EUR/USD: the main scenarios for the ECB meeting this week and what to expect

30 November 2015, 10:32

0

1 949

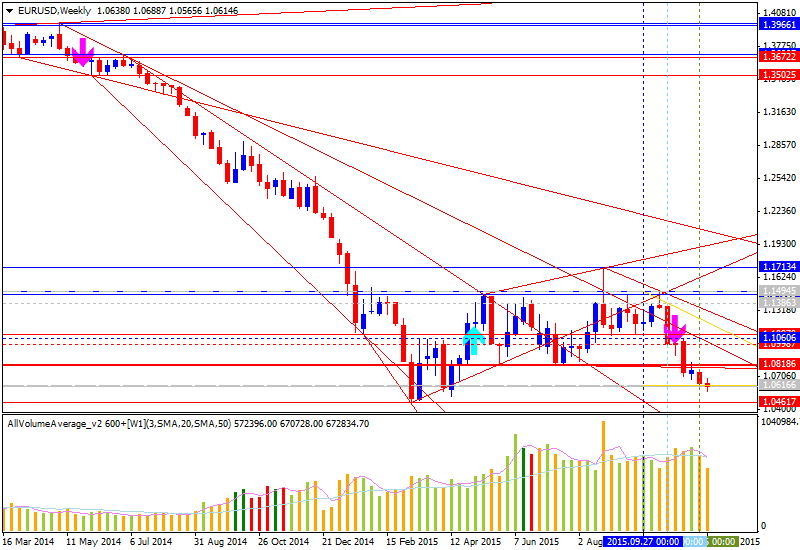

UOB Group estimated 3 main scenarios for European Central Bank meeting this week and made some forecast related to the EUR/USD price movement:

- The 'Mild' Easing Approach. QE Program: additional increase >10bn, 3-9 months.

The price will not break key support level at 1.04 by the end of the year - we may see the ranging within 1.05/1.09. - The 'Moderate' Easing Approach. QE Program: additional increase 10bn, 12 months.

The price will break 1.0461 support level from above to below but 1.0000 is not expected to be broken in the near future. - The 'Aggressive' Easing Approach. QE Program: additional increase 5-10bn, open-ended.

The price will likely to break 1.0461 support to below within 2 weeks, and 1.0000 will be the next real target in Q1'2016.

Some analytics stated that the most likely scenario is 'mild' approach and because of that - the EUR/USD will be ranging within 1.05/1.09 levels, and 1.0461 key support level will not be broken in this year for example.