Investors are persistent in getting the Fed's intentions wrong - Deutsche Bank

Market players have pushed back expectations of a rate increase since the Fed's Sept.17 meeting, with many traders anticipating the hike as soon as March 2016. But if history is any guide, investors have been getting the Fed's intentions wrong, says Deutsche Bank.

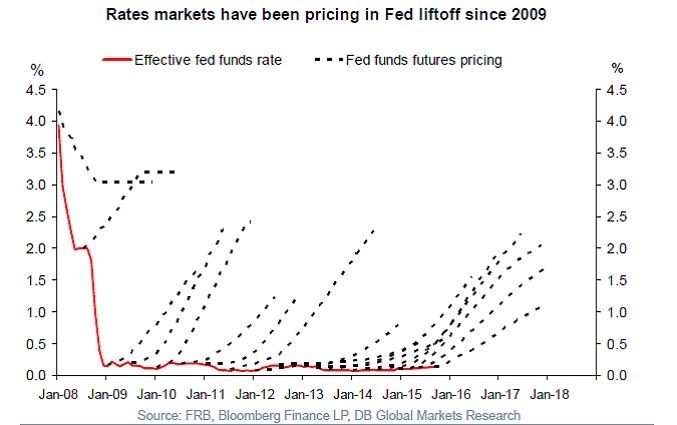

Since 2009, the market has kept overestimating the Fed’s intentions, being trapped in continuous cycles of awaiting a rate rise and readjusting as the Fed subsequently stayed put, said Torsten Slok, chief international economist at Deutsche Bank.

Fed-funds futures have been predicting a Fed increase for the past six years - and have been getting it wrong every time.

The dotted

lines in the following chart are the projected Fed-funds rate, based on Fed-funds futures

prices. The red line shows the actual Fed-funds rate.

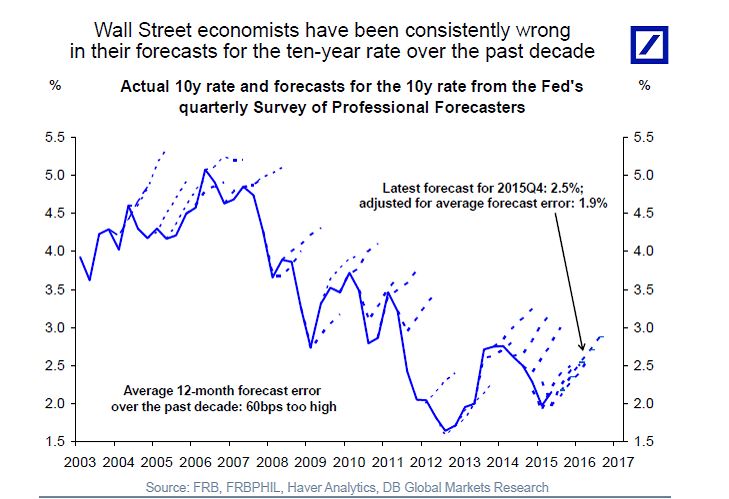

Wall Street analysts' forecasts on the benchmark 10-year rate have also been too upbeat for a very long time, the Deutsche Bank report showed.

As the following chart

shows, for more than ten years, projections for the 10-year rate from the Fed’s quarterly poll of

professional forecasters came in consistently about 60 basis points

higher than the actual 10-year yield.

At the moment, the Philadelphia Fed poll projects a 2.5% yield by the end of 2015, according to the report, - about 46 basis points above the current 10-year yield. On Monday it stayed around 2.037%, according to Tradeweb.

Making

a precise prediction about future interest rates might become even

more difficult since Fed officials, trying to be transparent, freely express their opinions, sometimes conflicting with each other. This in turn confuses the market.

“The data remain uneven and inconsistent, so you can see an argument to support both sides. Fed officials’ conflicting views just cause more volatility,” said Michael Arone, chief investment strategist at State Street Global Advisors.