GBP/USD: The pound will benefit from the policy of the Bank of England for now

The pound can probably count on support from the Bank of England's rate hike cycle until the economy starts to show more clear signs of a slowdown.

Economists are now predicting a higher rate peak in the UK than in the Eurozone or the US. At the same time, taking into account also the consequences of Brexit, in 2023-2024 economic growth will be weaker, and inflation will be higher than in the Eurozone and the United States.

It is possible that at some stage of tightening monetary policy, the danger of the prospect of a slowing economy will "take over" the risks of rising inflation. Many economists believe that this could happen as early as the 2nd half of 2023.

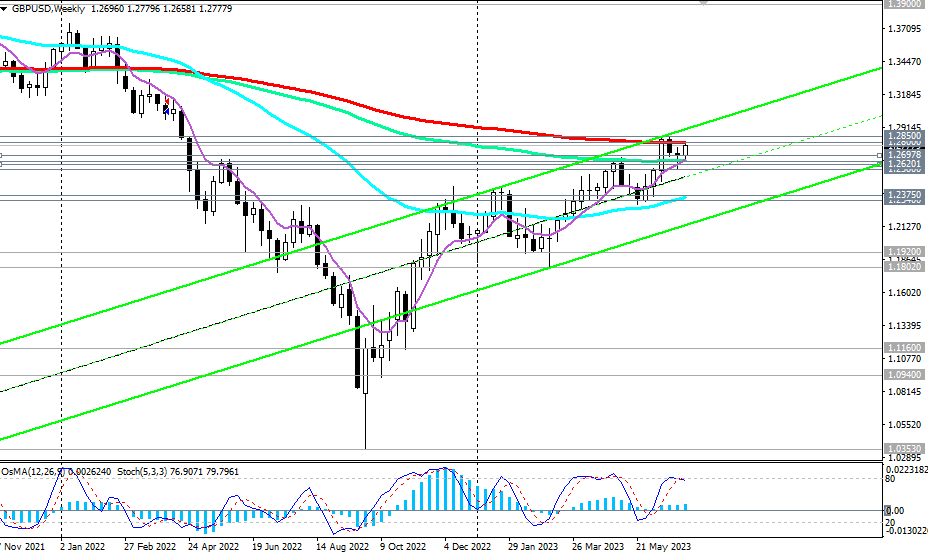

As soon as the Bank of England stops the process of raising the interest rate, the pound will lose support from it and the reverse process may begin. In addition, it is impossible not to notice that on the weekly chart the growth of the GBP/USD pair has stalled near the zone of key long-term resistance levels of 1.2800, 1.2850, from which a reverse movement may begin. It may turn out to be much more rapid than the growth of GBP/USD since September last year.

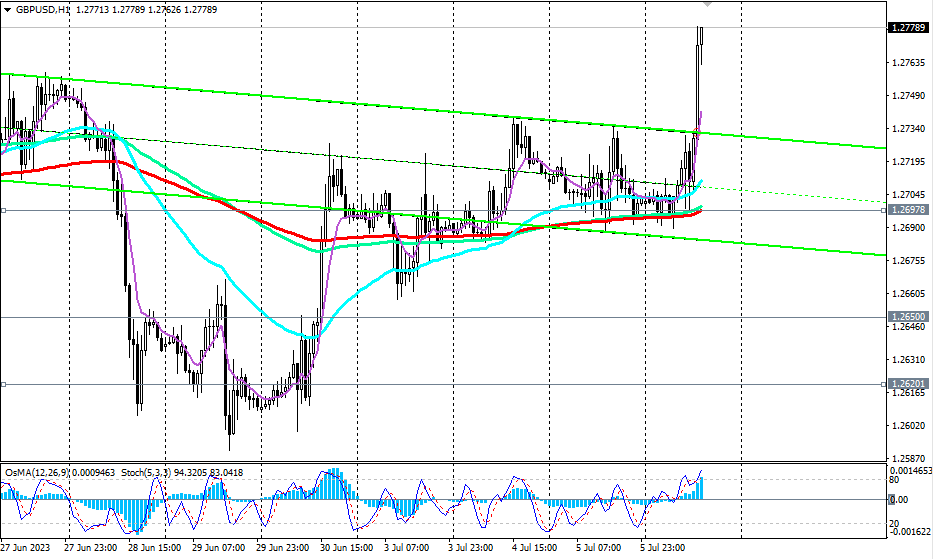

A signal for the resumption of sales may be either a rebound from the resistance levels of 1.2800, 1.2850, or a breakdown of the support levels of 1.2620, 1.2620. The fastest sell signal here may be a breakdown of the important short-term support level 1.2698.

A breakdown of the support level at 1.2580 will confirm our forecast for a decline in GBP/USD, and a breakdown of the key medium-term support levels at 1.2375, 1.2340 will return the pair to the zone of medium-term and long-term bear markets.

Support levels: 1.2698, 1.2650, 1.2620, 1.2580, 1.2400, 1.2375, 1.2340

Resistance levels: 1.2800, 1.2850, 1.3900, 1.4335

- see also “Technical Analysis and Trading scenarios" -> Telegram - https://t.me/traderfxcrypto

- channel - https://www.mql5.com/en/channels/fxcryptotrader

- contact - https://t.me/fxrealist