Tomorrow is expected to publish important data assessing the state of the Australian economy.

At 01:00 (GMT), the consumer price inflation expectations index from the Melbourne Institute will be published, reflecting consumer expectations for future inflation for the next 12 months. Previous rate is +4.2%. If the current figure for September is higher, then the likelihood of an increase in the RBA rate will increase, which will have a positive effect on the Australian currency.

At 01:30 (GMT), data from the Australian labor market for August will be released, which may exceed expectations that the increase in jobs in August will be 20,000 above the long-term average of 15,000, and the unemployment rate in August will be 5, 6% (in the previous month, the number of new jobs also turned out to be higher than the consensus forecast of 20,000, and unemployment was also at 5.6%).

Strong Australian employment data may force investors to reconsider their forecasts regarding the start of rate hikes by the central bank, which can support the national currency.

Last week, the Reserve Bank of Australia retained the key rate at a record low of 1.5%. "The growth of the exchange rate will become a factor of limited inflationary pressure in the economy, and, apparently, will cause a slowdown in the growth of economic activity and inflation compared to current forecasts", RBA Governor Philip Lowey said yesterday.

In combination with the recovery of Australia's GDP in the second quarter, strong data from the labor market can force the RBA to change its position from neutral to a tendency to tighten policies.

Also tomorrow (02:00 GMT) important macro data will be published from China (retail sales and level of industrial production for August).

China is the largest trade and economic partner and buyer of primary commodities in Australia. Therefore, positive news from China also positively affects the currencies of the Pacific region, including the Australian dollar.

It is expected positive macro statistics from China, which will also support the Australian dollar.

Thus, there are several strong fundamental factors that may tomorrow provoke the growth of the Australian dollar, including against the US dollar, which recently shows a large decline in the foreign exchange market and is under pressure amid growing pessimism of investors regarding the possibility of a further increase in the interest rate in the US, as well as the continuing tensions between the US and North Korea and the political contradictions in Washington.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

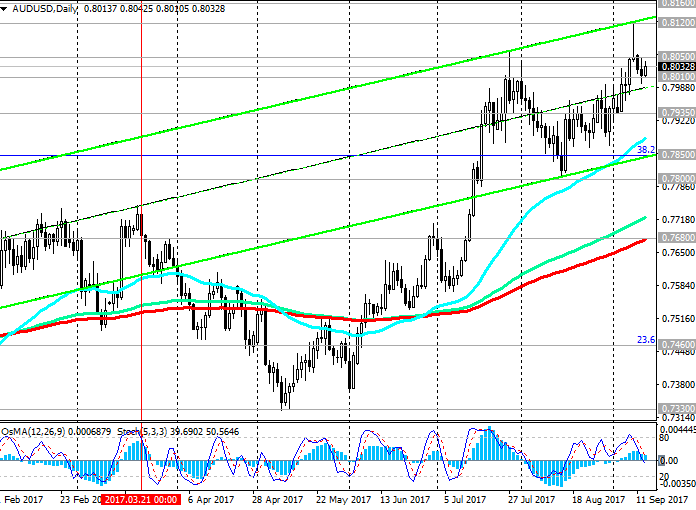

AUD/USD keeps positive dynamics and grows in the upward channels on the daily and weekly charts, the upper limit of which passes near the level of 0.8130.

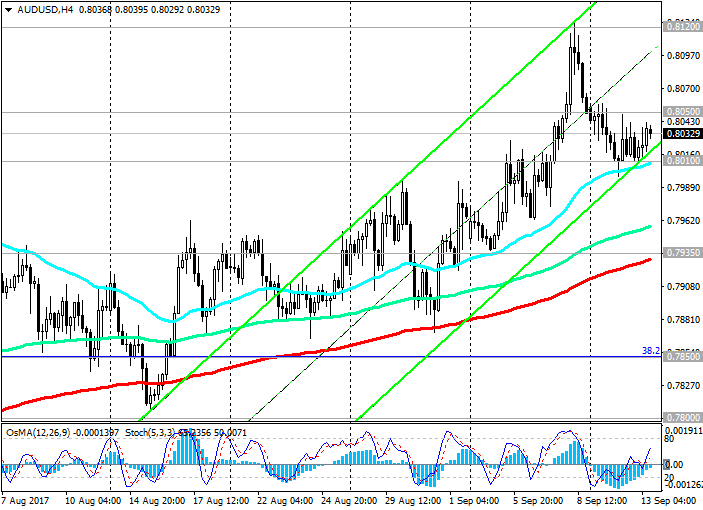

Long positions are still relevant. While the AUD / USD pair is above the short-term support levels of 0.8010 (EMA200 on the 1-hour chart, EMA50 on the 4-hour chart), 0.7935 (EMA200 on the 4-hour chart), the bulls are not threatened.

Moreover, with a correction decrease to support level 0.8010, it is possible to increase long positions with stops below the level of 0.7980.

You can return to consideration of short positions in case of breakdown of short-term support level 0.7935. In this case, a further corrective decrease to the support levels of 0.7850 is possible (the Fibonacci level of 38.2% correction to the wave of decline of the pair since July 2014, the minimum of wave is near 0.6830). Here, the bottom line of the ascending channel passes on the daily chart.

In case of breakdown of the support level 0.7800 (EMA144 on the weekly chart), the AUD / USD decline will accelerate with the target at the support level of 0.7680 (EMA200 on the daily chart, EMA50 on the weekly chart). The breakdown of the support level of 0.7460 (the Fibonacci level of 23.6%) will return the AUD / USD to the global downtrend beginning in July 2014.

Indicators OsMA and Stochastics on the 4-hour, weekly, monthly charts are on the buyers side.

Support levels: 0.8010, 0.7935, 0.7900, 0.7850, 0.7800, 0.7680

Resistance levels: 0.8050, 0.8120, 0.8160

Trading Scenarios

Sell Stop 0.8010. Stop-Loss 0.8055. Take-Profit 0.7935, 0.7900, 0.7850, 0.7800, 0.7680

Buy Stop 0.8055. Stop-Loss 0.8010. Take-Profit 0.8100, 0.8120, 0.8160

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com