As the American Petroleum Institute (API) reported yesterday in its weekly report on oil and petroleum products, crude oil inventories in the USA fell by 4.1 million barrels over the past week, while gasoline stocks increased by 4.2 million barrels, which significantly exceeded forecasts of analysts of the oil market. The growth in gasoline stocks signals a forthcoming drop in demand for oil from US refineries, which is a negative factor for oil prices.

During today's Asian session, oil prices fell to nearly 2-week lows, while WTI oil traded near a psychologically important level of $ 50 per barrel. November futures for light sweet crude on the NYMEX traded at $ 50.10 per barrel, with a decrease of $ 0.32 per barrel. December futures for Brent crude fell 0.48% to 55.73 dollars per barrel. The spot price for Brent crude was at the beginning of today's European session near the mark of $ 55.50 per barrel.

After last week, the price of Brent crude oil has reached a new annual maximum near the mark of 58.80, for the seventh consecutive day the price is falling. Investors record profits after oil prices in the third quarter jumped by more than 12%.

Investors also assess signs of increased oil production. OPEC's production in September was 32.86 million barrels a day, up from the previous month and above the agreed aggregate production ceiling of the cartel (just under 32 million barrels per day), which indicates a violation of OPEC's agreement to cut production.

On the other hand, American producers are resuming production growth, taking advantage of the situation with rising prices. According to data provided by the oil service company Baker Hughes Inc. on Friday, the number of active drilling rigs in the US rose for the first time in seven weeks, to 750 units. The rise in prices contributed to an increase in activity in the US oil-extracting sector.

Another point, negative for the dynamics of oil prices, is the seasonal decline in demand for oil in the autumn period.

The official weekly report from the US Department of Energy on oil and petroleum products will be released on Wednesday (14:30 GMT). If he also points to the growth of oil products, primarily gasoline, then oil prices will continue to decline.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

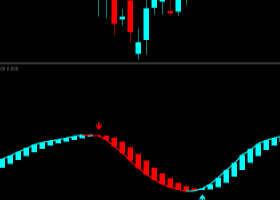

Technical indicators (OsMA and Stochastics) on the 1-hour, 4-hour, daily charts give signals to short positions.

The price for Brent crude oil is falling to the lower border of the rising channel on the daily chart and the support level of 54.70 (EMA200 on the 4-hour, weekly charts).

An alternative scenario will be associated with a price return to the zone above the level of 55.70 (the bottom line of the uplink on the 4-hour chart and EMA50 on the monthly chart).

The immediate goal in case of resumption of growth is level 56.60. The next medium-term target will be the level of resistance at 62.00, near which there are EMA144, EMA200 lines on the monthly chart. But you can talk about this goal only after the price will update the annual maximum near the level of 58.80.

So far, negative dynamics have prevailed. If the price falls below the level of 54.70, inside the downlink on the weekly chart, the lower limit of which passes near the level of 36.05 (the Fibonacci level of 23.6% of the correction to the decline from the level of 65.30 from June 2015 to the absolute minimums of 2016 near the 27.00 mark), increase risks of resuming the downtrend with targets at 51.80 (EMA200 on the daily chart), 50.70 (Fibonacci level 61.8%), 50.00 (lows in August), 48.75, 48.00, 46.20 (Fibonacci 50%), 44.50 (lows of the year), 41.70 (Fibonacci level 38.2%), 36.05 (the bottom line of the descending channel on the weekly chart ).

Support levels: 55.70, 55.00, 54.70, 53.75, 51.80, 50.70, 50.00

Resistance levels: 56.60, 57.50, 58.80

Trading Scenarios

Sell in the market. Stop-Loss 55.85. Take-Profit 55.00, 54.70, 53.75, 51.80, 50.70, 50.00

Buy Stop 55.85. Stop-Loss 55.20. Take-Profit 56.60, 57.50, 58.80, 59.00, 60.00, 62.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com