the vaccination campaign progressed in the EU. Investors expect the growth gap between the EU and the US should narrow. However, the services PMI data prove the opposite. The US PMI is close to the highest levels since 1997, while the euro-area PMI doesn’t show consistent growth.

If the Fed in such conditions used the classical approach of the rate hikes, which Janet Yellen reminded about just the other day, I would not hesitate to recommend selling EURUSD. However, the Fed believes that strong economic growth is needed to offset the shock resulted from the pandemic, so monetary policy will remain ultra-easy for a long time. When the Fed hawks turn into doves, the dollar is pressed down.

Weekly EURUSD trading plan

I believe the market should continue testing the Fed’s strength. The US April jobs report will be a good test. Strong employment data will increase the risk of the Treasury yield growth and the EURUSD drop towards 1.196 and 1.193. Otherwise, if Treasury yields do not react, the euro will rise to a level above $1.2045.*

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-is-set-back-by-central-bank-forecast-as-of-06052021/?uid=285861726&cid=79634

Dynamics of services PMIs

LiteFinance

Dollar gave in to temptation. Forecast as of 05.05.2021

Weekly US dollar fundamental forecast

The only way to get rid of temptation is to give in to it. Janet Yellen, the former chair of the Federal Reserve, now occupying the post of Treasury Secretary, clearly wanted to talk about monetary policy. And she finally gave in to the temptation by saying that interest rate hikes may be needed to stop the economy overheating as President Joe Biden’s spending plans boost growth. Being calmed by Jerome Powell's mantra that it was not time to think about winding down monetary stimulus, the markets woke up immediately. Tech stocks tumbled, followed by the S&P 500, and letting the US dollar strengthen.

Investors remember Donald Trump’s verbal interventions in monetary policy and the greenback exchange rate and how the US administration had to make excuses for him. Janet Yellen excused herself, saying that she did not forecast a federal funds rate hike and did not recommend the central bank to do anything. "If anybody appreciates the independence of the Fed, I think that person is me," Yellen said. Unlike Trump, Joe Biden and his team do not interfere in the activities of the Federal Reserve, understanding what turmoil in the financial markets this can lead to.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-gave-in-to-temptation-forecast-as-of-05052021/?uid=285861726&cid=79634

The reaction of stock indexes to hints at rate hikes

Weekly US dollar fundamental forecast

The only way to get rid of temptation is to give in to it. Janet Yellen, the former chair of the Federal Reserve, now occupying the post of Treasury Secretary, clearly wanted to talk about monetary policy. And she finally gave in to the temptation by saying that interest rate hikes may be needed to stop the economy overheating as President Joe Biden’s spending plans boost growth. Being calmed by Jerome Powell's mantra that it was not time to think about winding down monetary stimulus, the markets woke up immediately. Tech stocks tumbled, followed by the S&P 500, and letting the US dollar strengthen.

Investors remember Donald Trump’s verbal interventions in monetary policy and the greenback exchange rate and how the US administration had to make excuses for him. Janet Yellen excused herself, saying that she did not forecast a federal funds rate hike and did not recommend the central bank to do anything. "If anybody appreciates the independence of the Fed, I think that person is me," Yellen said. Unlike Trump, Joe Biden and his team do not interfere in the activities of the Federal Reserve, understanding what turmoil in the financial markets this can lead to.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-gave-in-to-temptation-forecast-as-of-05052021/?uid=285861726&cid=79634

The reaction of stock indexes to hints at rate hikes

LiteFinance

Euro has a plan. Forecast as of 04.05.2021

Fundamental euro forecast today

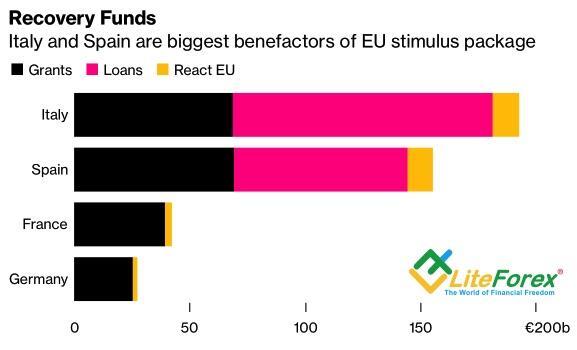

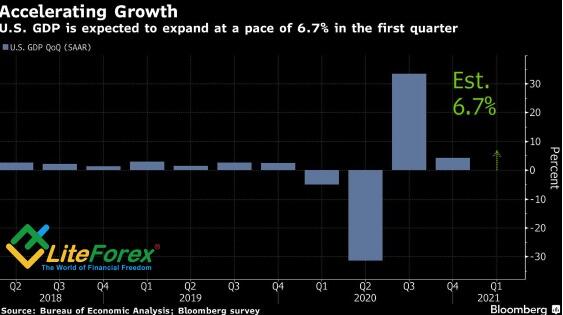

Italy, Greece, and Spain are running big budget deficits and planning to spend on a grand scale to revamp their economies. Italian Prime Minister Mario Draghi and other leaders in the region claim that increased investments can give lasting support to growth. If the plan doesn’t work, these countries will be saddled with some of the world’s highest debt ratios, potentially destabilizing the euro-area economy. After all, as long as things go according to the plan, the EURUSD bulls can go ahead.

Although the money from the European Recovery fund is not yet coming, and Brussels is criticized for the slow ratification process, the mechanism is already yielding the results, which is evident from the euro strengthening in April. The European Recovery Fund allowed Italy and other currency bloc members to have a reliable investment plan. Italy will receive €190 billion, including €70 billion in grants. Mario Draghi expects to add another € 60 billion from the local budget. It turns out to be quite a sum, allowing Italians to look to the future with optimism.

So, the stimulus, in addition to the acceleration of vaccination in the EU, supports the PMI growth. In April, the euro-area manufacturing PMI reached 62.9, the highest in the entire 24-year history of research. The sector is clearly booming as demand recovered so quickly that many products were in short supply. If we add to this the positive from retail sales in Germany, it becomes clear that the worst for the currency bloc is over, and the best is yet to come. But it will take several more months before the European economy features a clear improvement. According to the ECB Vice President Luis de Guindos, if the EU's ambitious plan to vaccinate 70% of the adult population is implemented, the central bank may start thinking about rolling back monetary stimulus.

The ECB may start unwinding the QE before the Fed takes active steps, which suggests a bullish outlook for the EURUSD. According to New York Fed President John Williams, the current data and conditions are not enough for the central bank to change its position. Jerome Powell recently argued that they need to see several months of positive data to show progress towards the Fed's goals. Is it possible that strong statistics on the US labor market for April will make adjustments to the Fed's outlook?

In my opinion, the euro is much stronger now than it was in the first quarter, but it is too early to give up on the greenback. May is seasonally a bad month for the S&P 500, whose drop amid the Treasury yield rally resulted from the strong US domestic data will lure investors back to safe-haven assets

EURUSD trading plan today

In the March-April period, the EURUSD had clear trends. In May, however, the pair can get stuck in the consolidation range, as both the euro and the dollar have their own benefits. If the price breaks out the resistance at 1.208, it could be relevant to enter longs. If the market breaks out the support level of 1.201, one could enter shorts.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-has-a-plan-forecast-as-of-04052021/?uid=285861726&cid=79634

Benefactors of European Recovery Fund

Fundamental euro forecast today

Italy, Greece, and Spain are running big budget deficits and planning to spend on a grand scale to revamp their economies. Italian Prime Minister Mario Draghi and other leaders in the region claim that increased investments can give lasting support to growth. If the plan doesn’t work, these countries will be saddled with some of the world’s highest debt ratios, potentially destabilizing the euro-area economy. After all, as long as things go according to the plan, the EURUSD bulls can go ahead.

Although the money from the European Recovery fund is not yet coming, and Brussels is criticized for the slow ratification process, the mechanism is already yielding the results, which is evident from the euro strengthening in April. The European Recovery Fund allowed Italy and other currency bloc members to have a reliable investment plan. Italy will receive €190 billion, including €70 billion in grants. Mario Draghi expects to add another € 60 billion from the local budget. It turns out to be quite a sum, allowing Italians to look to the future with optimism.

So, the stimulus, in addition to the acceleration of vaccination in the EU, supports the PMI growth. In April, the euro-area manufacturing PMI reached 62.9, the highest in the entire 24-year history of research. The sector is clearly booming as demand recovered so quickly that many products were in short supply. If we add to this the positive from retail sales in Germany, it becomes clear that the worst for the currency bloc is over, and the best is yet to come. But it will take several more months before the European economy features a clear improvement. According to the ECB Vice President Luis de Guindos, if the EU's ambitious plan to vaccinate 70% of the adult population is implemented, the central bank may start thinking about rolling back monetary stimulus.

The ECB may start unwinding the QE before the Fed takes active steps, which suggests a bullish outlook for the EURUSD. According to New York Fed President John Williams, the current data and conditions are not enough for the central bank to change its position. Jerome Powell recently argued that they need to see several months of positive data to show progress towards the Fed's goals. Is it possible that strong statistics on the US labor market for April will make adjustments to the Fed's outlook?

In my opinion, the euro is much stronger now than it was in the first quarter, but it is too early to give up on the greenback. May is seasonally a bad month for the S&P 500, whose drop amid the Treasury yield rally resulted from the strong US domestic data will lure investors back to safe-haven assets

EURUSD trading plan today

In the March-April period, the EURUSD had clear trends. In May, however, the pair can get stuck in the consolidation range, as both the euro and the dollar have their own benefits. If the price breaks out the resistance at 1.208, it could be relevant to enter longs. If the market breaks out the support level of 1.201, one could enter shorts.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-has-a-plan-forecast-as-of-04052021/?uid=285861726&cid=79634

Benefactors of European Recovery Fund

LiteFinance

Fed presses down the dollar. Forecast as of 29.04.2021

The Federal Reserve said what the market wanted to hear, which has weakened the greenback. Nonetheless, the euro is strengthening not only because of the dollar weakness. The single European currency has its own benefits, and there could emerge fresh growth drivers. Let us discuss the Forex outlook and make up a EURUSD trading plan.

Monthly US dollar fundamental forecast

It's good when you have a choice. Jerome Powell certainly had a choice. The Fed could follow the example of the Bank of Canada, announcing a reduction or at least hinting at a reduction in the QE pace. Or the US central bank could follow the path of the ECB, claiming that it is too early to consider finishing the monetary stimulus. Calling the QE end premature, Christine Lagarde managed to discourage the euro bulls for some time. Repeating Lagarde’s words, the Fed chairman has accelerated the US dollar decline. As a result, the EURUSD reached the first of the two previously set targets at 1.2155 and 1.218 and, it seems to continue the rally.

According to Jerome Powell, an excellent jobs market report for March is not enough to start discussing paring back its $120 billion a month bond-buying program. It is too early. The Fed is not close to its targets. The recent inflation rise resulted from temporary factors, and the central bank is not concerned by the growing inflation expectations. Furthermore, the Fed wants to see a further increase in inflation expectations to decide on the monetary policy changes.

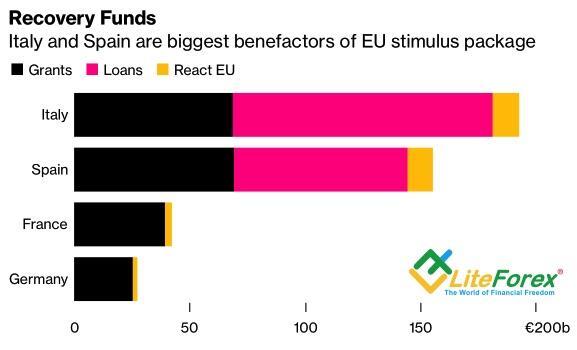

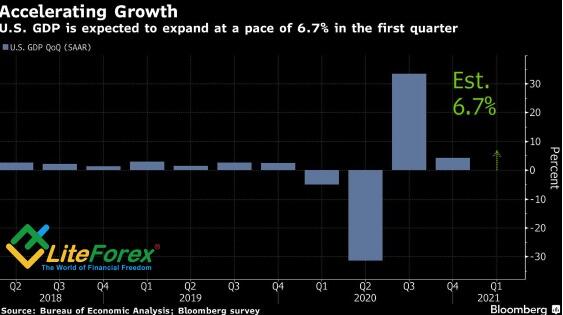

Markets heard what they wanted to hear, which led to a drop in Treasury yields and a weakening greenback. At the same time, the question of how the Fed's outlook will change as the US domestic data improve has not been removed from the agenda. Jerome Powell promised to warn the markets long before the start of the monetary stimulus reduction. Bloomberg believes that the tapering of QE will start in the first quarter of 2022, and the FOMC should start discussing monetary tightening in early summer. In this regard, US GDP strong data may once again bring Treasury yields back to growth. According to Bloomberg polls, the economy expanded by 6.7%, driven by a whopping 10.5% increase in consumer spending, the best since the 1960s.

After all, I still believe the factor of the US GDP surge has already been priced in the EURUSD, and investors should be focused on the vaccination rates. The vaccination rate is declining in the US, as people willing to inoculate have already received their doses. Some people are not sure about vaccination or are unwilling to receive the injections. In Europe, on the contrary, the vaccination campaign is progressing.

In the summer, the euro may have a new advantage. In the autumn, the chancellor will change in Germany since Angela Merkel is no longer applying for this position. If сo-leader of the Green party Annalena Baerbock comes to power, the prevailing ideology of ordoliberalism in the country, which considers duty almost immoral, may be abandoned. If Berlin begins to support its own economy with massive stimulus, as Joe Biden does, divergence in growth with the United States will narrow, and EURUSD will rise.

Monthly EURUSD trading plan

After all, investors are now focused on the publication of the US and euro-area GDP data for the first quarter. Will the Treasury yields rally resume, and how will the euro react to the double-dip recession in the euro area? I believe it is relevant to hold the EURUSD longs entered at the level of 1.193 and add up to the positions on the corrections. The expected target for the next three or four weeks is up from 1.218 to 1.23.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/fed-presses-down-the-dollar-forecast-as-of-29042021/?uid=285861726&cid=79634

Dynamics of US GDP

The Federal Reserve said what the market wanted to hear, which has weakened the greenback. Nonetheless, the euro is strengthening not only because of the dollar weakness. The single European currency has its own benefits, and there could emerge fresh growth drivers. Let us discuss the Forex outlook and make up a EURUSD trading plan.

Monthly US dollar fundamental forecast

It's good when you have a choice. Jerome Powell certainly had a choice. The Fed could follow the example of the Bank of Canada, announcing a reduction or at least hinting at a reduction in the QE pace. Or the US central bank could follow the path of the ECB, claiming that it is too early to consider finishing the monetary stimulus. Calling the QE end premature, Christine Lagarde managed to discourage the euro bulls for some time. Repeating Lagarde’s words, the Fed chairman has accelerated the US dollar decline. As a result, the EURUSD reached the first of the two previously set targets at 1.2155 and 1.218 and, it seems to continue the rally.

According to Jerome Powell, an excellent jobs market report for March is not enough to start discussing paring back its $120 billion a month bond-buying program. It is too early. The Fed is not close to its targets. The recent inflation rise resulted from temporary factors, and the central bank is not concerned by the growing inflation expectations. Furthermore, the Fed wants to see a further increase in inflation expectations to decide on the monetary policy changes.

Markets heard what they wanted to hear, which led to a drop in Treasury yields and a weakening greenback. At the same time, the question of how the Fed's outlook will change as the US domestic data improve has not been removed from the agenda. Jerome Powell promised to warn the markets long before the start of the monetary stimulus reduction. Bloomberg believes that the tapering of QE will start in the first quarter of 2022, and the FOMC should start discussing monetary tightening in early summer. In this regard, US GDP strong data may once again bring Treasury yields back to growth. According to Bloomberg polls, the economy expanded by 6.7%, driven by a whopping 10.5% increase in consumer spending, the best since the 1960s.

After all, I still believe the factor of the US GDP surge has already been priced in the EURUSD, and investors should be focused on the vaccination rates. The vaccination rate is declining in the US, as people willing to inoculate have already received their doses. Some people are not sure about vaccination or are unwilling to receive the injections. In Europe, on the contrary, the vaccination campaign is progressing.

In the summer, the euro may have a new advantage. In the autumn, the chancellor will change in Germany since Angela Merkel is no longer applying for this position. If сo-leader of the Green party Annalena Baerbock comes to power, the prevailing ideology of ordoliberalism in the country, which considers duty almost immoral, may be abandoned. If Berlin begins to support its own economy with massive stimulus, as Joe Biden does, divergence in growth with the United States will narrow, and EURUSD will rise.

Monthly EURUSD trading plan

After all, investors are now focused on the publication of the US and euro-area GDP data for the first quarter. Will the Treasury yields rally resume, and how will the euro react to the double-dip recession in the euro area? I believe it is relevant to hold the EURUSD longs entered at the level of 1.193 and add up to the positions on the corrections. The expected target for the next three or four weeks is up from 1.218 to 1.23.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/fed-presses-down-the-dollar-forecast-as-of-29042021/?uid=285861726&cid=79634

Dynamics of US GDP

LiteFinance

EURUSD is playing catch-up. Forecast as of 28.04.2021

Weekly euro fundamental forecast

Hope for the best, but prepare for the worst. Is the market ready for the Fed's optimism and Jerome Powell's hints at the monetary policy normalization? I strongly doubt it. The central bank convinced investors in its willingness to put up with high inflation and maintain monetary stimulus. Therefore, the Treasury yield dropped to six-week lows. Now, the US bond yields are rising again, encouraging the EURUSD bears.

Ahead of the FOMC April meeting results, the euro-dollar got stuck in a narrow trading range of 1.2055-1.211. Investors are sure they know what Jerome Powell will say, but what if something goes wrong? One wrong phrase can result in turmoil in financial markets. The Fed chairman must admit that economic growth is accelerating, but the unemployment rate is still too high. Powell has to say that this is a rebound, but not a recovery yet. The US economy has still not recovered from the pandemic.

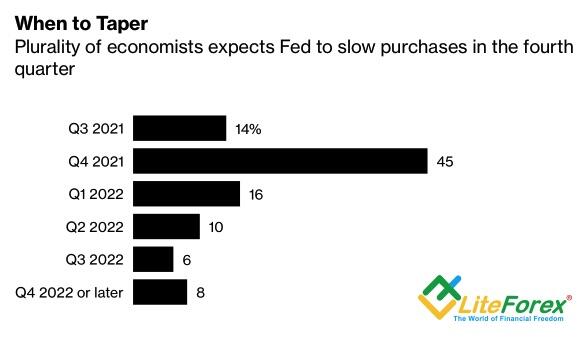

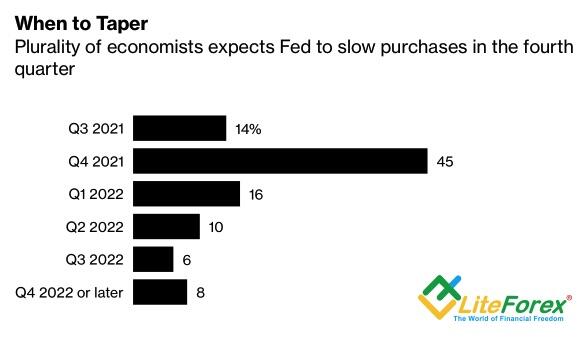

There are hardly any chances that the Fed Chair will talk about QE tapering in April. First, the Fed doesn’t want to repeat the taper tantrum of 2013 when Ben Bernanke announced the reduction in the volume of asset purchases and provoked a real panic in the financial markets. Second, the Fed is traditionally less aggressive than the CME derivatives or Bloomberg experts. Most of the latter expect the $120-billion program to wind down in the fourth quarter.Despite the improvement in the US economic situation, there are still many problems, and the central bank can afford to be patient. However, if inflation will be up to 3.5% in May-June amid high commodity prices, the best GDP growth over the past four decades, and the enormous deferred demand, the Fed will have to take active steps. After all, according to the PIMCO, the US PMI will slow down in the third and fourth quarters, which, along with resolving supply problems, will return the CPI to 2.1% by the end of 2021. It seems that the best way out for the Fed is to wait and see not to worsen the situation. Let the Treasury yields grow along with the PMI!

I do not think the Treasury yields rally will press down the EURUSD bulls as much as in March. French Finance Minister Bruno Le Maire warns that the EU must remain in the race while China has resumed its growth and the U.S. is booming. The EU governments have lost too much time in the adoption of the European Recovery Plan. The euro area must catch up.

Weekly EURUSD trading plan

Playing catch-up now is not the same as in the first quarter when the euro crashed amid the slow vaccination and the double-dip recession in the euro area. Even if the EURUSD, having broken the lower edge of the short-term consolidation range of 1.2055-1.211, starts correcting down, it will be relevant to buy the pair on the rebound up from the supports at 1.2045, 1.2, and 1.1965.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/eurusd-is-playing-catch-up-forecast-as-of-28042021/?uid=285861726&cid=79634

Economists’ forecasts for the terms of QE tapering

Weekly euro fundamental forecast

Hope for the best, but prepare for the worst. Is the market ready for the Fed's optimism and Jerome Powell's hints at the monetary policy normalization? I strongly doubt it. The central bank convinced investors in its willingness to put up with high inflation and maintain monetary stimulus. Therefore, the Treasury yield dropped to six-week lows. Now, the US bond yields are rising again, encouraging the EURUSD bears.

Ahead of the FOMC April meeting results, the euro-dollar got stuck in a narrow trading range of 1.2055-1.211. Investors are sure they know what Jerome Powell will say, but what if something goes wrong? One wrong phrase can result in turmoil in financial markets. The Fed chairman must admit that economic growth is accelerating, but the unemployment rate is still too high. Powell has to say that this is a rebound, but not a recovery yet. The US economy has still not recovered from the pandemic.

There are hardly any chances that the Fed Chair will talk about QE tapering in April. First, the Fed doesn’t want to repeat the taper tantrum of 2013 when Ben Bernanke announced the reduction in the volume of asset purchases and provoked a real panic in the financial markets. Second, the Fed is traditionally less aggressive than the CME derivatives or Bloomberg experts. Most of the latter expect the $120-billion program to wind down in the fourth quarter.Despite the improvement in the US economic situation, there are still many problems, and the central bank can afford to be patient. However, if inflation will be up to 3.5% in May-June amid high commodity prices, the best GDP growth over the past four decades, and the enormous deferred demand, the Fed will have to take active steps. After all, according to the PIMCO, the US PMI will slow down in the third and fourth quarters, which, along with resolving supply problems, will return the CPI to 2.1% by the end of 2021. It seems that the best way out for the Fed is to wait and see not to worsen the situation. Let the Treasury yields grow along with the PMI!

I do not think the Treasury yields rally will press down the EURUSD bulls as much as in March. French Finance Minister Bruno Le Maire warns that the EU must remain in the race while China has resumed its growth and the U.S. is booming. The EU governments have lost too much time in the adoption of the European Recovery Plan. The euro area must catch up.

Weekly EURUSD trading plan

Playing catch-up now is not the same as in the first quarter when the euro crashed amid the slow vaccination and the double-dip recession in the euro area. Even if the EURUSD, having broken the lower edge of the short-term consolidation range of 1.2055-1.211, starts correcting down, it will be relevant to buy the pair on the rebound up from the supports at 1.2045, 1.2, and 1.1965.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/eurusd-is-playing-catch-up-forecast-as-of-28042021/?uid=285861726&cid=79634

Economists’ forecasts for the terms of QE tapering

LiteFinance

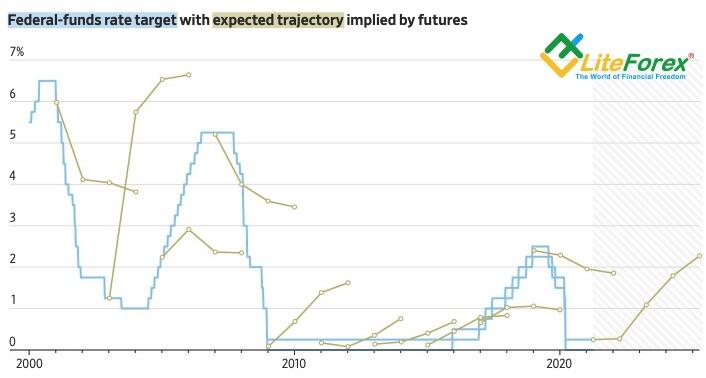

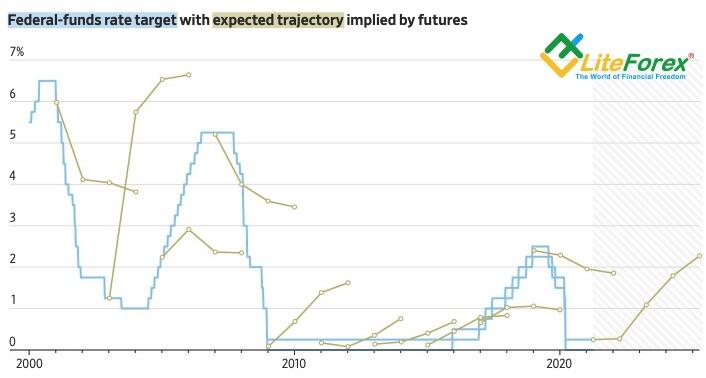

Dollar: trust and test! Forecast as of 27.04.2021

Weekly US dollar fundamental forecast

The weak German business climate index, the dovish stance of the ECB officials, and the hawkish shift in the forecasts of Bloomberg experts concerning the start of tapering the US QE didn’t allow the EURUSD bulls to consolidate the price at the bottom of figure 21. Nordea Markets notes that the markets underestimate the possibility of a quick return of unemployment to pre-pandemic levels, the ability of inflation to stay above 2% for a long time, and the risks of an earlier start of the Fed's monetary policy normalization. If so, it's time to buy the US dollar. If everything were so simple ...

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-trust-and-test-forecast-as-of-27042021/?uid=285861726&cid=79634

Dynamics of Fed interest rate and expected changes implied by market sentiment

Weekly US dollar fundamental forecast

The weak German business climate index, the dovish stance of the ECB officials, and the hawkish shift in the forecasts of Bloomberg experts concerning the start of tapering the US QE didn’t allow the EURUSD bulls to consolidate the price at the bottom of figure 21. Nordea Markets notes that the markets underestimate the possibility of a quick return of unemployment to pre-pandemic levels, the ability of inflation to stay above 2% for a long time, and the risks of an earlier start of the Fed's monetary policy normalization. If so, it's time to buy the US dollar. If everything were so simple ...

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-trust-and-test-forecast-as-of-27042021/?uid=285861726&cid=79634

Dynamics of Fed interest rate and expected changes implied by market sentiment

: