Forex Basics

What is Forex?

Forex is short for “foreign exchange”, and is also known as “currency exchange”, “currency trading”, “forex trading” and, for short, “fx”.

Generally speaking, forex trading is a speculative form of trading where traders look to get “long” or “buy” a currency pair (if they expect the exchange rate to go up), or to get “short” or “sell” a currency pair (if they expect the exchange rate to go down). These are the basics.

Is Trading Forex Risky?

Yes, and you need to understand what those risks are before you even get started. Like any form of trading, forex is as risky as you make it. For example, you can trade a free demo account to “get your feet wet” which carries no risk except time. Too often, though, new traders start off trading with a very high amount of leverage, trade with real money right away, and very quickly wipe out their equity before they have any clue what they are doing.

What is “leverage”?

Leverage is the amount of borrowed capitol that your broker lends you for each trade. In Forex trading the exchange rate changes are so small, for example the EURUSD might move from 1.3010 to 1.3015. That is a change of 0.005 or 5 pips. Without leverage then that difference is less than half a cent – hardly a big win or loss. With leverage that 0.005 exchange rate change can be turned into 5 cents, 50 cents, 5 dollars, 50 dollars, depending on the amount of leverage you use.

How much leverage should I use?

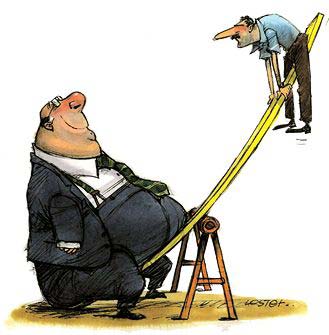

If you are asking this question then the answer is “none” – you should be trading on a demo account where you can’t hurt yourself or your equity. In general, the more leverage you use the riskier your trades are as you stand to lose more.

New traders who want to “get rich quick” often start with way too much leverage and get poor even quicker.

Ok, I understand trading forex is risky. How do I get started?

You should get started with a demo account first. On a demo account you can get the feel for buying and selling currencies without actually risking any of your hard-earned money. To find a demo account you need to find a broker.

What is a broker?

A broker is the middle-man between you and the banks that you are buying and selling the currencies from. The broker is also who provides your leverage, so choosing a reputable broker who you can trust is important.

We don’t have any connections with brokers, but in general a broker that is heavily regulated (US or UK based-brokers are generally heavily regulated) is your best bet as they are required to adhere to certain transparency rules and to have certain levels of cash reserves. Also a broker with a “no trading desk” policy is favored by us so that we have a reasonable amount of confidence that our broker isn’t actively trading against us.

How do I find a broker?

Head to Google and start doing your research. Make sure to read the actual broker’s site and to check their regulatory status – don’t just trust some random third party site to do your broker research for you. There are too many websites out there that just recommend brokers based on how much that particular broker is paying them to recommend them, if that makes sense.

Also make sure to use the demo accounts for several brokers to see which trading platform you like the best.

You can Try for Demo trading Click here

What is a “trading platform”?

A trading platform is the software that you use to do the actual buying and selling of the currencies. If you think about buying a new car, then the trading platform would be the actual car you are buying, the dealership where you bought the car is the broker and the manufacturer of the car would be the banks.

To find out which trading platform you like the best just get a demo account for each one. A broker that doesn’t offer you a demo account is probably not that great of a broker, as a blanket rule. Common trading platforms are Trading Station, MetaTrader, and Ninja Trader but there are a lot more than just those three. Again, do your homework and decide for yourself.

Also, just like buying a new car, in every step of that process there is a markup along the way for each middle man. In forex, the markup is called the “spread” or the “commission”. Spreads can range from a few pips for the major pairs (where beginners should be starting) to a lot larger spreads for “exotic” pairs (relatively low volume pairs that as a beginner you should ignore for now).

Ok, I have a broker. What now?

Demo, demo, demo! Now you need to keep trading a demo account until you are consistently profitable on that demo account. There is no rush here, no need to start risking all of your hard-earned equity trading live money right away. Hope is not a strategy.

You can Try for Demo trading Click here

How do I get a consistently profitable strategy?

Whoa, you are jumping the gun here. Can you tell me what the best time frame to trade is? When the best time of day to trade is, for each pair? How to identify trends? The correlation between different currencies and commodities?

Remember: you are now swimming with sharks. The markets want your money, and they know a lot more than you. You wouldn’t show up to a pool hall with a wad of cash and just start wagering you could beat everyone there would you? Of course not – you’d be out of money before your drinks arrived. Don’t be fooled just because you can’t see.

Sponsored by: Exness Global Ltd. [CY]