Plotting two channels on the chart are just about everything the trained eye might need in order to get the sense of the next move.

- The support that starts on the low of December 5, 2016, and continues thru the low of August 16, 2018.

- The resistance dragged to the high of July 6, 2016.

- The support, beginning the low on October 9, 2018, with and continuing with the low on November 13, 2018.

- The resistance dragged to the high of February 20, 2019.

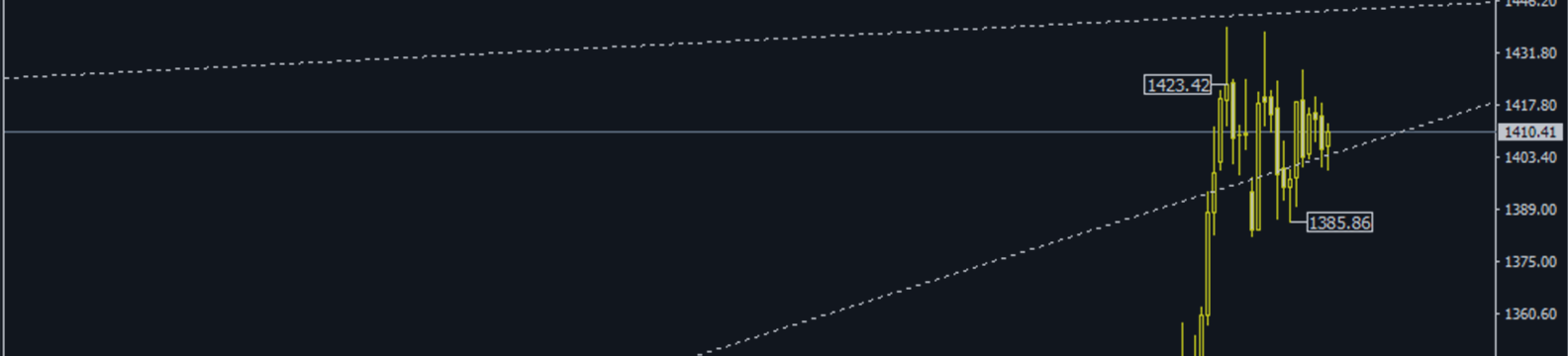

These two channels place the price under the resistance of the first and above the resistance of the second. This is a very interesting placement, as discussed next.

After confirming the fist channels' resistance, the price entered in a consolidative phase contained within the boundaries of the aforementioned lines, alongside with the 1423.42 and 1385.86 resistance and support levels. These kind of structures are favoring the continuation of the move that preceded them, and since this one followed a rally, it is natural to expect a move towards north. So, basically, this diminishes the possibility of a correction developing as the result of a strong retracement from the resistance line of the first channel. Simply put, instead of a 'downwards" correction, the market offered a "horizontal" consolidation.

Noteworthy is the fact that, because the price established itself above the resistance of the second channel, the bulls got all the reasons to keep their dominance fresh, by invalidating any bearish intention to bring the price under the resistance of the second channel and the 1385.86 level.