Pro Indicator Trader: How to setup a trading strategy.

This article will show an example of how you can use/configure Pro Indicator Trader for one of the most popular strategies - scalping during the Asian session. This will help users to better understand how the EA works and how it can be adjusted to suit their own strategies.

Scalping during the Asian session is a classic strategy used by many traders. The main goal is to make profit on a pullback before the market closes. Therefore, we will use indicators such as Bollinger Bands, Williams Percent Range, CCI to find overbought and oversold zones. And we use the Ozymandias indicator to enter trades only along the trend.

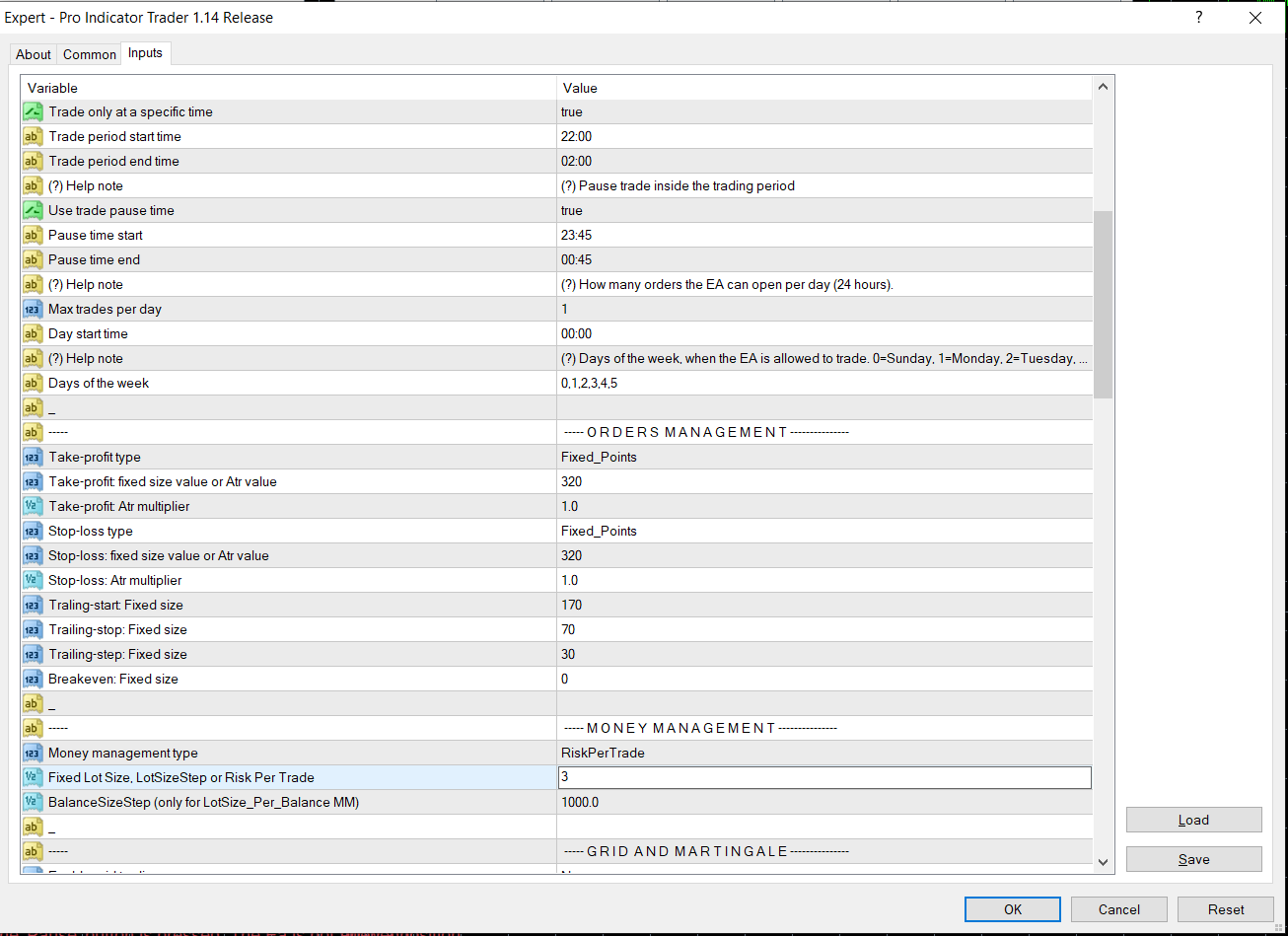

1. First of all, you need to configure the input parameters of the advisor so that it trades only during the Asian session. Therefore, it is important to set the trading period at (Trade period start / end time) to ' 22:00 - 02:00'. It is also important to take into account that the spread widens before the market closes, so it is necessary that the EA doesn't open orders during this time. So we use the 'Use trade pause time' pause time '23:45 - 00:45'.

2. Now we need to select indicators for out strategy. We have already selected our indicators for classic trading: Williams Percent Range, Bollinger Bands, Ozymandias.

Let's first set up the Ozymandias indicator so that our trading always follows the trend. Let's choose 'amplitude' 30 and make the entry rule show a 'Buy' signal when Ozymandias shows a bullish trend and a 'Sell' signal when the indicator shows a bearish trend. The second rule type doesn't matter to us, so no matter where the price is (above/bellow/between the line), the signal will be 'Both'.

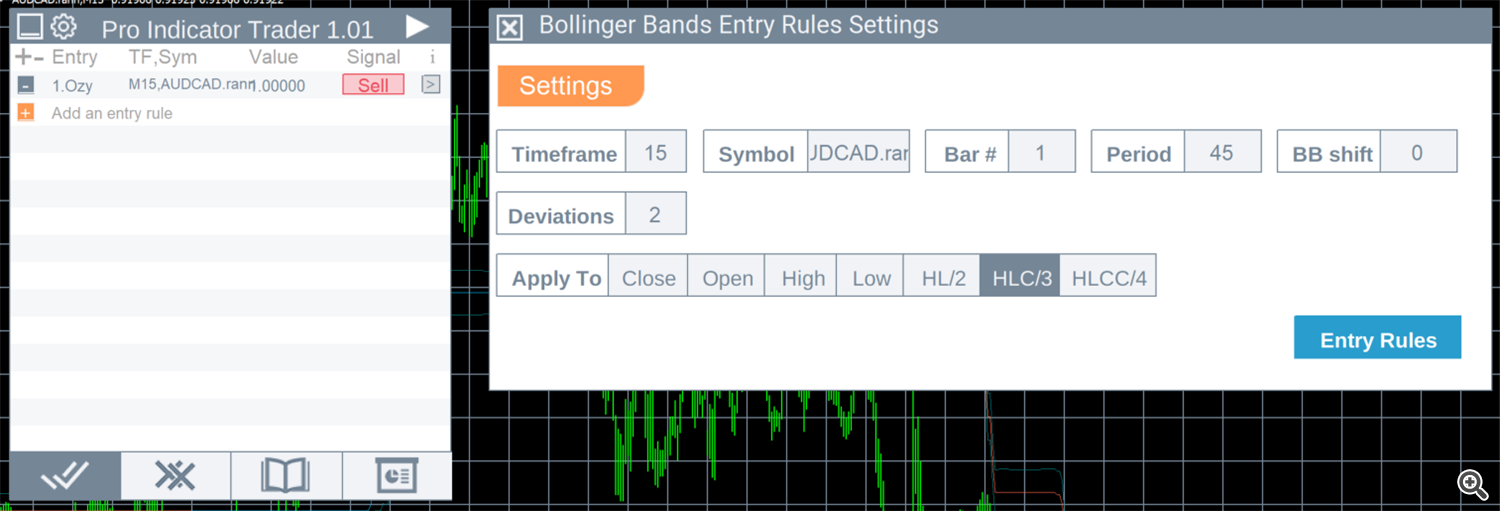

Now let's add an Bollinger Bands entry rule. The most important indicator setting is the period. We need to make sure that the period is sufficient to filter out small market noise, so we set the value to 45.In terms of setup, our strategy involves trading on pullbacks. Therefore, we need the Bollinger Bands rule to show a 'Sell' signal when the price crosses the upper boundary of the channel and a 'Buy' signal when the price crosses the lower boundary. For the other rule types we will use a 'Both' signal, since they don't matter to our strategy.

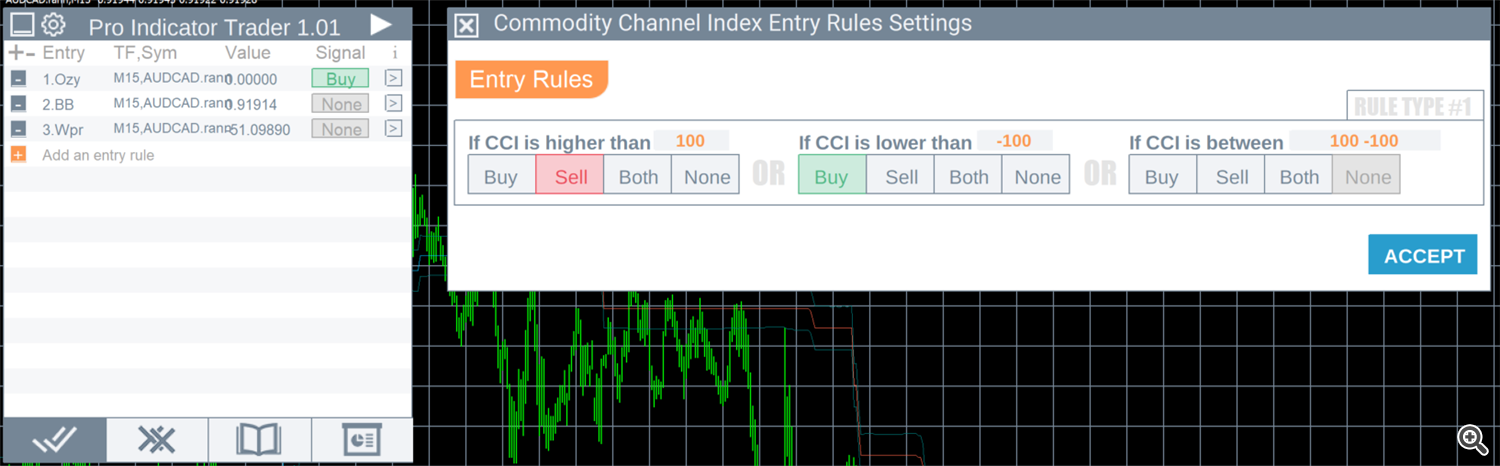

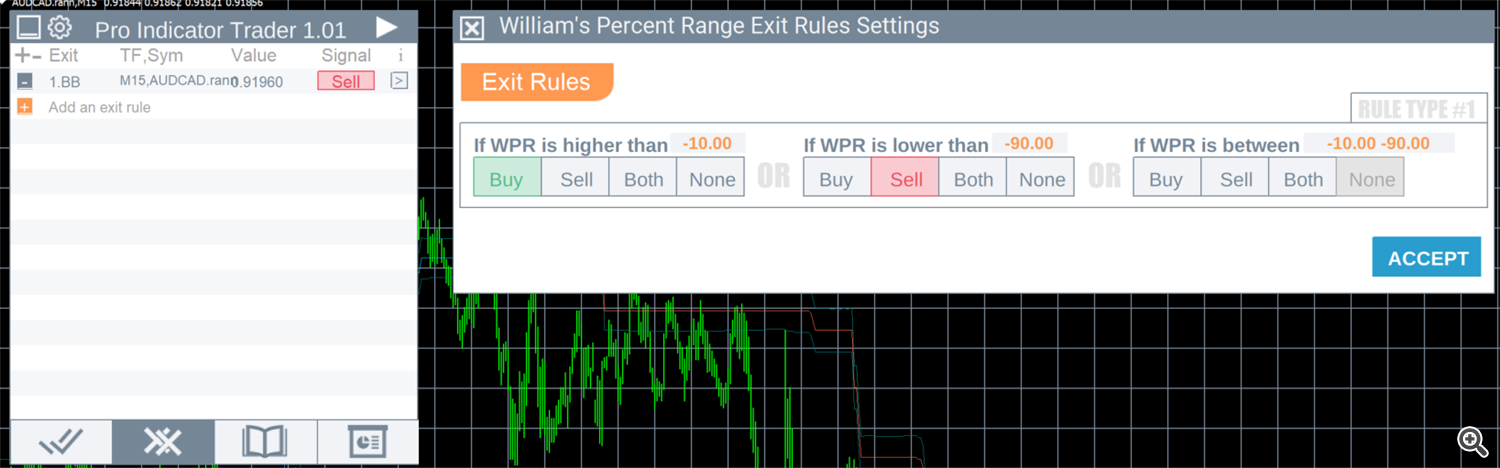

Now let's add a pair of oscillators (William's Percent Range, CCI) to find overbought / oversold zones. Both indicators will show a 'Sell' signal when the WPR/CCI value is equal or higher than '-90', '100'. And a 'Buy' signal when the value is below '-10' / '- 100'

Our whole strategy is ready. Now let's test it and see how it works.