Macro Events & News

FX News Today

European Outlook:

Risk aversion is picking up, with stock markets continuing to head

south in Asia, oil prices down and save haven assets rising. The EUR is

little changed against the dollar. However, European bond futures failed

to get support from rising risk aversion and a broad decline in stock

markets yesterday so weak leads won’t necessarily translate into a drop

in yields early in the session, especially if German data at the start

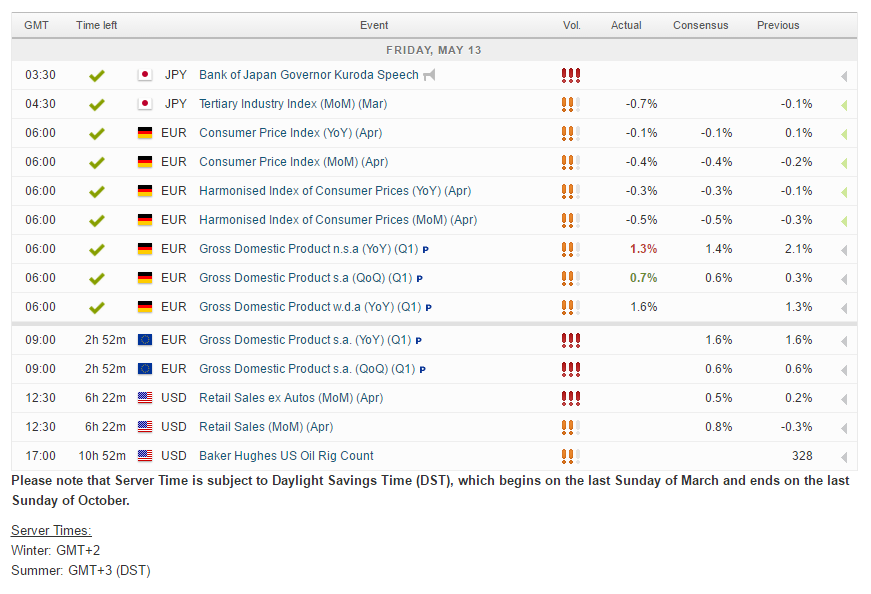

is hawkish. The data calendar is very busy see below for German figures

on GDP and CPI. Italy also has preliminary Q1 GDP and there are final

inflation numbers from Spain and Italy as well as French payrolls data.

German GDP and CPI:

The German economy gained pace at the start of this year. In the first

quarter of 2016, the gross domestic product (GDP) rose 0.7% on the

fourth quarter of 2015 after adjustment for price, seasonal and calendar

variations. GDP numbers are stronger than expected, the strong

expansion is unlikely to be sustained in the second quarter and the

risks to the medium term outlook remain tilted to the downside. Still,

for now the numbers back the ECB’s wait and see stance. Consumer prices

in Germany fell by 0.1% in April 2016 compared with April 2015. The

inflation rate – measured by the consumer price index – thus decreased,

following a slight increase in the previous month. A negative rate had

last been recorded in January 2015 (–0.3%). Compared with March 2016,

the consumer price index fell by 0.4% in April.

BoE Warns Brexit would Lower Growth and Lift Inflation:

The BoE once again voted unanimously to keep rates on hold today, as

widely expected. The uncertainty ahead of the Brexit referendum on June

23 is now clearly having an impact and the inflation report lowered the

expected growth trajectory even though it is based on the assumption

that the U.K. will remain in the EU. At the same time the MPC stated

very clearly that a a vote to leave the EU would lead to lower growth

and higher inflation. The implication for the monetary policy outlook in

such a scenario may be ambiguous, but the comments very clearly provide

further ammunition to the “remain” camp in the run-up to the

referendum.

Fedspeak: George (known hawk) said

rates are too low for current conditions, in her speech on “Longer-Term

Labor Market Trends, the Economic Outlook and Monetary Policy.” Boston

Fed’s Rosengren warned risk of a hike is bigger than markets think.

Cleveland Fed’s Mester (hawk): risks around Fed forecasts shouldn’t

paralyze policymakers, and oil prices and the dollar have partly

stabilized recently.

Main Macro Events Today

US Retail Sales:

April retail sales are out on later today and should reveal a 0.6%

(median 0.8%) headline with the ex-autos figure up 0.4% (median 0.4%)

for the month. This follows March figures which had retail sales down

0.3% and ex-autos up 0.2%. The outlook for the release looks promising

as vehicle sales rebounded to a 17.3 mln clip for the month alongside

continued strength in construction employment which could help lift

building material sales.

US PPI: April PPI is

out today and should reveal a 0.4% (median 0.3%) headline with a 0.1%

(median 0.1%) core increase for the month. The March headline was -0.1%

as was the core and inflation measures had been struggling to post gains

alongside the renewed downturn in oil prices that we saw over the

winter. Oil prices remain depressed but there was some rebound in April

which could help lift the PPI.

![]()