USD/CHF: Rebound after testing short term descending channel - SocGen

16 February 2016, 13:51

0

43

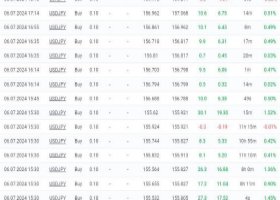

Research Team at Societe Generale, suggests that USD/CHF hit a multiyear upward channel limit near 1.0330 last year and since then it is evolving within a choppy retracement.

Key Quotes

“Last week the pair has retested the upper limit of a formation similar to a triangle at 0.9750/0.97. Weekly RSI still shows some room for downside before it achieves a support trend suggesting possibility of continuation in retracement in medium term. However, graphical levels at 0.95 will remain an important support and will decide if a larger down move takes shape.

After breaking above multi month triangle USD/CHF found stiff resistance near last year highs of 1.0330. Since then it is undergoing a retracement and has achieved the triangle limit at 0.9750/0.97, also 50% retracement since last May. Multi month ascending trend at 0.95 will decide if a larger downtrend takes shape.

If we drop down to daily chart, the pair probed the lower limit of a descending channel last week at 0.9750/0.97 where it also met a projection for the ongoing correction and has formed a daily bullish engulfing. Daily stochastic indicator is near a floor suggesting 0.9750/0.97 as immediate support. A recovery looks likely in very short term. 0.9820 is an immediate hurdle while 1.00, the 50% retracement since November should cap the pullback.”