--------------------------------------------------------------------------------------------------------------------------------------------------------------------------LIMITED LAUNCH OFFER--------------------------------------------------------------------------------------------------------------------------------------

The first buyers of the HIBgRID EA will receive for free the light version of the "Big Ben Climber" EA which will be in the market soon. The Big Ben Climber works on GBPCAD and does not use GRID nor martingale. The light version has a limitation on the lot size. The max lot size is 0.1 X 1000 Balance. The Big Ben Climber is the perfect companion of teh HIBgRID to diversify the strategy.

It is enough to rate the HIBgRID EA 5 stars if you like it or alernatively PM me with the MQL5 screenshot proof of the purchase of HIBgRID.

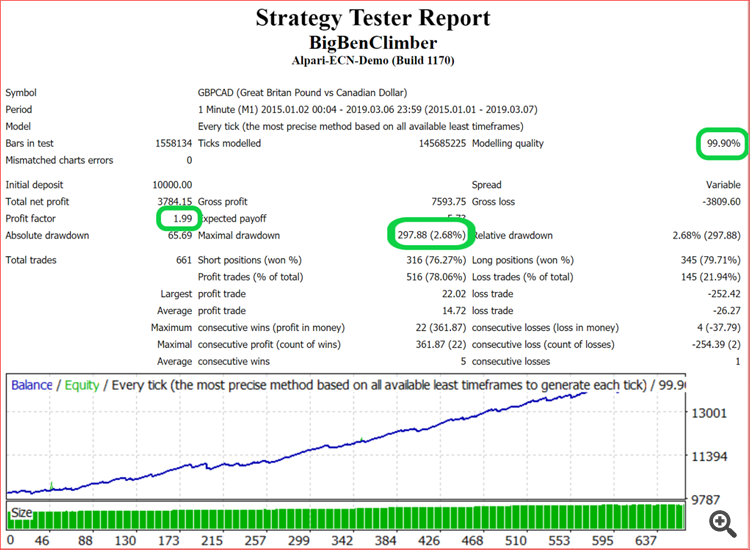

Backtest of the Big Ben Climber:

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------LIMITED LAUNCH OFFER--------------------------------------------------------------------------------------------------------------------------------------

--------------------------------------------------------HIBgRID--------------------------------------------------------

Market link

https://www.mql5.com/en/market/product/36523

Description:

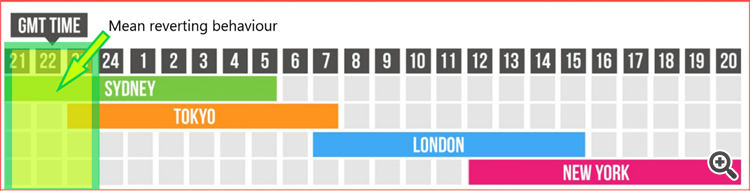

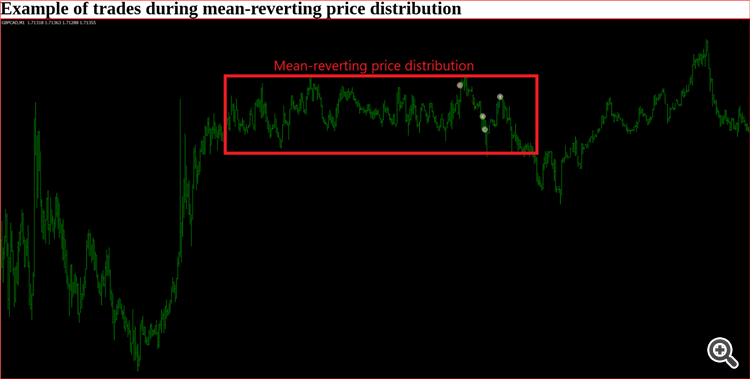

The HIBgRID is a Hybrid Grid trading strategy based on the mean reverting characteristics of the pair GBP/CAD during low volatility and low volume period, meaning after New York closes until Tokyo has just opened.

The EA utilizes the mathematical principles of a Ornstein–Uhlenbeck process to identify trading opportunities with higher success probability.

After a signal and a trade is opened, if the price behaves following the mean-reverting process the EA will calculate the most likely target profit and close the trade.

In case the price behaviour turns out to be not mean-reverting the Risk Manager will close the first trade at a lower profit target or even with a small loss.

In case the target profit is not reached and the Risk Manager does not identify early evidences of a non mean-reverting distribution the EA will open recovery orders up to a maximum of 4 open orders.

The EA utilizes a proprietary dynamic grid logic with light lot size increment in order to minimize drawdown and risk exposure.

Parameters:

Standard setting can be used for GBPCAD 1M,

Lot size: Standard settings 0.03. Lot size to be utilized for the specified balance

For balance: Standard settings: 1000. Balance used to calculate lot size. As an example: lot size 0,03 X balance 1.000 means that with a balance of 10.000 the EA will open trade for 0.3 lot size.

Max slippage: Standard settings 1. Maximum allowed slippage. As the EA works with market orders it is necessary to make sure no trades are opened in case of a significant slippage.

Max allowed Draw Down Standard settings -0.25 as a factor of the current balance. In case the equity drops below this threshold the EA will close all orders as a capital protection measure. As en example, balance is 10.000, Max allowed draw down is -0.2, this means that if the equity goes below 8.000 the EA will close all open orders. VERY IMPORTANT: respect the standard ratio Lot/MaxDD: If your want to set your max risk at 10%, then use 0.01 lot per 1000 and max draw down -0.1.

3 days swap/rollover filter It is recommended not to trade against the three days rollover (usually between Wednesday and Thursday night for the majority of brokers). In case of GBP/CAD the EA will not open BUY orders just before the 2 days rollover.

Broker GMT offset. The EA is designed to work with a New York close broker, meaning GMT +2 or GMT +3 during DLS. So if you run the EA with a new close broker like ICmarkets or Darwinex, or Axitrade leave the parameter in standard settings, meaning 0.

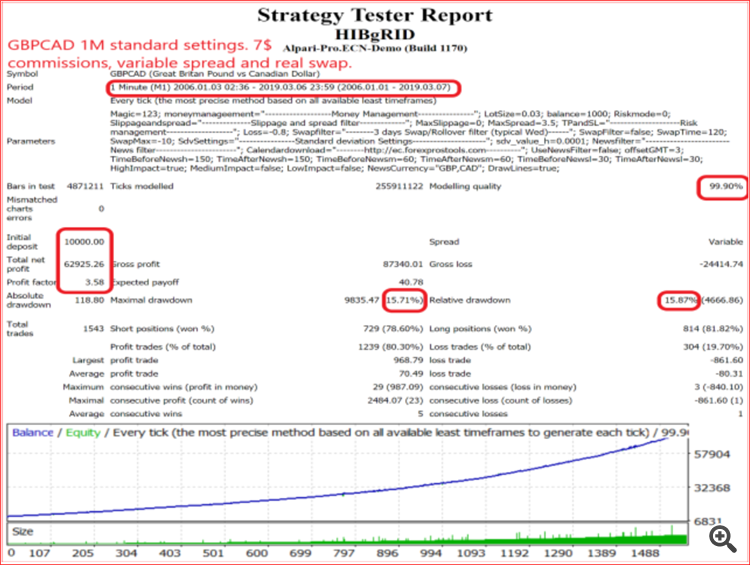

Backtest:

As the spread plays an essential role in the real performance and it is used also as a volatility filter especially before rollover/swap charge and during strong price movement, only a tick by tick, 99% accuracy variable spread test has a statistical meaning. Please avoid testing with fixed spread as it is worthless.

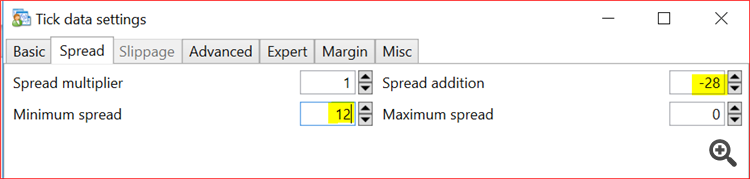

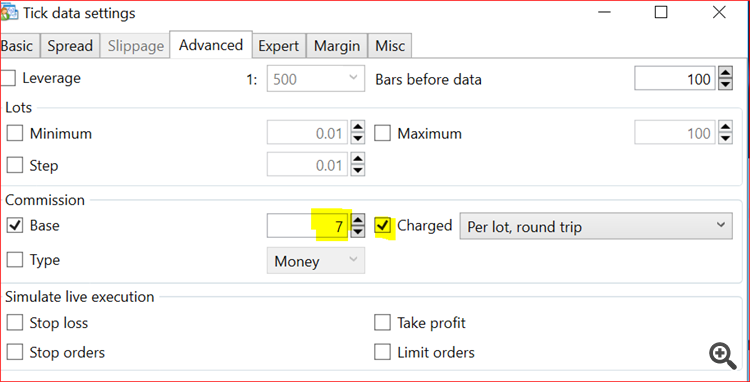

My backtest use Dukascopy data with a negative cap of 28 points and minimum of 12 points. This is the closer to the best ECN broker real conditions.

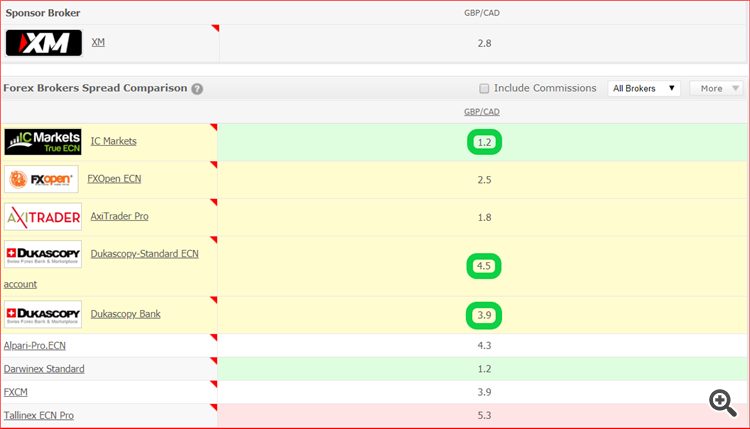

Spread comparision during EA operations:

Spread comparision during EA operations:

The average difference between ICMarkets and Dukascopy is around 27/28 points.

This is the backtest results with standard settings and standard risk

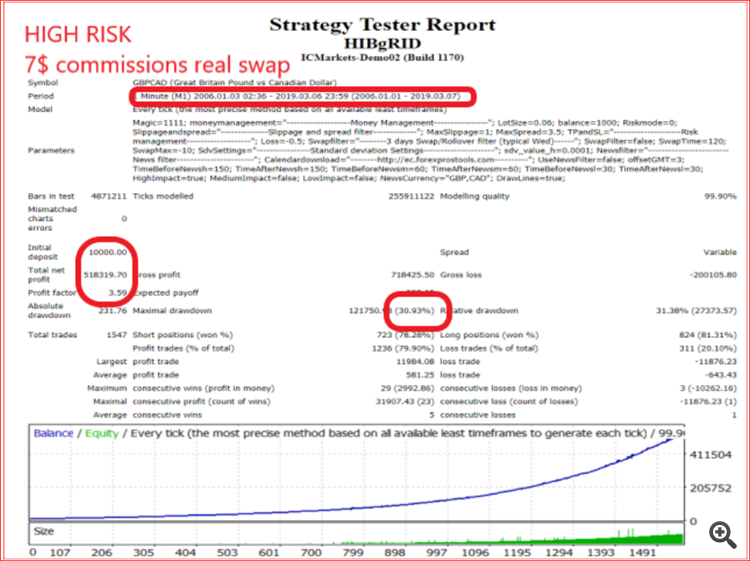

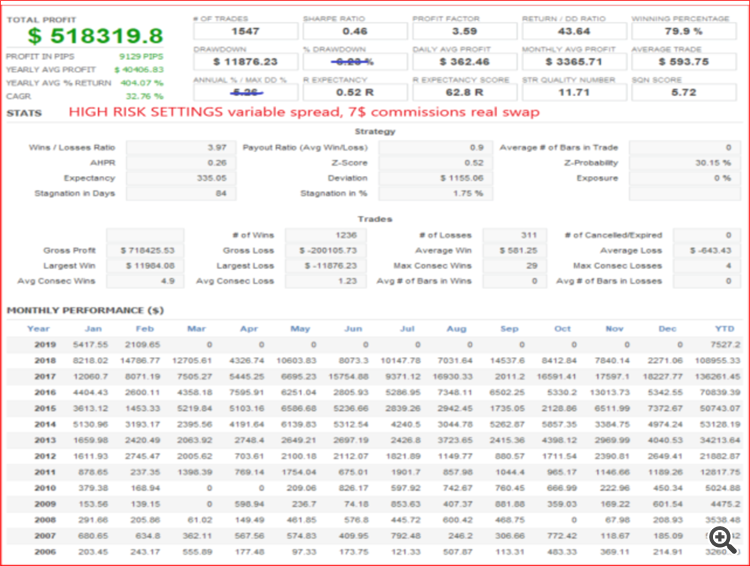

If you dare to risk more, around 30% this is the result:

32% CAGR per year.