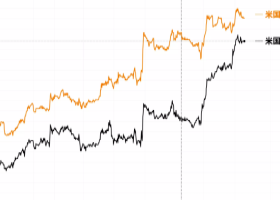

This week, the foreign exchange market saw rapid yen appreciation. The USD/JPY pair dropped to the 151 yen level, falling about 10 yen from the July 3 high of 161.95 to 151.94. This sharp movement resulted from a combination of factors.

Firstly, the Japanese government and the Bank of Japan (BOJ) intervened in the market for two consecutive days, promoting yen buying in response to weaker-than-expected U.S. Consumer Price Index (CPI) data. Political factors, including comments from Trump and Biden's withdrawal from the presidential race, also supported yen buying. Additionally, Japanese government officials, such as Digital Minister Kono and LDP Secretary-General Motegi, expressed concerns about yen depreciation, increasing pressure on the BOJ to raise interest rates.

Moreover, a global stock market downturn fueled risk-averse behavior, further encouraging yen buying. The sharp drop in U.S. semiconductor stocks, a temporary 1,300-point decline in the Nikkei 225, and slowing economic growth in China also contributed. This situation intensified the unwinding of yen carry trades, leading to the formation of new yen buying positions.

Yesterday, the U.S. preliminary GDP data for the second quarter was released, showing a better-than-expected annualized growth rate of 2.8%. This news led to a rapid rebound in the USD/JPY to the 154 yen level.

Today's focus is on the upcoming U.S. personal income and spending data, as well as the PCE deflator. The PCE deflator is expected to show a year-over-year increase of 2.4%, down from 2.6%, with the core deflator also forecast to slow slightly to 2.5%.

Heading into the weekend, with the BOJ's policy decision meeting and the U.S. Federal Open Market Committee (FOMC) scheduled for the 31st, the market is expected to face difficulty in moving in a single direction. However, the market's response may provide insights into the biases in USD/JPY and broader market sentiment.

Currently, USD/JPY is unable to break through the "Kanda ceiling" support line at 152 yen, with the Japanese yen being sold off. It is anticipated that 152 yen will continue to be seen as a crucial support level.