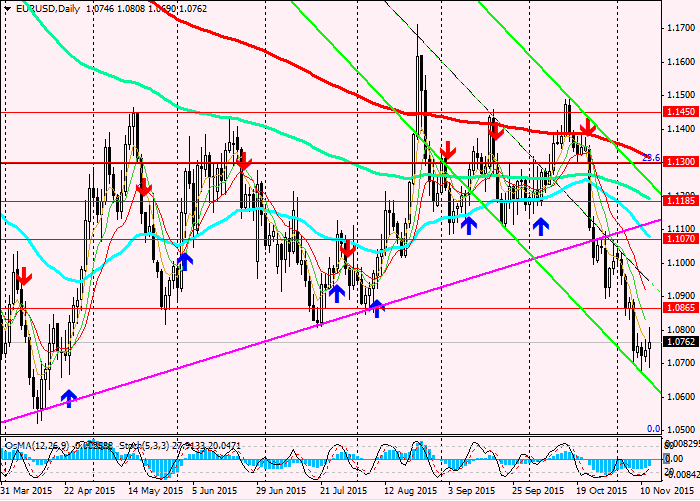

EUR / USD: the day was filled with presentations by central banks

Trading recommendations and Technical Analysis – HERE!

Speaking at a conference of the Fed, Janet Yellen did not comment on the prospects for the economy or monetary policy in his welcoming speech. However, trading on the US stock market started down. Released in early US trading session data on the number of initial claims for unemployment benefits in the United States remained unchanged in the first week of November (276 000 applications vs. 270,000).

Earlier in the morning the head of the ECB Mario Draghi spoke in favor of expanding the asset purchase program, saying that the ECB reconsider its monetary policy meeting in December. Although Mario Draghi did not say anything new, his words confirmed market expectations that the ECB may, in December announced the expansion of the program QE, which will certainly create pressure on the pair EUR / USD, and so have dropped significantly since last May. Recall also that the speech before the US Congress last week, Janet Yellen reiterated that a rate hike in December, "is indeed possible."

If

monetary policy in the euro area will indeed be reduced, and the Fed will not

retreat from its intention to raise interest rates in December, the pair EUR /

USD will continue to decline toward euro parity against the US dollar. And then

the forecasts of economists expecting the pair to the end of the year near the

1.0500 mark, can take place.

See also review and trading recommendations for the pair USD/JPY!