Analysts at one of Italy's leading research house have lowered their expection for the Euro and projections for Dollar and British Pound in the wake of news the ECB and U.S. FED are ready to act once more.

The three month outlook for the pound v dollar exchange rate has meanwhile been raised.

The ECB has been preparing for the possibility that more stimulus will be needed to reach its medium-term inflation target of near 2%.

Monetary stimulus inevitably results in a weaker currency. The opposite is true when monetary tightening is deployed, most typically through the raising of interest rates.

This is exactly what could happen in the United States in December. At the October FOMC meeting it was indicated that December could be the month that the first interest rate is delivered.

The Bank of England is widely tipped to follow the lead of the US Fed and exert upside pressure on the pound sterling.

So we have two banks moving in opposite directions creating downside pressure on the euro.

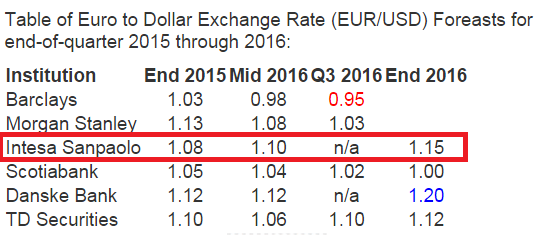

Adjusted Euro to Dollar Forecasts

On the outcome of the FOMC the euro corrected by a full 200 pips, hitting a low of EUR/USD 1.0897.

“With the ECB’s new stance a week ago, and the Fed’s last night, the divergence between the two central banks has further widened. Therefore, we have revised downwards our forecasts for the exchange rate,” says Asmara Jamaleh at Intesa Sanpaolo.

In the one month time frame the forecast for EURUSD is shifted from 1.10 to 1.08, staying at 1.04 in the 3 month frame, from 1.12 to 1.10 in the 6 month frame and 1.15 to 1.13 in the 12 month.

Intesa Sanpaolo therefore stand with that group of forecasters that see the euro trading above 1.10 in a years time, as opposed to the camp that are pricing in parity.

The reason for the euro’s expected resilience lies with the expected pace of Federal Reserve cuts, after making its move in December the central bank could proceed at a more gradual pace in hiking rates over the following months.

“Also, a more timely reversal by the Fed could reduce the size of any potential accommodation implemented by the ECB. Downward risks prevail in any case, and downside potential stretches towards parity,” says Jamaleh.

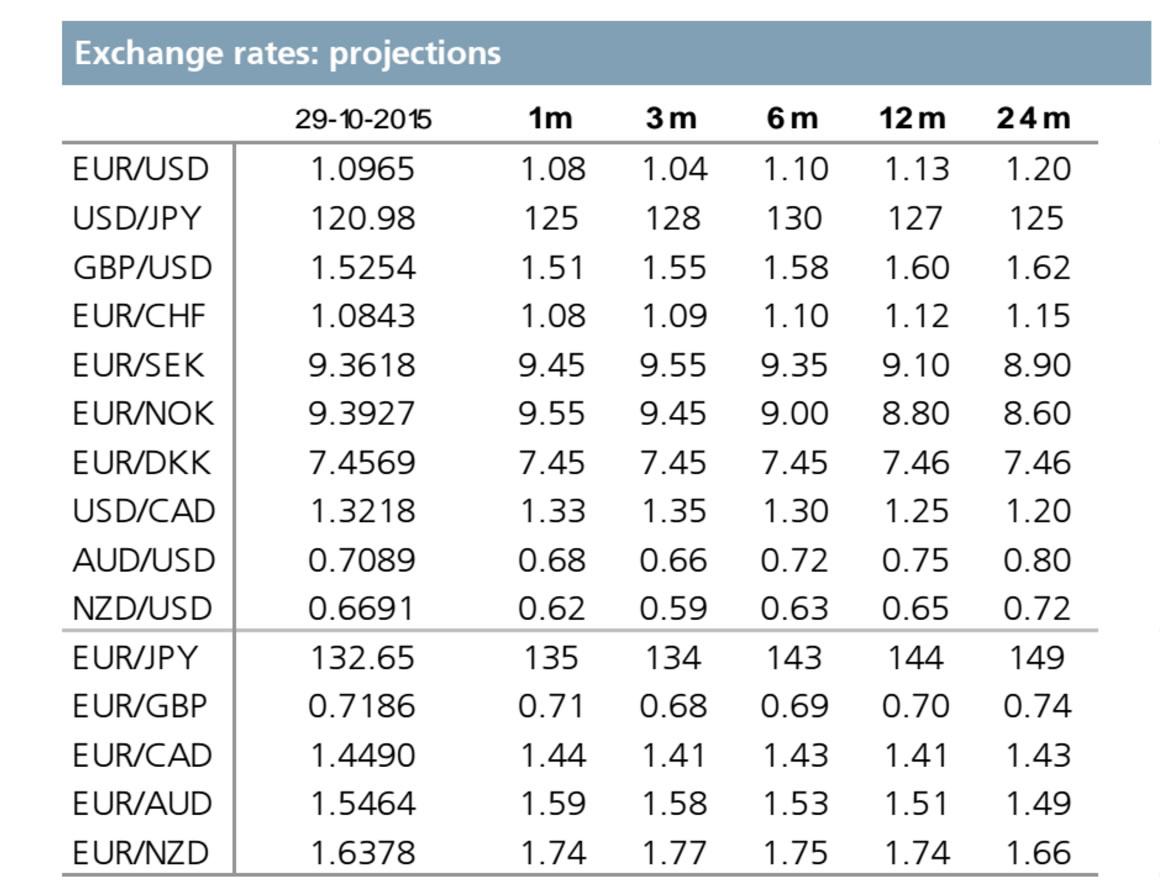

Adjusted Pound to Dollar Forecasts

Sterling also dropped on the outcome of the FOMC, but markedly less than the euro, against which it appreciated significantly from EUR/GBP 0.7240 to 0.7140.

Against the dollar, the retreat was modest, from GBP/USD 1.53 to 1.52, "which may be explained by the prospect that the sooner the Fed makes its move, the sooner the BoE will be able to do likewise," says Jamaleh.

In the meantime, however, Intesa Sanpaolo have revised downwards their 1m projection from GBP/USD 1.55 to 1.51 on the increased probability of the Fed hiking rates in December.

The 3m projection is meanwhile lifted upwards, from GBP/USD 1.52 to 1.55, in the assumption that the BoE will follow suit around one quarter later.

“However, on this point light will be shed by the next BoE meeting on 5 November, when the Inflation Report will be published, containing updated inflation and growth forecasts,” says Jamaleh.

The likely downward revision of inflation implies moderate downside risks to the pound warns the Milanese bank.

Image courtesy of Intesa Sanpaolo.

Image courtesy of Intesa Sanpaolo.