Is the Bow About to Break? GBP/JPY at Support Ahead of Super Thursday

Is the Bow About to Break? GBP/JPY at Support Ahead of Super Thursday

Talking Points

- GBP/JPY at support heading into BoE ‘Super Thursday’

- Immediate focus is lower sub 128.18

- Updated targets & invalidation levels

Technical Outlook: GBP/JPY is trading within the confines of a modified ascending pitchfork formation off the October low with the pair testing confluence support today at 126.71- a region defined by the 50% retracement of the late-October rally and the lower parallel. Heading into tomorrow’s highly anticipated Bank of England ‘Super Thursday’ the pair remains at risk while sub-128.18/31 (near-term bearish invalidation).

Subsequent support targets are eyed at 126.41 backed closely by confluence support into 126.12 (area of interest for possible exhaustion). A break below this region risks substantial losses for the pair with such a scenario targeting 125.27 & the 2016 low at 124.79. From a trading standpoint, I would be looking to fade strength while below the median-line / monthly open with a break below the lower parallel needed to keep the short-side focus in play.

Keep in mind the central bank is widely expected to stand pat on monetary policy this month and the focus will be on the quarterly inflation forecast. Market participants are looking for an improved inflationary outlook on account of the sharp repricing seen in the sterling over the past few months and could put a near-term floor on the sterling crosses.

- A summary of the DailyFX Speculative Sentiment Index (SSI) shows traders are net long GBPJPY- the ratio stands at +2.54 (72% of traders are long)- bearish reading

- Long positions are 11.4% above levels seen last week while short positions are 26.3% lower over the same time period.

- Open interest is 1.0% higher than yesterday and 4.6% below its monthly average.

- The current dynamic suggests that the near-term risk remains weighted to the downside heading into tomorrow’s rate decision and we’ll be looking for a further build in long-exposure with a break below near-term support to validate a more significant decline.

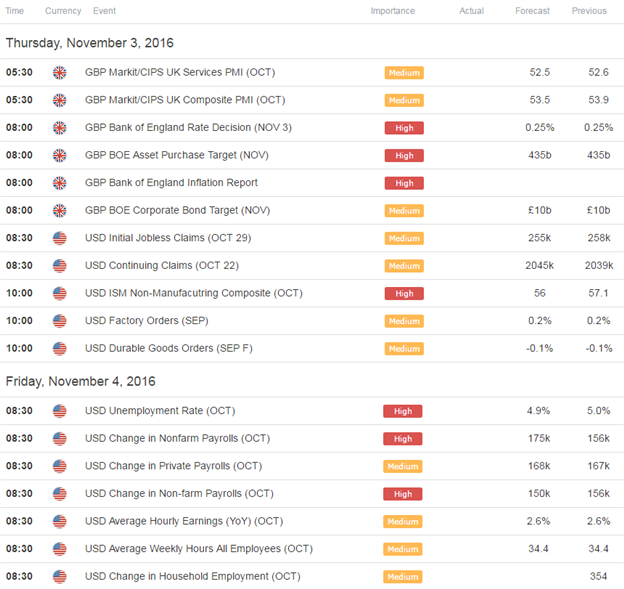

Relevant Data Releases This Week