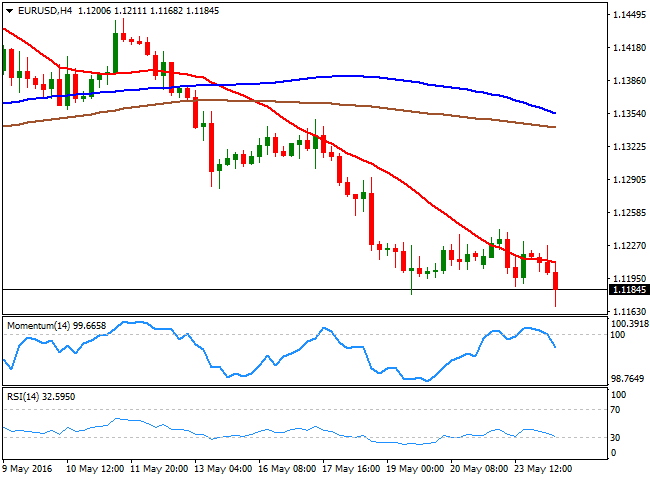

EUR/USD Forecast: Bearish Acceleration, 1.1120 at Sight

After Monday's pause, the greenback resumes its rally, broadly higher against most of its major rivals but the Pound. European equities opened sharply higher, but the EUR/USD pair fell to a fresh two-month low of 1.1168.

In the data front, Germany released its final Q1 GDP figures, with no changes from the previous reading and therefore doing little for the common currency. The ZEW survey, on the other hand, came in mixed, as economic sentiment declined in Germany in May, printing 6.4 against the 12 expected and the 11.2 previous. The assessment of the current situation, however, improved, reaching 53.1 against the 47.9 expected. For the EU, economic sentiment fell to 16.8 from previous 21.5, missing expectations of 23.4.

The US will release some housing data later on en the day, which if it is positive, should see the pair extending its decline down to 1.1120.

Technically, the 4 hours chart shows that the price bounced modestly from the mentioned low, but also that it remains capped by a bearish 20 SMA. In the same chart, the technical indicators have turned south from around their mid-lines, with the RSI heading south around 33, all of which favors additional slides on a break below 1.1160, the immediate support.

Approaches to the 1.1210 region could see selling interest resuming, although some gains beyond it could see the pair recovering up to the 1.1240/50 region.