Gold drops to lowest in London on strengthened greenback, platinum and palladium decline

Gold fell to an eight-month low in

London as the greenback was strengthened by the signs of an improving U.S. economy thus curbing demand for a protection of wealth. Platinum

sank to an almost 15-month low and palladium declined.

The dollar rose to a four-year high against the basket of other major currencies after the yesterday data showed sales of new U.S. homes surged in August and before a report tomorrow that analysts said will show economic growth quickened.

Bullion is headed for the first quarterly loss in three and

Goldman Sachs Group Inc. repeated a forecast for gold to decline

this year. Jeffrey Currie, head of commodities research at Goldman

Sachs, maintained the bank’s forecast for gold to drop to $1,050

by the end of 2014. Support to prices from political uncertainty

in Ukraine and the Middle East earlier this year has faded, and

inflation is expected to be subdued, Currie said.

Central banks from Russia to Ukraine increased gold

reserves in August as Mexico and Czech Republic trimmed

holdings, International Monetary Fund data showed. The Kyrgyz

Republic, Kazakhstan and Azerbaijan also showed higher gold

reserves for the month, figures on the IMF website showed.

Silver for immediate delivery fell 0.8 percent to $17.5597 an ounce in London. It reached $17.3491 on Sept. 22, the lowest since July 2010. Palladium dropped 1.6 percent to $804.04 an ounce, after touching $795.33, the lowest since April 24. Platinum lost 0.6 percent to $1,309.31 an ounce, after touching $1,300.38, the lowest since June 28, 2013.

Platinum, which traded at a 10-month high in July, slid 4.5 percent this year even as demand for the commodity used in pollution-control devices in cars improved, and supplies from South Africa, the world’s largest producer, were curbed by a strike that ended in June.

Federal Reserve officials raised interest-rate forecasts last week, even as they maintained a pledge to keep rates low for a considerable time to aid the recovery.

“It’s all on the back of the stronger dollar” and improving U.S. economy, Bernard Sin, the head of currency and metal trading at MKS (Switzerland) SA, a Geneva-based refiner, said today by phone. Still, lower prices have attracted more physical purchases and demand may increase ahead of the Golden Week holiday next week in China, the largest buyer, he said.

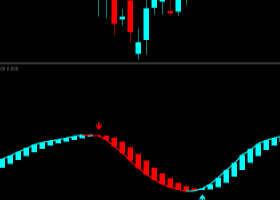

Gold for immediate delivery fell 0.5 percent to $1,210.53 an ounce by 10:51 a.m. in London, according to Bloomberg generic pricing. It reached $1,207.04, the lowest since Jan. 2, and is up 0.7 percent this year. Gold for December delivery slipped 0.7 percent to $1,210.90 on the Comex in New York.

According to data compiled by Bloomberg, futures trading volume was 40 percent above the average for the past 100 days for this time of day.

Holdings on gold-backed exchange-traded products are at the lowest in five years, data compiled by Bloomberg show.