Dollar Index: End Of Week Technicals - Bullish To Continue or Correction To Be Started?

22 July 2016, 16:55

1

134

This

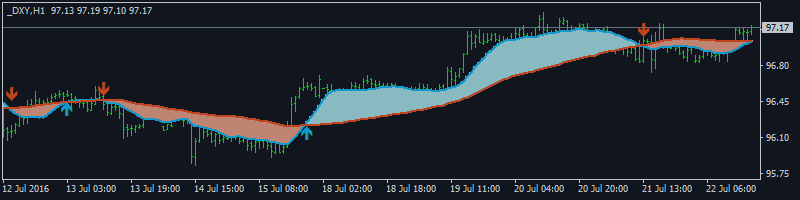

trading week ended with some dilemma: bullish trend to be continuing in

case the price breaks 97.32 resistance level, or the secondary

correction to be started just in case of support level at 96.79 to be

broken to below.

----------

D1 price is on located above Ichimoku cloud for the bullish market condition with the ranging within 97.32/96.79 narrow levels.

H4 price

is on bullish ranging with 97.21 resistance level to be tested for

97.32 level as a nearest target to re-enter. Chinkou Span line of

Ichimoku indicator is located above the price for the bullish trend to

be continuing by the direction. Absolute Strength insdicator is

estimating the possible bullish breakout in the near future.

If H4 price breaks 96.79 support so the bearish reversal may be started with the secondary ranging way.

If not so the price will be ranging within the levels.

| Resistance | Support |

|---|---|

| 97.21 | 96.83 |

| 97.32 | 96.79 |

| N/A | 95.91 |

SUMMARY : bullish