With losses in many investor accounts, and a feeling of desperation towards metals and miners, many in the metals world were

cut at the base by the action of the metals and mining stocks in 2014.

However, as Investing.com's analysts consider, out of these 2014 ashes should rise a powerful phoenix in 2015 and into 2016.

At the beginning of 2014, most in the metals world were exceptionally bullish. Everyone was pointing to the “double bottom” in Gold, followed by a strong rally, to bolster their feelings of bullish euphoria. Many viewed this as a strong indication that the metals bull was back. However, many analysts came into 2014 being quite suspicious about these folks, especially those using Elliott Wave analysis. And, it was telling us that there was a high probability that a lower low was sitting out there.

Moving into 2015, analysts take courage to suppose that a lower low is going to be seen in Silver, as has been discussed many times over the last few weeks. At the same time, most of the indications point to lower levels yet to be seen in the metals and miners. And, the question on most people’s minds is if we can still hit those lower lows sooner rather than later or will it be delayed until 2015.

If one were to ask me what the most unreliable pattern to trade would be, based upon Elliott Wave analysis, I would probably describe a truncated 5th wave followed by a leading diagonal in the opposite direction. The reason is that a truncated 5th wave is not a common occurrence, and neither is a leading diagonal, for the start of a new trend. So, when you combine the two, it makes for a very unreliable trading cue.

Alas, that is exactly the type of pattern set up we would have to rely upon for the downside in SPDR Gold Trust and which is causing hesitancy in suggesting an aggressive short position on the metals.

With all this, there is an important note that the metals are still set up quite bearishly,

even though the setup is nowhere near as ideal.

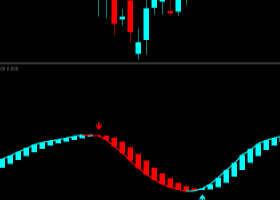

If you look at the 8 minute chart of GLD, you will see that as long as it maintains below the resistance box, it is set up for an imminent decline which should see a target of 105, with the potential to go lower with appropriate extensions. And, surprisingly, it still can happen before the end of the year. In fact, if we go back to last year, we will see that GLD dropped 8 points during the last few weeks of the year and bottomed on the last day of the year. So, it is still quite reasonable for this to occur again. But, that would mean next week should provide us with indications of this decline.

Thus, with the clearest regions of support and resistance being presented on the GLD chart, I would say that a break down below 113.50 can be shorted, using a stop of 114.50 based upon the current 1-2, i-ii set up. If something changes in that set up, I will alert you during the week. But, as it stands right now, should this set up follow through to the downside, that would be the short term trade I would do.

To put it another way, should resistance be taken out, it means that this 4th wave has still not yet been completed, and our lower lows will not be seen until later in the first quarter of 2015.