Generally speaking, if the U.S. equity market like S&P 500 and Dow Jones is rising, then foreign investment dollars will flock the U.S. equity market by leaps and bounds pumping the U.S. dollar higher. If the equity market is falling then the domestic as well as foreign investors will sell their shares to seek investment opportunities abroad thereby dragging the U.S. dollars down. However this relationship can be very uncanny in times of economic uncertainties.

Currency market is very dynamic. Topnotch traders must always stay tuned with every forex fundamentals to stay ahead in the game.

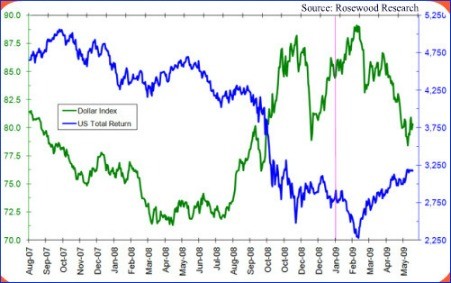

In the image above a negative correlation between the U.S. dollar Index and the U.S. Equity total return in 2009. This strong negative correlation stands at -0.86%, meaning that when the U.S. dollar is up the equity market is down and vice versa. Number adds more meaning in analysis but the mirror image of dollar with the U.S. equity returns give clear picture about this strong negative correlation. In another words, currently (as of Nov. 2009), Eur-Usd, S&P 500 and Dow correlation is strongly positive correlation, i.e. Euro up = Dow up = S & P 500 up. This correlation came to exist around 2003 after the tech bubble burst.

Should the U.S. economy rebound, investors both domestic and foreign will flood the U.S. equity driving demands for U.S. dollar and other U.S. dollar denominated assets. Then and then only we should see reversal in the current correlation that is in existence among the Dow, S & P 500 and EUR/USD. Needless to say, a relationship exists between the Dow, S & P 500 and EUR/USD.