______________________________________

Last 12 months currency classification

The last 12 months currency classification from a longer term perspective are provided for reference purposes. See for more information the article: Monthly Currency Score for October where the charts are available. There are no changes since June and the currencies are classified for the coming months as follows:

- Strong: CHF / GBP / USD. The preferred range is from 6 to 8.

- Average: EUR / JPY. The preferred range is from 4 to 5.

- Weak: AUD / CAD / NZD. The preferred range is from 1 to 3.

______________________________________

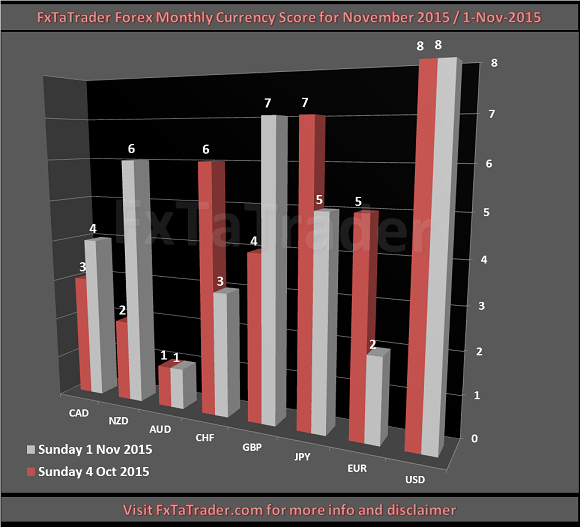

Currency Score for November 2015

For analyzing the best pairs to trade the last 3 months currency classification is the first issue. When looking at the most recent score that is used for the coming period we can see in the screenshot below the deviations and we can come to certain conclusions. These are explained below the screenshot.

______________________________________

In essence it comes down to the 3 following lines of text:

- A strong currency can be traded long against all the other currencies except on a pullback(deviation) then it seems best to trade it only against a weak currency.

- A weak currency can be traded short against all the other currencies except on a pullback(deviation) then it seems best to trade it only against a strong currency.

- When an average currency is outside the range(deviation) it is best not to trade it against it's own currncies in the average range and the currencies in the range it is at.

Strong currencies

There is a deviation for the CHF with a score of 3. This is a strong currency and it should have by preference a score from 6 to 8.

- There is a decrease of momentum for the CHF which is getting weaker.

- The CHF has a score at the moment of a weak currency and it seems best for trading, depending on the opportunities coming around, going long against the weak currencies.

- going long against the average currencies

- going long against the weak currencies

Average currencies

There is a deviation for the EUR with a score of 2. This is an average currency and it should have by preference a score from 4 to 5.

- There is a decrease of momentum for the EUR which is getting weaker.

- The EUR has a score at the moment of a weak currency and it seems best to for trading, depending on the opportunities coming around, going short against the strong currencies.

- going short against the strong currencies

- going long against the weak currencies

Weak currencies

There is a deviation for the NZD with a score of 6. This is a weak currency and it should have by preference a score from 1 to 3.

- There is a decrease of downward momentum for the NZD which is getting stronger.

- The NZD has a score at the moment of a strong currency and it seems best for trading, depending on the opportunities coming around, going short against the strong currencies.

- There is a decrease of downward momentum for the CAD which is getting stronger.

- The CAD has a score at the moment of an average currency and it seems best for trading, depending on the opportunities coming around, going short against the strong currencies.

- going short against the strong currencies

- going short against the average currencies

Summary:

- The weak currencies against the EUR are most probably ranging and there are most probably no opportunities in the Top 10 of this month "Ranking and Rating list".

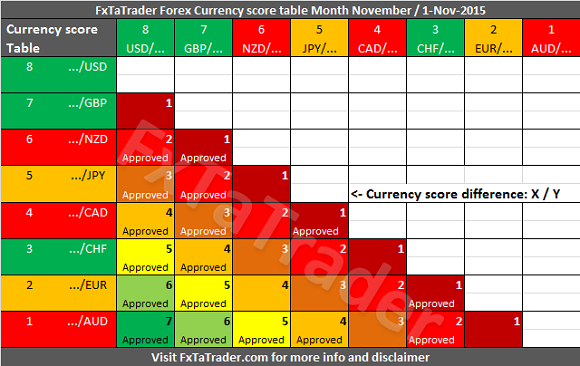

- The CHF, NZD and CAD may offer a good opportunity to step in. However, it is important to determine if the specific pair is indeed having a pullback. For that reason it is good to see the momentum returning in that pair, check the "Ranking and Rating list". If there is momentum then check also the"Currency score difference" table.

- All the other pairs may be in a trend when complying to the "Currency score difference" table which can be seen here below. There are most probably opportunities in the Top 10 of this week "Ranking and Rating list".

- By using the (1)"Ranking and Rating list" with the (2)above Monthly Currency Score analysis and the (3)"Currency score difference" table with the (4)Bollinger Band analysis provided here below a good foundation is provided for looking at the Monthly and Weekly Technical analysis chart of a specific pair.

______________________________________

Currency Score difference for November 2015

- GBP/AUD with the EUR/GBP

- AUD/USD with the EUR/GBP

- EUR/USD with the GBP/AUD

______________________________________

- The GBP/AUD is in an uptrend and at the Bollinger Band.

- The EUR/GBP is in a downtrend and at the Bollinger Band.

- The AUD/USD is in a downtrend and within the Bollinger Band.

- The EUR/USD is in a downtrend and within the Bollinger Band.

______________________________________

When trading according to the FxTaTrader Strategy some

rules are in

place. For more information

see the page on my blog FxTaTrader Strategy.

Depending on the opportunities that may

come up the decision to trade a

currency may become more obvious at that moment. If you would like to use this article then mention the source

by

providing the URL FxTaTrader.com

or the direct link to this article. Good luck in the coming month.

______________________________________