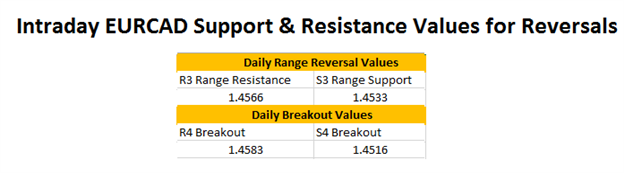

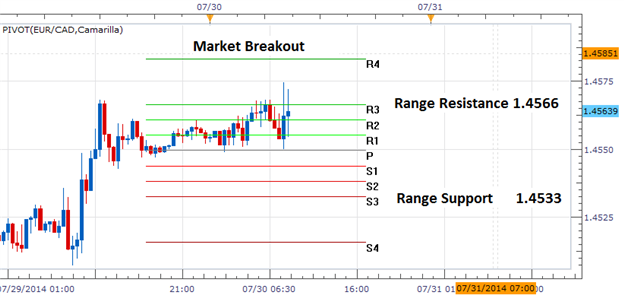

- Price Hovers Near Range Resistance

- Range Support Sits at 1.4533

- Price Above R4 Signals a Breakout

For the beginning of Wednesdays trading, the EURCAD remains locked

between defined values of support and resistance. Range resistance, as

marked above by the R3 camarilla pivot, resides at 1.4566. Range support

is found below at 1.4533 creating a 33 pip trading range for the pair.

Traders looking for a potential price reversal will monitor the EURCAD

under resistance while looking for a move back towards price support.

A breakout should also always be in consideration, in the event that

range bound markets come to a conclusion. Utilizing camarilla pivots, a

breakout would be identified by price moving above either the R4

resistance pivot or the s4 support pivot. Currently the R4 camarilla

pivot sits at 1.4583.A price advance over this value would signal a

change in market conditions, in which traders should consider concluding

any range trades. A break of R4 would also suggest a move to higher

highs where traders may consider entries with the markets new influenced

direction.