Macro Sniper

- Эксперты

- Leonardo Keber

- Версия: 1.0

- Активации: 5

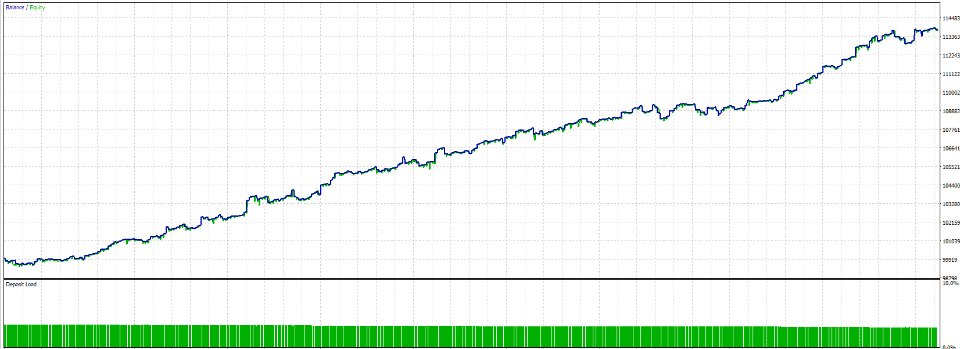

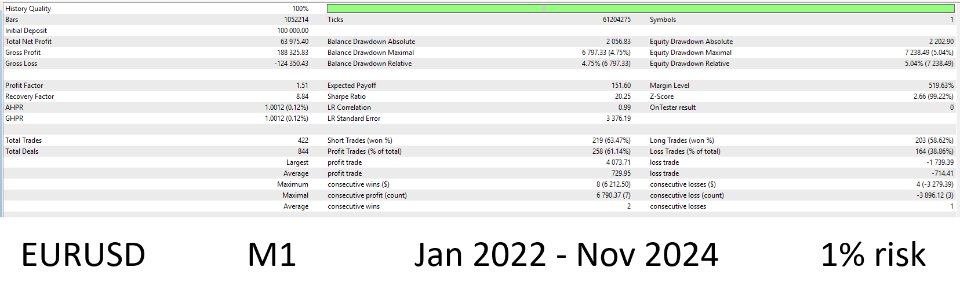

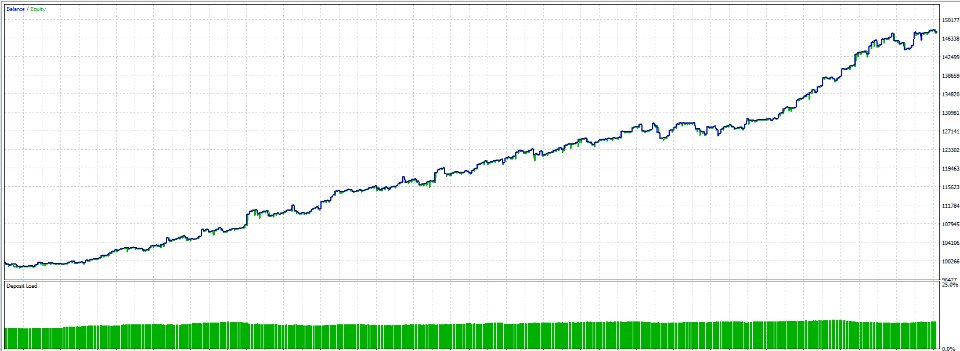

Macro Sniper EA follows a scalping breakout strategy.

The trades are placed at a specified time of the day, when the most trading activity is recorded each day (on average). This time range is calculated automatically and it adjusts itself in the case of Daylight saving time changes. The only thing is that for backtesting the first 2 parameters have to be set relative to the server-time offset relavitve to GMT, example: if your server is set to GMT+3, you should set winter to 3 and summer to 4 (these are the defaults anyway).

The EA is as Plug-and-Play as possible, most of the parameters are automatically derived from the pair where the EA is put on to. A little optimization and some robustness tests have suggested that these are good parameters.

Each order has a fixed Stop-loss and only 1 trade per direction per session is opened at maximum. The stoploss is 200 points for EURSD and 500 points for USDJPY. There is no use of any money management tactics such as martingale/grid or similar, there is just a trailing stop that quickly follows price to secure profits.

Since the EA style of trading is sensitive to price fluctuations, a broker with spreads as low as possible is advised, even if that means slightly higher commission costs.