Outlook for the Overseas Markets: Lack of Catalysts, Will the Decline in USD/JPY Stabilize?

The overseas markets at the beginning of the week lack notable catalysts. There are no major economic indicators scheduled for release in major countries, with only some announcements such as Turkey's employment statistics for January and Norway's Consumer Price Index (CPI) for February expected in the early London session. Tomorrow, the focus will be on the release of the US Consumer Price Index, likely leading to a cautious mood.

Last week saw a strengthening trend in yen buying. Over the weekend, there were reports suggesting that the Bank of Japan (BOJ) was considering new quantitative monetary policies regarding government bond purchases. Alongside speculations about abolishing the Yield Curve Control (YCC) and a leaning towards negative interest rate policy removal, emerged.

This week, the 13th is a concentrated day for responses to the spring labor negotiations in Japan, with the first results set to be announced on the 15th. For the BOJ's normalization of monetary policy, wage hike trends are a crucial point well known. There's a possibility of continued pressure for yen appreciation, making the movement of USD/JPY in the subsequent overseas markets worth monitoring.

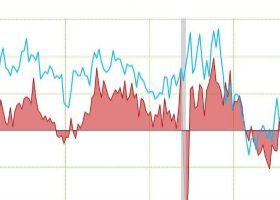

However, today's low in the Tokyo market was around 146.54, failing to break below the previous week's end low of 146.49. Currently, there's a struggle around the 147 yen level. While short-term adjustments in selling positions seem likely, it remains uncertain how much retracement will occur.

Regarding speaking events, there's a limited schedule during London hours. Moving into New York hours, the release of the NY Fed's 1-year Inflation Expectations for February and the US 3-year bond auction ($56 billion) will take place. In the UK, BOE's MPC member Mann is scheduled to speak at an event titled "Monetary Policy Towards Inflation Post-Pandemic."

Today, there are no significant economic indicators, but Bitcoin has surpassed the $70,000 resistance level, suggesting further upside potential. Maintaining a long position in BTCUSD.