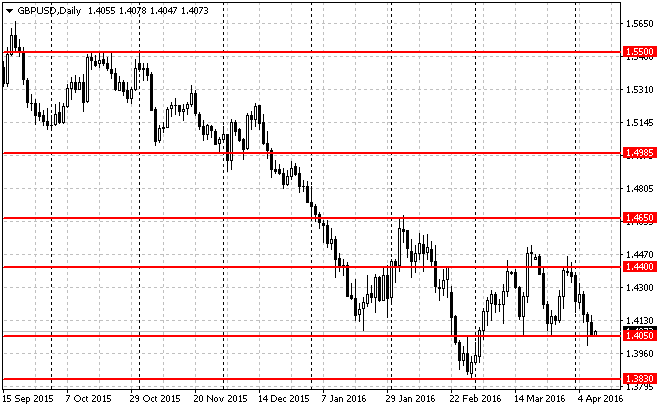

Analytical Review of the Currency Pair GBP/USD

Technical data of the currency pair:

Previous closing: 1.4057;

Daily range: 1.4049-1.4080;

Opening: 1.4057;

52- week range: 1.3833-1.5930;

Annual revenue: -5.43%;

Change in % for the previous day: -0.45.

Analytical review:

- Since the beginning of April the pound has significantly weakened against the USD (over 250 points). During yesterday’s trading session the GBP fell by 0.45%.

- Management of the ECB has announced that the bank is ready to introduce additional incentive measures if needed.

- Yesterday, important US economic statistics was released, which showed that the number of initial applications for unemployment benefits fell over a week by 3.2% to 267000 against the forecast of 270000.

- “Commitments of Traders” shows the increase in the number of long positions by 3157, up to 52161 contracts. The number of contracts for the short positions amounted to 143001.

- The data on the volume of production in the UK manufacturing sector will become known today.

Summary:

- The decrease in market sentiments in the EU and increased volatility in the financial markets put pressure on the GBP. Demand for the USD is supported by the positive data on the number of applications for unemployment benefits in the USA. According to “COT” large investors have increased the number of long positions.

- Market movement is mixed. We recommend to enter the market from the key support and resistance levels.

Trading tips for the currency pair GBP/USD

Long-term trading: at the moment the issuer is traded near support level of 1.4050. After breaking out and testing of this level and in case of the respective confirmation (such as pattern Price Action), we recommend to open short positions. Risk per trade is not more than 2% of the capital. Stop order can be placed slightly above the signal line. Take profit can be placed in parts at the levels of 1.3850, 1.3725 and 1.3600 with the use of trailing stop.

Short-term trading: on the chart with the timeframe 15M the currency is traded in the range of 1.4050-1.4110. It is recommended to open positions near the signal line and the nearest support/resistance levels. Risk per trade is not more than 3% of capital. Stop order can be placed slightly above/ below the signal line. Take profit can be placed in parts of 50%, 30% and 20% with the use of trailing stop.

The material has been provided by LiteForex - Finance Services Company - www.liteforex.com