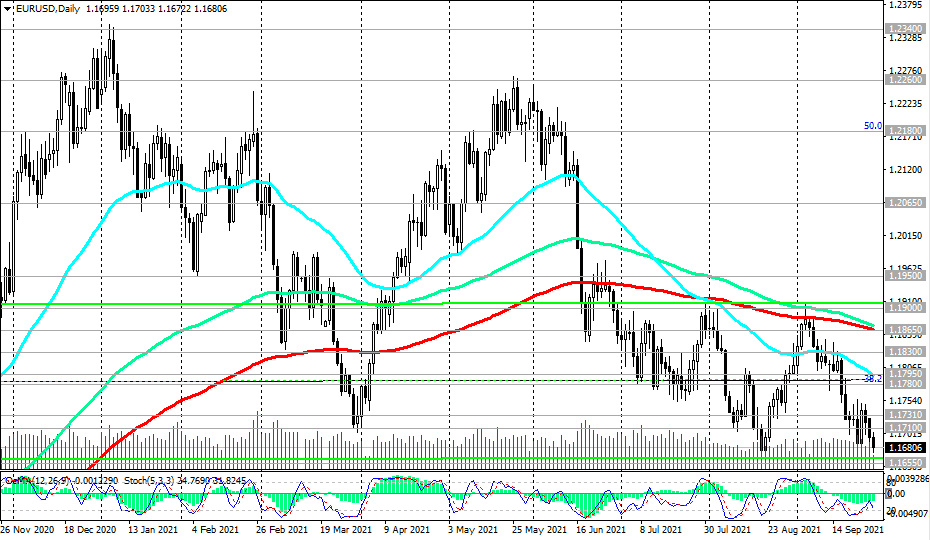

A confirmed breakdown of the zone of key support levels 1.1655, 1.1630 will mean the pair's transition to a long-term bear market with the prospect of a decline towards the lower border of the descending channel on the weekly chart passing through the support level 1.1285 (Fibonacci level 23.6% of the upward correction in the wave of the pair's decline from the level 1.3870, which began in May 2014, to the level of 1.0500).

In an alternative scenario and after the breakdown of the resistance levels 1.1780 (Fibonacci level 38.2%), 1.1795 EUR / USD growth will resume towards the key resistance level 1.1865.

Its breakdown will return EUR / USD to the bull market zone with the prospect of its further growth to resistance levels 1.2180 (Fibonacci level 50%), 1.2260, 1.2340, 1.2450, 1.2500, 1.2580 (Fibonacci level 61.8%), 1.2600.

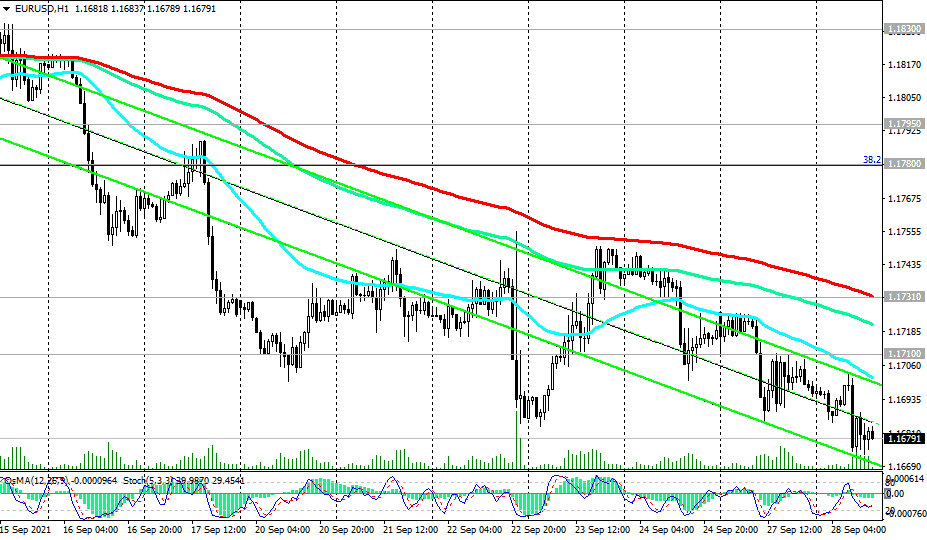

The first signal for the implementation of this scenario will be a breakdown of the important short-term resistance level 1.1731.

Trading Recommendations

Sell Stop 1.1670. Stop-Loss 1.1715. Take-Profit 1.1655, 1.1630, 1.1285

Buy Stop 1.1715. Stop-Loss 1.1670. Take-Profit 1.1731, 1.1780, 1.1795, 1.1830, 1.1865, 1.1900, 1.1950, 1.2065, 1.2180, 1.2260, 1.2340, 1.2450, 1.2580, 1.2600

*) the most up-to-date "hot" analytics and trading recommendations (including entries into trades "by-the-market") - https://t.me/fxrealtrading