The BAD: this YEAR is very bad years after a decade of much benefit in emerging markets, said Harvard Kennedy School economists, Carmen Reinhart, one of the world's leading experts on the financial crisis and the country's economy growing. In the BRICS comprising Brazil, Russia, India and China, which was once regarded as a global growth engine, is now Brazil and Russia are facing severe recession, while China's economic growth slow, hard-fought tackle its stock market collapsed quickly. The photo shows the mood of the market in Rio de Janeiro, Brazil.

Emerging markets are booming and a history of failure, but in the near future, the State might even be more drab. Investors now faces what likely could make the loss of a decade to recover, with four or five more years. "These are the years that very bad after a decade of much benefit," said Harvard Kennedy School economists, Carmen Reinhart, one of the world's leading experts on the financial crisis and the country's economy growing.

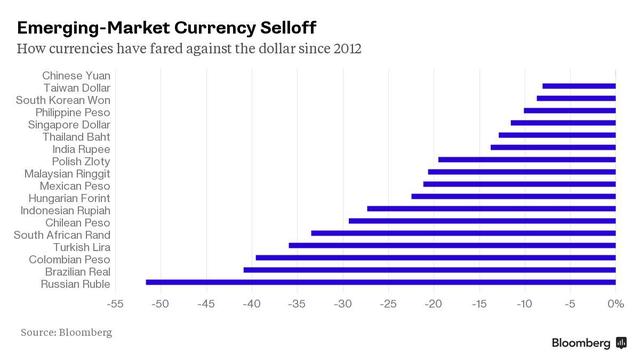

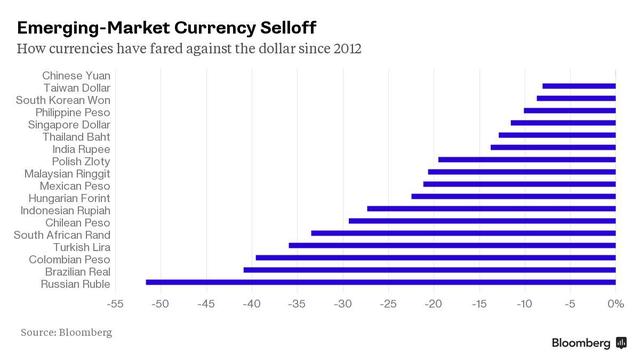

Some time ago, the BRICS are made up of Brazil, Russia, India and China, is celebrated as the engine of global growth. Now Brazil and Russia are facing severe recession due to the collapse in global commodity, while slow and China fought hard to overcome its stock market collapsed quickly. The prospect of a U.S. interest rate ascent only make things grow murkier. Currency values ranging from rand South Africa until the ringgit Malaysia plummeted again Wednesday on fears the US Federal Reserve Agency (Fed) Act more quickly with the possibility in September.

Ruchir Sharma, head for the part of emerging markets (countries developing new economic rise) at Morgan Stanley Investment Management Inc., upside down State shows the result of a large investment in the early 2000s--the MSCI Emerging Markets Index is even almost quadrupled between 2002 and 2010--now it seems strange and distorted from the ordinary.

All sides say, emerging currencies plummeted to the lowest level since 1999, and bonds in currencies they have abolished the value profit over five years.

Meanwhile, on the stock exchange, the emerging world and developed nations differ sharply. Since 2009, the MSCI index fell 10% while in developed markets climbed about 50%. Based on the ratio of price-towards-income estimate, emerging markets are trading with their biggest piece to the developed countries, since 2006--reached 36%.

During most of the last 15 years, cheap credit from the Fed and the Chinese economy is growing rapidly, in addition to the movement of investment dollars into emerging markets and strengthening growth.

Out of sync

Now, the risk is that the Fed's twin "Sun" and China would be out of sync, because the us started to raise interest rates and the economy of China slow, said Stephen Jen, a founding member of SLJ Macros Partners LLP based in London and a former economist with the International Monetary Fund (IMF).

If that happens, SLJ predicts, will increase difficulties for emerging markets, said Jen.

However, even when China cools, exportir snatch market share from its competitors everywhere, including in other emerging economies, said David Lubin, an economist at Citigroup Inc. at the same time, Chinese manufacturers increase the procurement of components in the country, rather than import it. The second development that be bad news for other emerging economies. Except for China, growth in developing countries was almost flat during the second quarter.

The IMF still expects emerging economies worldwide grow 4.2% this year, even as Brazil and Russia sank into recession. But it was just 0.9% points faster than the growth of the world economy as a whole, most small differences since 1999.

In many countries of the developing world, politics and policy are also becoming big worries. In recent weeks, Chinese policy makers are taking steps as never before to shore up his country's stock exchange, with investors left many in doubt about what steps might be taken next in Beijing. In Brazil, President Dilma Rousseff, who was raided by a sweeping corruption scandal, trying to trim the budget, potentially jeopardizing his country's credit rating.

Many analysts see more trouble ahead. Fourteen of the 23 major emerging market currencies is expected to go down against the dollar as of the end of June 2016, Bloomberg compiled data shows. Porkas income for companies in the MSCI index down to the lowest level since the end of 2009. "This is really a crisis with slow-motion," said Bhanu Baweja, head of emerging markets assets strategy is part of London-based UBS AG Group. "The real challenges facing us in the future," he said. https://www.mql5.com/en/signals/120434#!tab=history