Analytical Review of the Stocks of Johnson & Johnson

Johnson & Johnson, #JNJ [NYSE]

Health care, Production of drugs, USA

Financial performance of the company:

Index – DJIA, S&P 500;

Beta – 0.63;

Capitalization – 287.98 В;

Return on asset – 11.70%;

Income - 15.41 B;

Average volume – 9.22 М;

P/E - 18.99;

ATR – 1.81.

Analytical review:

- The company ranks the first on capitalization in the sector of “Health care” among the issuers traded in the American stock market.

- Yesterday, the company presented a report for Q1 of the fiscal year 2016, which showed that company’s stocks has grown by 1.6%.

- According to press-release company’s revenue has grown by 0.6% to 17.48 billion USD against market expectations of 60 million USD. Net profit of the company in the reporting period was 4.29 billion against 4.32 billion USD a year earlier. EPS reached at the level of 1.68 USD, пexceeding analysts’ expectations of 1.65 USD.

- At the press-conference company’s management stated that positive results achieved by the company, were attributed to the cost reducing program and the increase in sales.

- Sales have increased by 5.9% to 8.2 billion USD due to the increase in demand for cancer drugs Imbruvica and diabetes medicine Invokana. Sales of medical equipment rose by 2.4% to 6.1 billion USD.

The company has presented revised forecast for the fiscal year 2016. It is expected that the volume of sales will increase to 71.2-71.9 billion USD against expectations in January at the level of 70.8-71.5 billion USD. The rise in profit can go up to 6.53-6.58 USD per share against earlier expected level of 6.43-6.58 USD per share.

Summary:

- Last company’s report has increase investors’ trust to the company. Despite pressure from the strong USD company’s sales have grown above market expectations. Johnson&Johnson has strong growth potential. Revised forecast for the current fiscal year will trigger the rise in price of the company’s stocks.

- It is likely that in the near future company’s quotes will go up.

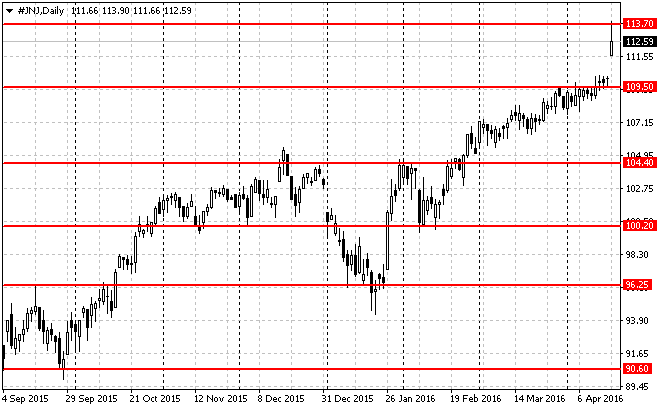

Trading tips for CFD of Johnson & Johnson

Long-term trading: the issuer has broken out and consolidated above the resistance level of 109.50 USD. If the price maintains and tests the mirrored support level and in case of the respective confirmation (such as pattern Price Action), we recommend to open long positions. Risk per trade is not more than 2% of the capital. Stop order can be placed slightly below the signal line. Take profit can be placed in parts at the levels of 114.00 USD, 116.50 USD and 119.00 USD with the use of trailing stop.

Short-term trading: The release of the company’s report for Q1 of the fiscal year 2016, caused gap up in the market. During yesterday’s trading session the price of Johnson&Johnson shares has grown by 1.5%. on the chart with the timeframe 15M the issuer at the local support level of 112.30 USD. If the price maintains and tests this level it is advisable to open long positions. Risk per trade is not more than 3% of the capital. Stop order can be placed slightly below the signal line. Take profit can be placed in parts at the levels of 113.70 USD, 114.20 USD and 114.50 USD with the use of trailing stop.