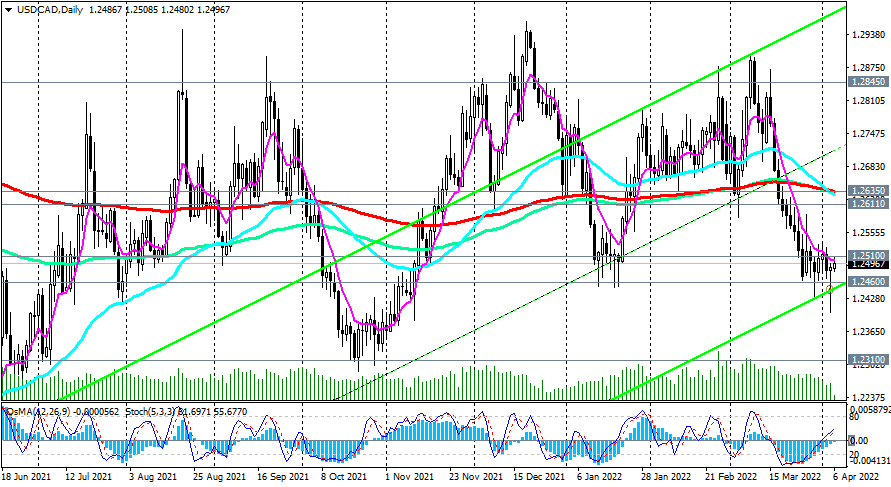

On the eve of the publication of the minutes of the Fed's March meeting, the USD/CAD pair is trading in a narrow range today, maintaining the potential for further decline. Scheduled for release at 18:00 GMT, they may contain additional information about the start date of the Fed's balance sheet drawdown, as well as the pace, structure and methods of this process, as well as sentiment among Fed leaders regarding the main parameters of the monetary central bank policies. If the minutes point to a less aggressive contraction, the US dollar could weaken, economists say.

The pair remains in the bear market zone, trading below key resistance levels 1.2365, 0.2845. Downward dynamics prevails, making short positions preferable.

In an alternative scenario, the first signal for the resumption of long positions will be a breakdown of the resistance level of 1.2510.

However, in order to open long long-term positions, one should still wait for the USD/CAD to rise to the zone above the resistance level of 1.2635.

Support levels: 1.2460, 1.2400, 1.2310, 1.2165, 1.2050

Resistance levels: 1.2510, 1.2611, 1.2635, 1.2700, 1.2800, 1.2845, 1.2900

*) see also “Technical analysis and trading recommendations” -> Telegram

**) Get no deposit StartUp bonus up to 1500.00 USD

Source: InstaForex