Takeaways From This Week's COT Report: USD Bulls Continue To Pull In Their Horns -Scotiabank

Data in this report cover up to Tuesday March 29 & were released Friday April 1.

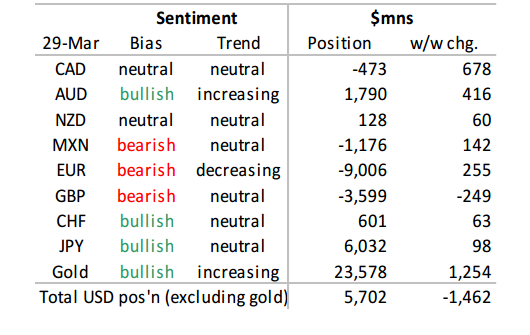

The latest snapshot of positioning in the speculative FX community via the CFTC data for the week through March 29th shows theaggregate bull bet on the USD dropping for a fifth consecutive week (to its smallest since 2014). Comments from Fed Chair Yellen Tuesday may have contributed to the continued reduction in bullish USD positioning this week.

The rally in the CAD since the January low continues to force repositioning among investors. Accounts boosted gross CAD longs modestly and slashed gross CAD shorts to more than halve the net bet against the CAD back to USD678mn this week. The fact that there is still a modest outstanding short position in the market after a near 10 cent (US) rally in the CAD suggests that position adjustment may provide some further lift for the CAD.

EUR short-covering is slowly but surely chipping away at what has been a popular and core position for speculative accounts in recent times. The net short EUR position fell more than 2k contracts this week to 63k contracts—down from a net short of 226k contracts a year ago.

Net GBP shorts were lifted by nearly USD250mn in the week to USD3.6bn. Net GBP shorts are nearing recent peaks (around -40K contracts) but net positioning has extended well beyond these levels in recent years (peaking around –78k net in 2013). There is room for the GBP short bet to grow.

Elsewhere, the market added to net long bets on the AUD and (very modestly) to net JPY longs

Copy signals, Trade and Earn $ on Forex4you - https://www.share4you.com/en/?affid=0fd9105