First sacred cow: "If the trend started, it will continue" - page 75

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

So we are talking about different things. I'm talking about the second picture - the momentum, which is just more like a self-organization than the trend in the first one. I would be much more satisfied with quickly taking one third of the second movement (30 pips), which has minimal fractal dimension, - than with long and tedious, though doubtful, taking the whole first, very noisy movement (yes, trend, but "swampy").

But a correlated oscillatory movement is something new. Let's ponder.

No one has a problem with that. That's not what we're talking about here.

2 artikul:

Ни у кого с этим проблем нет. Здесь о др. речь.

Then it's too boring and pointless to waste time on it )))

Yes, about the initial reaction of the system, I didn't answer. All I was saying was that to start the process with PIC (avalanche), you still need to kick the foot off by kicking the first stone.

Perhaps this reaction would be more pronounced on other pairs than on the one where the disaster occurred - don't know, haven't dealt with it.

As Alexey says - everyone's horizon is different.

The main thing is profit ;)

Главное профит ;)

А я как раз строю матаппарат, соответствующий сути явления.

Vita, ну вот смотри. До некоторого момента был флэт одной валюты ко всем остальным. Т.е. к некоторым она росла, к некоторым падала, а к некоторым просто стояла - и все это равновесие было динамическим, т.е. не статичным. Это обычный широкий флэт, на котором пипсари свои деньги делают. И вдруг все поменялось: эта валюта вдруг начала целенаправленное движение ко всем остальным в одном направлении. Это не похоже на фазовый переход системы в другое состояние?

OK, this is a phase transition of the system to another state.

I have a simple question - what is the formal rule for determining whether a transition (catastrophe) has occurred or not? For your 150-200 points.

If relevant, tell us what is the length of the window by which we can determine that "the currency has suddenly started a purposeful movement towards all others?"

Картинка начинает проясняться. Candid, спасибо за дифференциацию понятий.

Значит, мы говорим о разных вещах. Я говорю о второй картинке - об импульсе, который как раз больше похож на самоорганизацию, чем тренд на первой. Меня гораздо больше устроило бы быстренько взять треть второго движения (30 пунктов), которое имеет минимальную фрактальную размерность, - чем долго и нудно, с сомнениями, хоть и целиком брать первое, весьма шумное движение (да, тренд, но "болотный").

It seems to me that it is easier (or rather safer) to take it in a trend according to your definition of directional movement of currencies. And the clearer the directionality (better for both currencies in a pair), the more pronounced the trend.

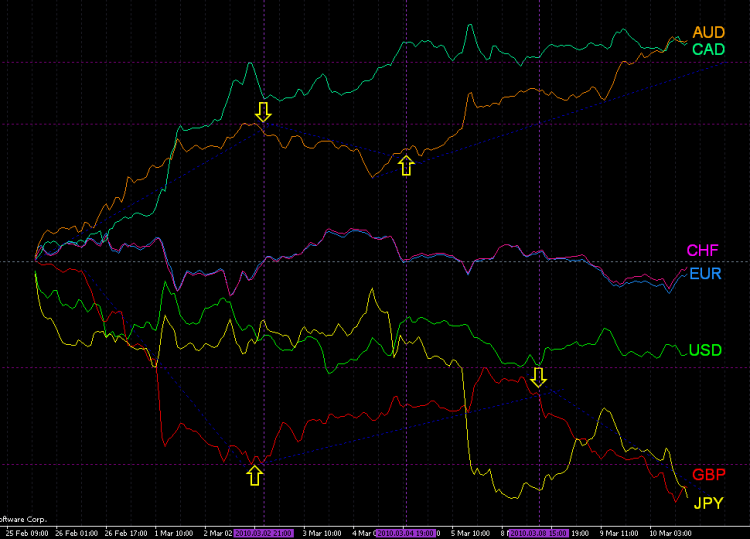

In the picture I have shown only as an example for GBP/AUD (see the dates on the chart for anyone interested), although the dependence of the major currencies (21 pairs) is clearly visible there.

The main thing is not the direction (and it is the direction that is the main core of the concept "Trend"), the main thing is where the stops of the open positions are (on which side and at what distance from the Bid and Ask). The least probability of reaching a certain point with the minimum drawdown during the given period of time is chosen, and SL is set in this place. At the same time, each particular trade must have a "life time". The allotted time for the trade - it must be closed! - If the TP has not been reached - the fact is equated to the wrong TP and is regarded as a bad decision, even if the position was closed with a profit.

From this bell tower, it makes absolutely no difference what a "trend" is, when it started and when it will end.

True, gaps and other nastinesses happen, but they are rare and do not interfere with this approach. Even if the market changes so much that gaps occur in every bar, it will still be possible to work with profit.

In some ways I am close to Peter's point of view, with its context. There are some similarities in these approaches.

Ок, это фазовый переход системы в другое состояние.

У меня простой вопрос - каково формальное правило определения произошел переход (катастрофа) или нет? Для твоих 150-200 пунктов.

Если уместно, то поведай какой протяженности окно, по которому мы можем определить, что "валюта вдруг начала целенаправленное движение ко всем остальным?"

Can I be curious?

What is used in the FP coordinates?