Daily economic digest from Forex.ee

Stay informed of the key economic events

Tuesday, April 25th

The EUR/USD pair was showing deadly quiet trades within 15-pips narrow range during the Asian session, consolidating Monday’s heavy gains near 1.0870 region. However, the pair broke out of its consolidation corridor in early Europe and now is navigating in north direction, as traders have started to price in E.Macron’s win on upcoming French presidential elections. Meanwhile, currently all investors’ attention shifts toward US president’s tax reform details, that will be announced on Wednesday, however, market’s participants believe that tomorrow’s announcement will once again provide lack of details on US economic taxation program, thereby lending no support to the greenback. Today only data reports from the US economy are scheduled in event calendar of this Tuesday, while nearest crucial events, such as tomorrow’s US president’s speech, Thursday’s ECB policy decision and French elections will continue to keep market cautious in the near future.

The GBP/USD pair extends its consolidation pattern for the fifth consecutive day so far, failing to build any gains on recent UK PM Theresa May's announcement to call for a snap election on June 8th. Moreover, modest optimist around US president D.Trump’s upcoming “historical” tax reforms is also remaining unable to provide the greenback with enough impetus to recover its recent losses. Nevertheless, traders now await for details on US president’s taxation program, that will be announced later this week, and which expectedly will point to further US dollar’s trajectory. With another relatively empty UK docket, today traders will closely watch for US data releases, that will be able to bring some short-term impetus to the pair.

The USD/CAD pair caught some fresh bids this morning, extending its yesterday’s bearish rally and refreshing this year tops at 1.3562. Yesterday the Loonie came under strong selling pressure across the board on news that D.Trump’s administration is planning to impose 20% tariff on soft lumber imports from Canada. Such measures could potentially harm trade relations between North American neighbors. Adding to that, ongoing softness in oil prices is also collaborating with pair’s upside this Tuesday. Now focus shifts toward US fundamentals, featuring CB Consumer Confidence and New Home Sales, that will be able to bring fresh trading opportunities during the NY trading session.

The USD/JPY pair is trading on a firm note after yesterday’s drop, having recovered most part of previous session’s losses. Seems that risk-on rally, triggered by weekend’s French elections, is not over yet, still driving flows away from safe-haven assets, such as the yen. Moreover, ongoing talks around BOJ further easing measures in order to achieve inflation target level at 2% are also adding to yen’s retreat. However, uncertainty over Trump’s tax reforms, about which the US president promised to bring more details later this week, will keep the US dollar unmotivated today, however, Donald Trump’s positive outlook on further political and economic plans will be able to set up further direction for the US dollar. Looking ahead, today the pair most likely will continue to trace global market’s sentiments ahead of US data reports, that will shape up pair’s further directional course in NA session.

The main events of the day:

US CB Consumer Confidence – 17.00 (GMT +3)

US New Home Sales – 17.00 (GMT +3)

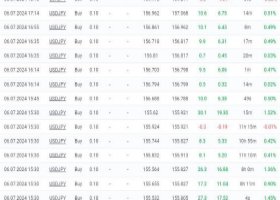

Support and resistance levels for the major currency pairs:

EURUSD S. 1.0780 R. 1.0946

USDJPY S. 109.08 R. 110.92

GBPUSD S. 1.2735 R. 1.2865

USDCHF S. 0.9858 R. 1.0028

AUDUSD S. 0.7517 R. 0.7609

NZDUSD S. 0.6984 R. 0.7066

USDCAD S. 1.3365 R. 1.3587

The best conditions for making a start on STP only at Forex.ee! Register an account now

and feel the difference from the first trade!

Your European ECN-broker,

Forex.ee