Area Reversal Short

- Yardımcı programlar

- Justin Ray Martin

- Sürüm: 1.0

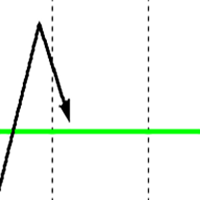

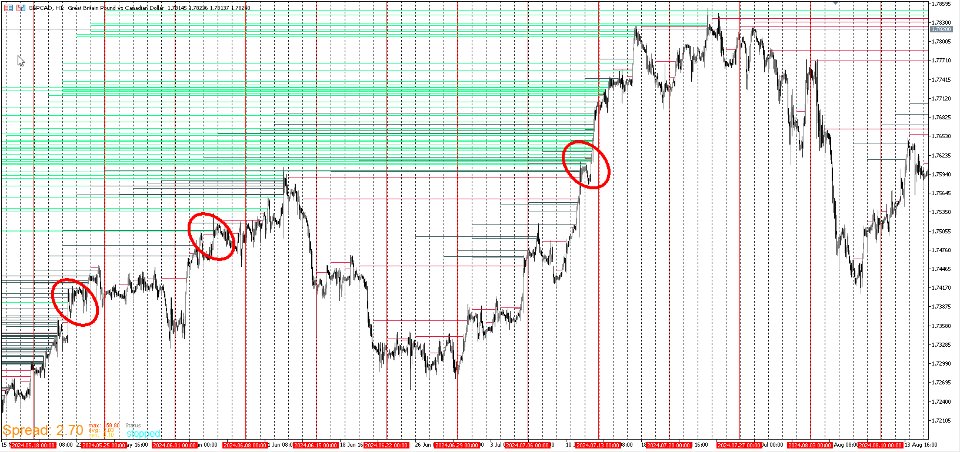

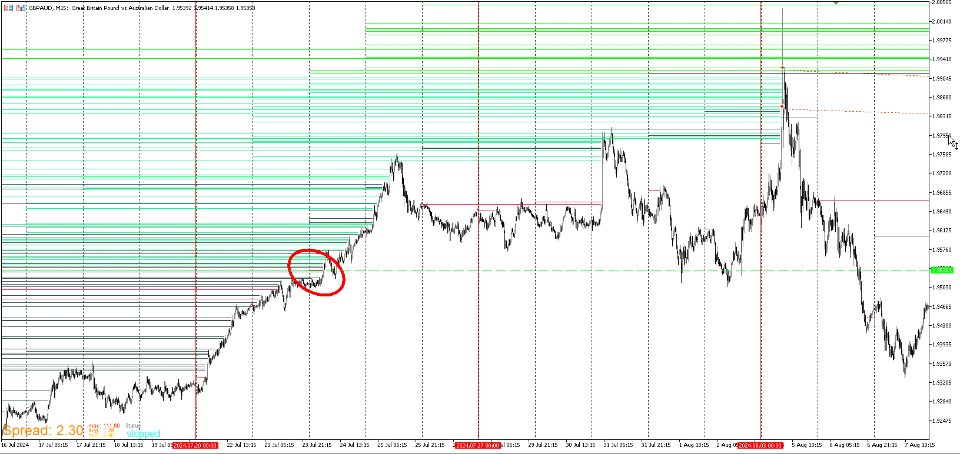

The Reversal Area EA is designed to identify likely price ranges for price to turn from. This EA is used in conjunction with other EA's that I developed and serves as filtering tool to keep from entering too early. The overall idea is to be a seller above the green line. A buyer below the green line for the buy version. The second thing to keep in mind is time. When price fluctuate over the course of a few days and move further below this zone (long bias) it offers greater likelihood of setting up a reversal for a swing. There will be times when price do reach below but doesn't stay long before reversing. Or price will hit to the tick on the line. Those are less probable trades that should only be taken if you have a well studied analysis via other methods. You will be better served being on the safe side by seeing activity well within this zone. Higher volatile pairs go further than pairs that don't move as much. This is only for major and minor pairs. No exotics, no indices, no commodities, etc.

Instructions: My EA'S do not take trades. They are all based on backtesting methods that provide a template in which the EA can be applied to the template on a live chart to visually spot signals. This EA doesn't need to be applied to a live chart and shouldn't be due to the amount of lines generated. All that is needed is the EA to be ran in the strategy tester and get the the bottommost green line (short bias). upmost for for the buy version.

Nothing complicated for the setting. Keep it simple for fast backtesting.

Date: Start from first of current or you can start with the start of previous year. There is no need to go back any further.

Timeframe:M15

Modeling: OHLC

Once started, minimize the window for faster testing. No need to watch it.

Once completed, get the value of of the bottommost green line(vice versa for the buy version)

Insert a line with that same value on a live chart and keep the general rules in mind.

What this EA is: A signal generator to let the traders know that a reversal swing setup is likely coming. It also keep traders from buying too early even when they do get a solid signal from another method.

It's built to aid swing/positional players.

What this EA is not: This isn't something to plug on a live chart. It's not for everyday daytrading. It's not an exact on the line entry tool.

Conclusion: Though this EA/Method shouldn't be used alone in making decisions, it is definitely the most useful out of all my EA's because it can keep traders from jumping in too early when they get the direction right.