Daily Analysis of Major Pairs for March 18, 2016

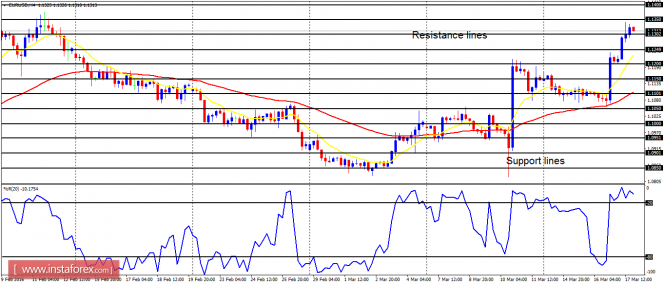

EUR/USD: The EUR/USD pair broke upwards on Wednesday, ending the short-term consolidation phase in the market. The price moved further upwards on Thursday – making it a movement of at least 260 pips within two days. There is now a clean Bullish Confirmation Pattern on the chart, and the price is supposed to continue moving upwards.

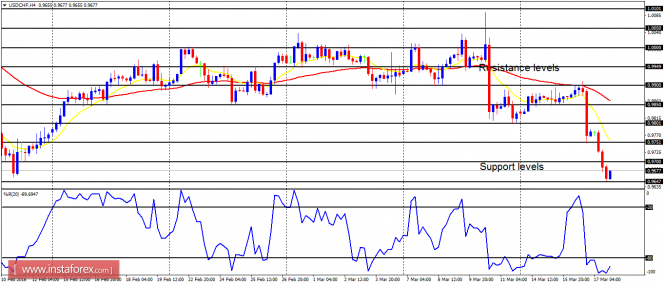

USD/CHF: The USD/CHF pair broke further downwards yesterday: plus the price has moved below our target for this week. There is now a bearish bias in the market. The EMA 11 is below the EMA 56 while the Williams' % Range period 20 is in the oversold region. Long trades are not logical on the USD/CHF. Go short.

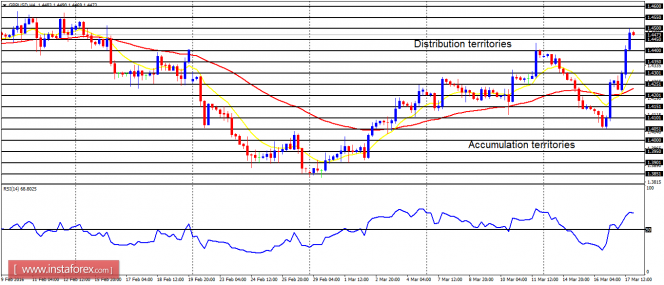

GBP/USD: Since almost testing the accumulation territory at 1.4050, the Cable has gone up by 430 pips. This massive northward movement has brought back the bullish outlook that was seen in the market last week. It is highly probable that the price would continue moving upwards, reaching the distribution territories at 1.4550 and 1.4600 (though there would be possibilities of pullbacks along the way).

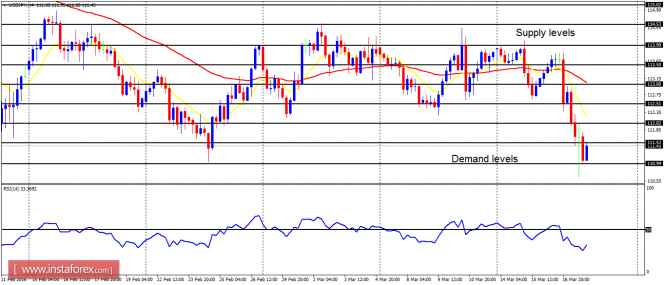

USD/JPY: This pair broke south on March 16, 2016. On Thursday, the price moved further southward; seriously this time around. Altogether, there has been a drop of about 300 pips this week, and irrespective of any upwards bounces we may see, further bearish movement is expected.

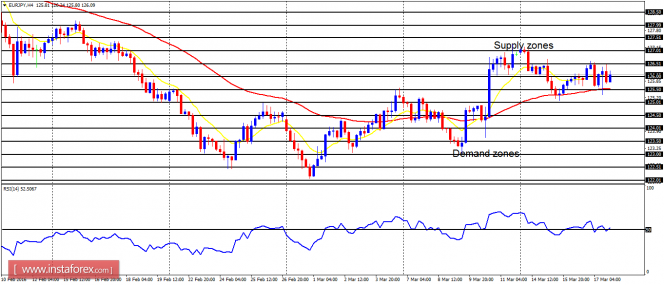

EUR/JPY: This cross pair simply consolidated on Thursday (unlike its USD/JPY counterpart), now above the demand zone at 126.00. There is a clear bullish signal here because the EMA 11 is above the EMA 56 and the RSI period 14 is above the level 50. The price might now target the supply zones at 127.00 and 127.50.

The material has been provided by InstaForex Company - www.instaforex.com