Long Range is a low risk system designed for stable and consistent trading. It is a breakout system that takes its entry around swing high and swing lows with a potential high reward per low risk. The system fits both long term trading and short term scalping and the design makes it less prone to market fluctuations such as news releases and price spikes.

The system fits both long term trading and short term scalping and the design makes it less prone to market fluctuations such as news releases and price spikes.

Features

- Non-Repaint signals

- Non-Back Paint Signals

- Ideal for long term trading and short term scalping

- Stop Loss at Support and Resistance levels

- Less prone to market fluctuations and price spikes

- Tradable on all symbols

- Tradable on all timeframes

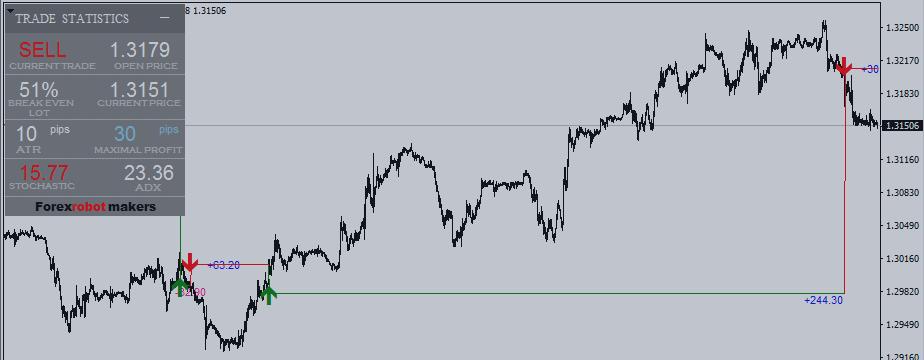

- Fully packed trade dashboard to fit your trading needs

How To Use

Enter when ADX is above 30

The trade dashboard is equipped with an ADX indicator. One thing to take congnisance of in taking a signal is the Average Directional Index (ADX) . Only take signal when the ADX is above 30. The reason for this is that signals come at support / resistance and these levels sometimes may be a consolidation zone thus the signal may be a false signal. Thus it is important for the ADX to be above 30 so a direction can be defined before taking a trade.

Take Partial Profits at ATR Levels until Break Even

The trade dashboard is equipped with an ATR indicator and a Break Even Calculator. How to use this indicator is that you attempt to first break even and ride out the rest of the trend . Every signal is a potential long range trend so zero out the risk first. You achieve this by closing partial profits at every ATR level (pips). E.g ATR value = 10 pips, so at 10 pips from open price you close out 30 % of the lot size, at 20 pips (2*ATR) you close out another 30 % of the remaining lot size, continue doing this at every ATR level until potential loss (from stop loss line to trade open price) is equal to my profit closed. When break even is achieved, you can relax and ride out the remaining trend.

Ride the trend and milk out the profits by closing partially at every stochastic overbought/oversold zone

This system is not designed for signal to signal trading. This means don’t open at one signal and wait till reverse signal to exit. Take partial profit at every swing high / stochastic overbought and swing low stochastic oversold. That is exit buy trade partial profit at every stochastic overbought and sell trade partial profit at every stochastic oversold.

Exit Fully at Reverse Signal

Make sure to fully exit every trade at reverse signal but always ensure you milk out the profits along with the trend.

Trade Dashboard Break Even Lot %

The Trade Dashboard is fully packed with every parameter that will fit your trading needs. The Break Even Lot is the lot size in percentage that needs to be closed for a position to break even taking the current price and stop loss lines as reference. E.g. A trade of 1 lot is opened. Stop Loss from opening price = 10 pips . So if the current price is 10 pips from the opening price then the Break Even Lot is 50%. So the calculation becomes :

50%*1 Lot=0.5 Lot

Opening Price>Stop Loss (10 pips*0.5 lot) = $50

Current Price >Opening Price (10 pips *0.5)= $50

Since the partial profit is equal to the loss, then we have break even.

Available at https://www.mql5.com/en/market/product/32374/

INPUT

- Long Range : Long Range Period in bars

- Stoch%K : Stochastic %K period

- Stoch Slowing : Stochastic Slowing period

- Average True Range : ATR period

- Average Directional Index : ADX period

- Enable PopUp Alert : True/False

- Enable Email Alert : True/False

- Enable Push Alert : True/False