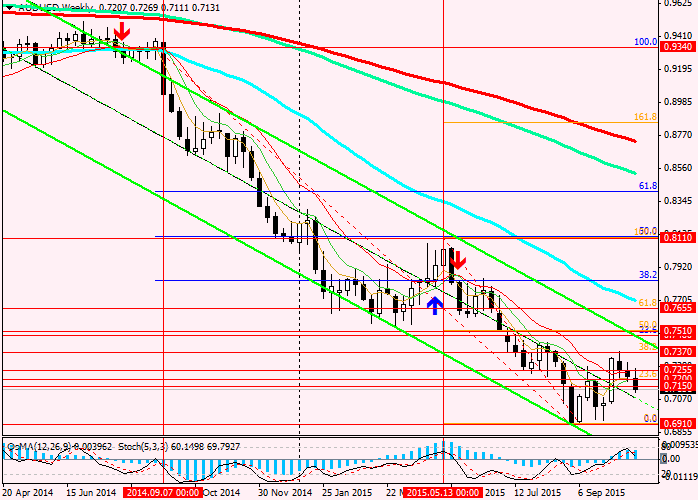

AUD/USD: the pair further decrease more likely. Trading recommendations

Trading recommendations and Technical Analysis – HERE!

Against the background of weak activity in the financial markets on Wednesday in anticipation of the Fed's decision on interest rates, the pair AUD / USD, however, declined sharply in the Asian session. At the time of release of data on inflation in Australia for Q3 03:30 (GMT + 3) with AUD / USD lost an hour more than 70 points when the average daily volatility over the last 3 months 96 points. On the weak inflation data the Australian dollar fell 0.9% against the US dollar. In Q3, inflation in Australia rose 0.3% in the previous period with the forecast of 0.5%. The consumer price index (CPI) in Australia in Q3 rose by 1.5% year on year (forecast 1.8%) and 0.5% to the 2nd quarter (forecast 0.7%). Weak inflation data suggest that the RBA will reduce the interest rate in Australia at its next meeting on November 3. Despite the relatively strong decline in the Australian dollar against the US dollar for the year (1,700 points or 20%), slowing inflation says about the weakness of the economy. Nearly zero inflation and consumer prices suggests slow growth in wages and reduction of investments.

On the other hand the rising cost of housing and mortgage loans creates risks for the country's banking system that kept the RBA from lowering rates. However, the central bank appeared to maneuver, since last week a number of large commercial banks raised rates on mortgage loans.

If export-oriented economy of Australia, the mining sector is one of the key values to replenish the country's budget. The decline in global commodity prices, the decline of the Chinese imports from Australia amid slowing Chinese economy reduces the supply of export earnings, putting pressure on the country's budget.

If the Fed will postpone raising interest rates in the

US, Australia, Belarus will have to revisit the issue of reduction of interest

rates in Australia to support the economy, as well as the formation of the

state budget at the expense of cheaper local currency in the next meeting on

November 3.

See also review and trading recommendations for the pair EUR / GBP