During today's Asian session, the Japanese broadcaster NHK announced the next launch of the North Korean ballistic missile towards Japan. Investors reacted rather sluggishly to the next launch of the missile. The price of oil in response to this message has slightly decreased. However, in general, quotations were stable, and during the European session, the growth of oil prices resumed.

A sharp increase in oil prices is observed for the second week in a row. The tension between the United States and North Korea has somewhat decreased. Concerns about the effects of hurricanes in the United States and the political contradictions in Washington have also weakened a bit.

American refineries have been restoring their work after the hurricanes, and the demand for oil in the US is gradually recovering.

On Tuesday, its monthly report was released by OPEC. According to this document, the cartel's output in August fell for the first time since April. In addition, OPEC countries adhered to the agreement on oil production reduction more strictly. OPEC and countries outside the cartel are discussing the possibility of extending the agreement after March next year.

The International Energy Agency (IEA) on Wednesday presented a report according to which the world oil supply in August fell for the first time in the last 4 months, by 720,000 barrels per day. At the same time, the IEA raised the forecast for the growth of world oil demand in 2017 to 1.6 million barrels per day. Optimistic forecasts for oil demand in the coming months and data on the fall of world oil reserves contribute to higher oil prices.

Today at 17:00 (GMT) the American oil service company Baker Hughes will publish a weekly report on the number of active drilling platforms in the US. This report is an important indicator of the activity of the oil sector of the US economy and significantly affects the quotes of oil prices. The previous report indicated a reduction in the number of active drilling platforms due to Hurricane Harvey (up to 756 against 759 weeks earlier and 768 two weeks ago). If the number of active drilling rigs decreases again, this will also contribute to the growth of oil quotes.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

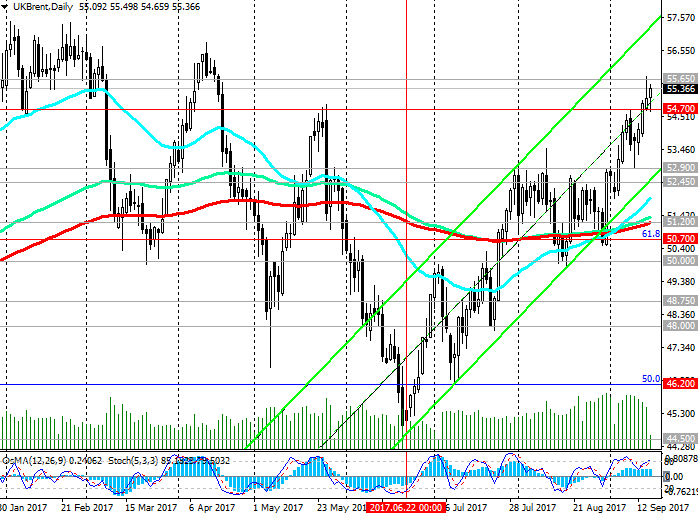

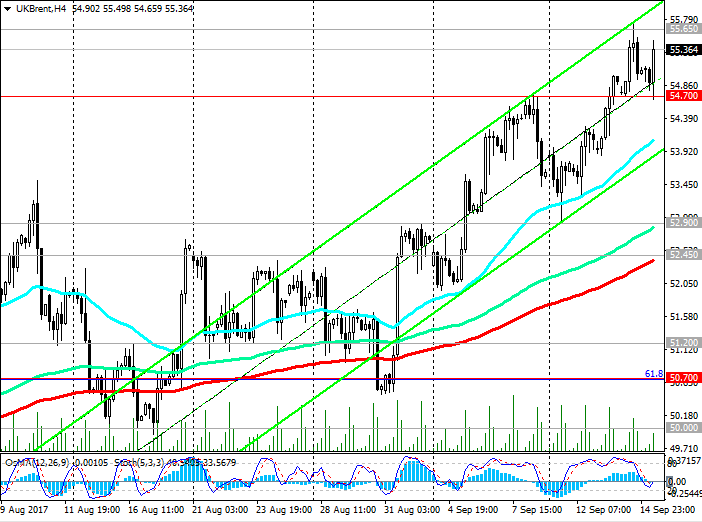

This week, the price of Brent crude oil broke through an important resistance level of 54.70

(EMA200 on the weekly chart) and continues to grow in the upward channel on the daily chart, the upper border of which passes near the mark of 58.45 (highs of 2017).

The fundamental factors speak in favor of maintaining the positive dynamics of oil prices and the likelihood of their further growth.

The breakthrough of resistance level 55.65 (EMA50 on the monthly chart) will create prerequisites for further price growth with the target of 58.45 dollars per barrel of Brent crude oil.

The reduction scenario involves a breakdown of the 54.70 support level and a further price fall with targets at support levels of 52.90 (EMA144 on the 4-hour chart and the bottom line of the uplink on the daily chart), 52.45 (EMA200 on the 4-hour chart).

The breakdown of the support levels 51.20 (EMA200 on the daily chart), 50.70 (EMA50 on the weekly chart, as well as the Fibonacci retracement level of 61.8% of the correction to the decline from the level of 65.30 from June 2015 to the absolute lows of 2016 near the 27.00 mark) will mean a price return to bearish trend, and the decline may extend to the level of support at 50.00 (the lows of August). Further objectives are support levels 48.75, 48.00, 46.20 (50% Fibonacci level), 44.50 (lows of the year). A more distant goal is the level 41.70 (the Fibonacci level of 38.2% and the lower boundary of the descending channel on the weekly chart).

So far, positive dynamics have prevailed.

Support levels: 55.00, 54.70, 53.45, 53.30, 52.90, 52.45, 51.70, 51.20, 50.70, 50.00

Resistance levels: 55.65, 56.50, 56.80, 57.50, 58.45

Trading Scenarios

Sell Stop 54.90. Stop-Loss 55.80. Take-Profit 54.70, 53.45, 53.30, 52.90, 52.45, 51.70, 51.20, 50.70

Buy Stop 55.80. Stop-Loss 54.90. Take-Profit 56.00, 56.50, 56.80, 57.50, 58.45

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com