Martynas Juska / Profil

- Information

|

3 Jahre

Erfahrung

|

0

Produkte

|

0

Demoversionen

|

|

0

Jobs

|

2

Signale

|

0

Abonnenten

|

Finance Broker

in

Myriad Capital

Professional in this area.

More about my experience you can find in LinkedIn:

www.linkedin.com/in/MartynasJuska

More about my experience you can find in LinkedIn:

www.linkedin.com/in/MartynasJuska

Freunde

10

Anfragen

Ausgehend

Martynas Juska

Hat ein MetaTrader 5 Signal veröffentlicht

Introducing DYNAMIC HEDGE TRADE – a flexible and risk-managed trading strategy designed to capture steady profits in any market condition. This strategy combines dynamic hedging techniques with smart profit-taking to optimize your performance and minimize risk. Whether the market is trending or ranging, DYNAMIC HEDGE TRADE adapts, using strategic trade entries and exits to ensure optimal results. Key features: Smart profit capture – once the profit target is reached, all positions are closed

Martynas Juska

Hat ein MetaTrader 5 Signal veröffentlicht

The HedgeMaster Strategy is a sophisticated trading approach designed for those seeking a balanced combination of risk management and profit maximization. This strategy employs a dynamic hedging mechanism that adapts to market conditions, ensuring that your positions are protected while capturing potential market moves. With the HedgeMaster Strategy, you can benefit from: Adaptive Hedging: The strategy adjusts its hedging levels based on real-time market analysis, reducing exposure to

Martynas Juska

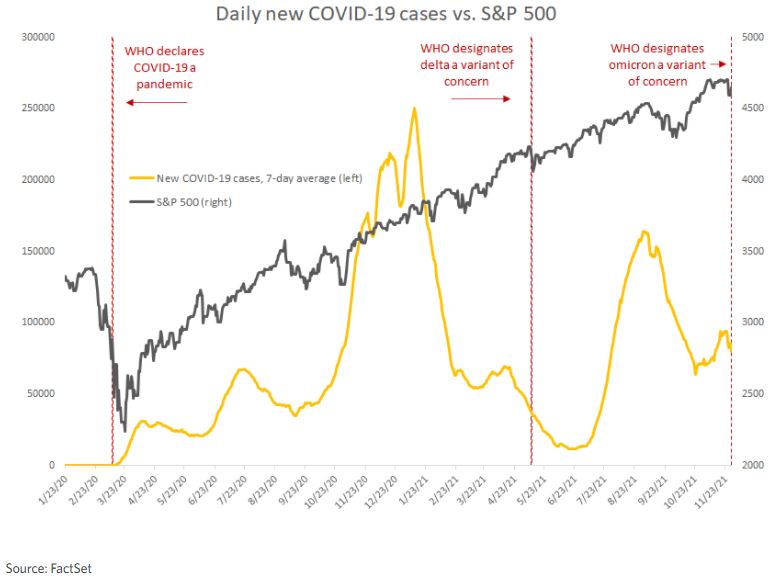

Better preparedness – With more medical solutions available, including vaccines that could be adjusted to different variants as well as new antiviral treatments, the health system is better prepared to deal with another wave of the virus. For this reason, governments are less likely to impose the strict restrictions that caused most of the economic damage last year. Additionally, after almost two years of having lived with the pandemic, consumers and businesses have adjusted behaviors and processes, potentially helping soften the blow from any future disruption in economic activity. The fact that stock-market performance has been largely immune to prior upticks in virus cases (including the late-summer delta-variant surge) demonstrates the economy's resiliency and shows that investors are willing to look through any temporary weakness.

Martynas Juska

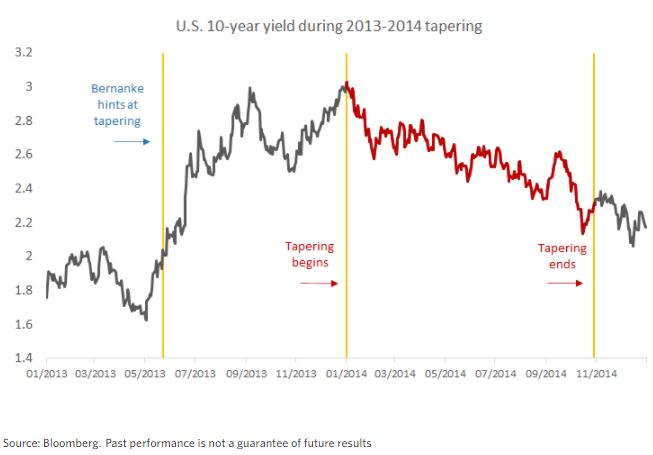

*The last Fed tapering in 2013 had little impact on equity markets. While volatility increased as former Chair Bernanke hinted at a step-down in asset purchases, equities performed well during the 10 months of tapering. The S&P 500 rose 9.5%, with the health care, real estate and utilities sectors leading the market gains.

*Bond yields rose sharply in anticipation of the tapering (the so-called 2013 "taper tantrum") but actually declined while the Fed was reducing its stimulus. In my opinion, the path for rates will be shaped by economic growth and inflation rather than Fed tapering. My guess is that longer-term bond yields are likely to trend modestly higher through 2022 as the economy improves.

*Bond yields rose sharply in anticipation of the tapering (the so-called 2013 "taper tantrum") but actually declined while the Fed was reducing its stimulus. In my opinion, the path for rates will be shaped by economic growth and inflation rather than Fed tapering. My guess is that longer-term bond yields are likely to trend modestly higher through 2022 as the economy improves.

Martynas Juska

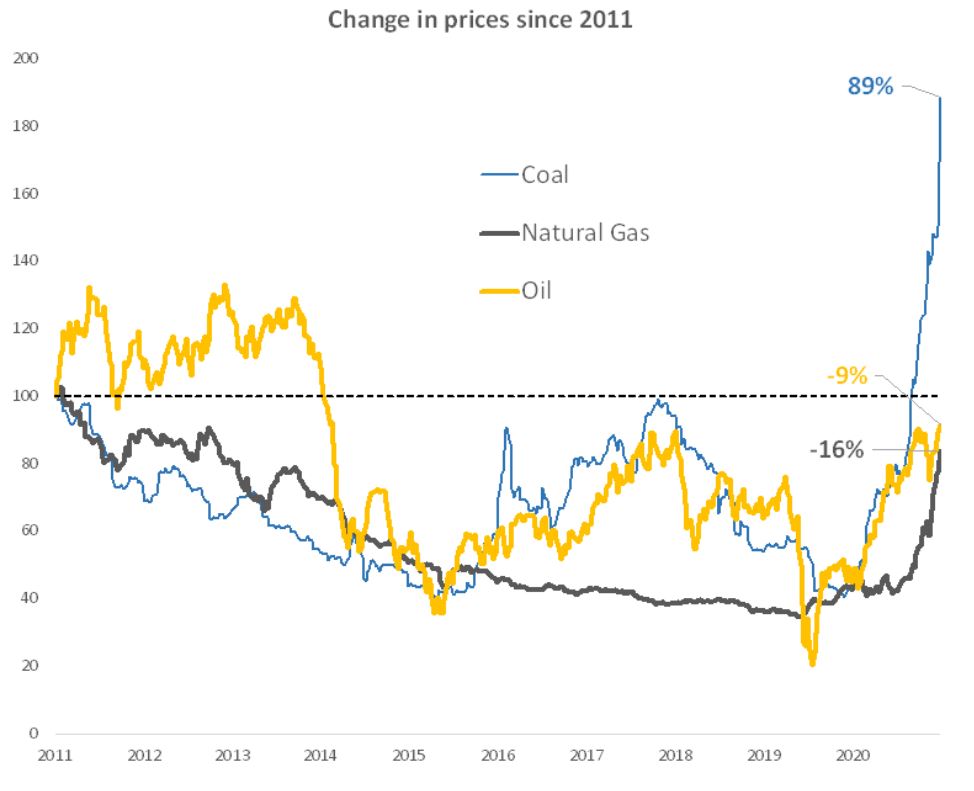

A temporary deal to raise the debt ceiling until December boosted investor optimism, but volatility remained elevated amid a surge in energy prices, persistent supply-chain disruptions, and labor-market shortages.

Martynas Juska

Monthly market update

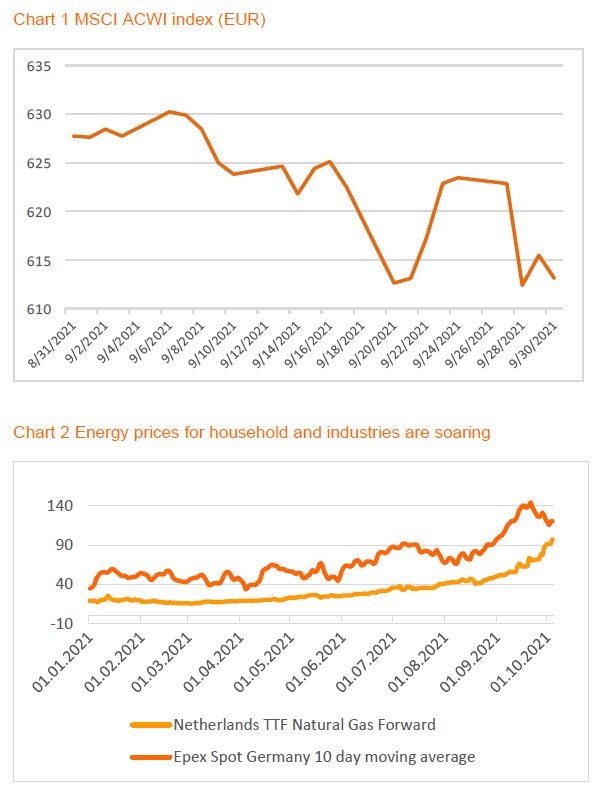

September was an exceptionally eventful month and gave support to the negative historical seasonality statistics in the equity markets. Global equity markets decreased 2.3% in euros (MSCI All Country World index). Selling pressure was evenly spread across emerging and developed regions whereas value outperformed growth. US dollar appreciated 2% against euro.

For the most of the month the global financial markets were on high alert mode as Chinese property giant Evergrande struggled to meet its bond interest payments. As its debt constitutes a decent proportion of the corporate high yield indexes, there are perceptions that it might be too big to fail. Comparisons made with Lehman bankruptcy have definitely damaged the investor sentiment towards riskier assets. In addition to Evergrande, the economic data in China has been deteriorating for some time, making slowdown in China a real problem.

Major central banks had their policy meetings. Hawkish comments from both the FED and ECB had seemingly not been priced in to their full extent and therefore took their toll on the yields. US and German 10 year government bond rates reacted evenly with +18 bps monthly increase. Naturally, credit spreads suffered as well following the expectation that corporate asset purchases will lessen.

September was an exceptionally eventful month and gave support to the negative historical seasonality statistics in the equity markets. Global equity markets decreased 2.3% (Chart 1) in euros (MSCI All Country World index). Selling pressure was evenly spread across emerging and developed regions whereas value outperformed growth. US dollar appreciated 2% against euro.

For the most of the month the global financial markets were on high alert mode as Chinese property giant Evergrande struggled to meet its bond interest payments. As its debt constitutes a decent proportion of the corporate high yield indexes, there are perceptions that it might be too big to fail. Comparisons made with Lehman bankruptcy have definitely damaged the investor sentiment towards riskier assets. In addition to Evergrande, the economic data in China has been deteriorating for some time, making slowdown in China a real problem.

Major central banks had their policy meetings. Hawkish comments from both the FED and ECB had seemingly not been priced in to their full extent and therefore took their toll on the yields. US and German 10 year government bond rates reacted evenly with +18 bps monthly increase. Naturally, credit spreads suffered as well following the expectation that corporate asset purchases will lessen.

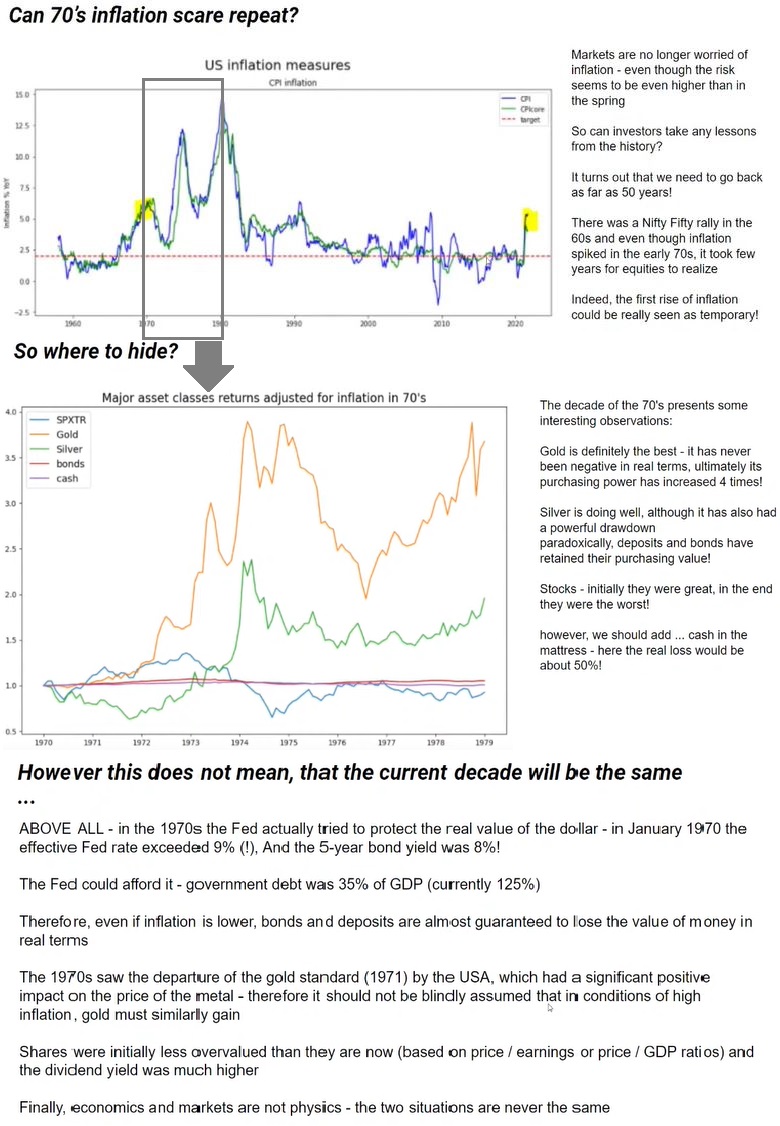

Inflation numbers have been increasing noticeably in both US and Eurozone. With ongoing trends in energy prices, the expectation of the spike in inflation being temporary becomes increasingly undermined. Both households and industries will have to face much higher bills for energy sources in the coming period. In September both electricity and natural gas prices were skyrocketing (Chart 2).

September was an exceptionally eventful month and gave support to the negative historical seasonality statistics in the equity markets. Global equity markets decreased 2.3% in euros (MSCI All Country World index). Selling pressure was evenly spread across emerging and developed regions whereas value outperformed growth. US dollar appreciated 2% against euro.

For the most of the month the global financial markets were on high alert mode as Chinese property giant Evergrande struggled to meet its bond interest payments. As its debt constitutes a decent proportion of the corporate high yield indexes, there are perceptions that it might be too big to fail. Comparisons made with Lehman bankruptcy have definitely damaged the investor sentiment towards riskier assets. In addition to Evergrande, the economic data in China has been deteriorating for some time, making slowdown in China a real problem.

Major central banks had their policy meetings. Hawkish comments from both the FED and ECB had seemingly not been priced in to their full extent and therefore took their toll on the yields. US and German 10 year government bond rates reacted evenly with +18 bps monthly increase. Naturally, credit spreads suffered as well following the expectation that corporate asset purchases will lessen.

September was an exceptionally eventful month and gave support to the negative historical seasonality statistics in the equity markets. Global equity markets decreased 2.3% (Chart 1) in euros (MSCI All Country World index). Selling pressure was evenly spread across emerging and developed regions whereas value outperformed growth. US dollar appreciated 2% against euro.

For the most of the month the global financial markets were on high alert mode as Chinese property giant Evergrande struggled to meet its bond interest payments. As its debt constitutes a decent proportion of the corporate high yield indexes, there are perceptions that it might be too big to fail. Comparisons made with Lehman bankruptcy have definitely damaged the investor sentiment towards riskier assets. In addition to Evergrande, the economic data in China has been deteriorating for some time, making slowdown in China a real problem.

Major central banks had their policy meetings. Hawkish comments from both the FED and ECB had seemingly not been priced in to their full extent and therefore took their toll on the yields. US and German 10 year government bond rates reacted evenly with +18 bps monthly increase. Naturally, credit spreads suffered as well following the expectation that corporate asset purchases will lessen.

Inflation numbers have been increasing noticeably in both US and Eurozone. With ongoing trends in energy prices, the expectation of the spike in inflation being temporary becomes increasingly undermined. Both households and industries will have to face much higher bills for energy sources in the coming period. In September both electricity and natural gas prices were skyrocketing (Chart 2).

: