How To Trade - Spread indicator, What Does It Tell Traders and Free to Downloads

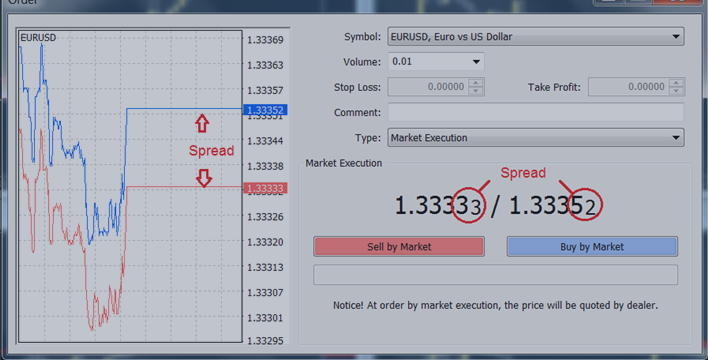

- Spreads are based off the Buy and Sell price of a currency pair.

- Costs are based off of spreads and lot size.

- Spreads are variable and can change during news.

Every market

has a spread and so does Forex. A spread is simply defined as the price

difference between where a trader may purchase or sell an underlying

asset. Traders that are familiar with equities will synonymously call

this the Bid: Ask spread.

Since the spread is just a

number, we now need to know how to relate the spread into Dollars and

Cents. The good news is if you can find the spread, finding this figure

is very mathematically straight forward once you have identified pip

cost and the number of lots you are trading.

Remember, pip cost is

exponential. This means you will need to multiply this value based off

of the number of lots you are trading. As the size of your positions

increase, so will the cost incurred from the spread.

It is important to remember

that spreads are variable meaning they will not always remain the same

and will change sporadically. These changes are based off of liquidity,

which may differ based off of market conditions and upcoming economic

data.

Traders should always consider the risk of trading volatile markets. One

of the options for trading news events is to immediately execute orders

at market in hopes that the market volatility covers the increased

spread cost. Or, traders can wait for markets to normalize and then take

advantage of added liquidity once market activity subsides.

Free to download from MQL5 CodeBase: